Gold prices hit an all-time high on Thursday after the Fed signaled a potential two interest rate cuts this year, increasing the appeal of the precious metal amid persistent geopolitical and economic tensions.

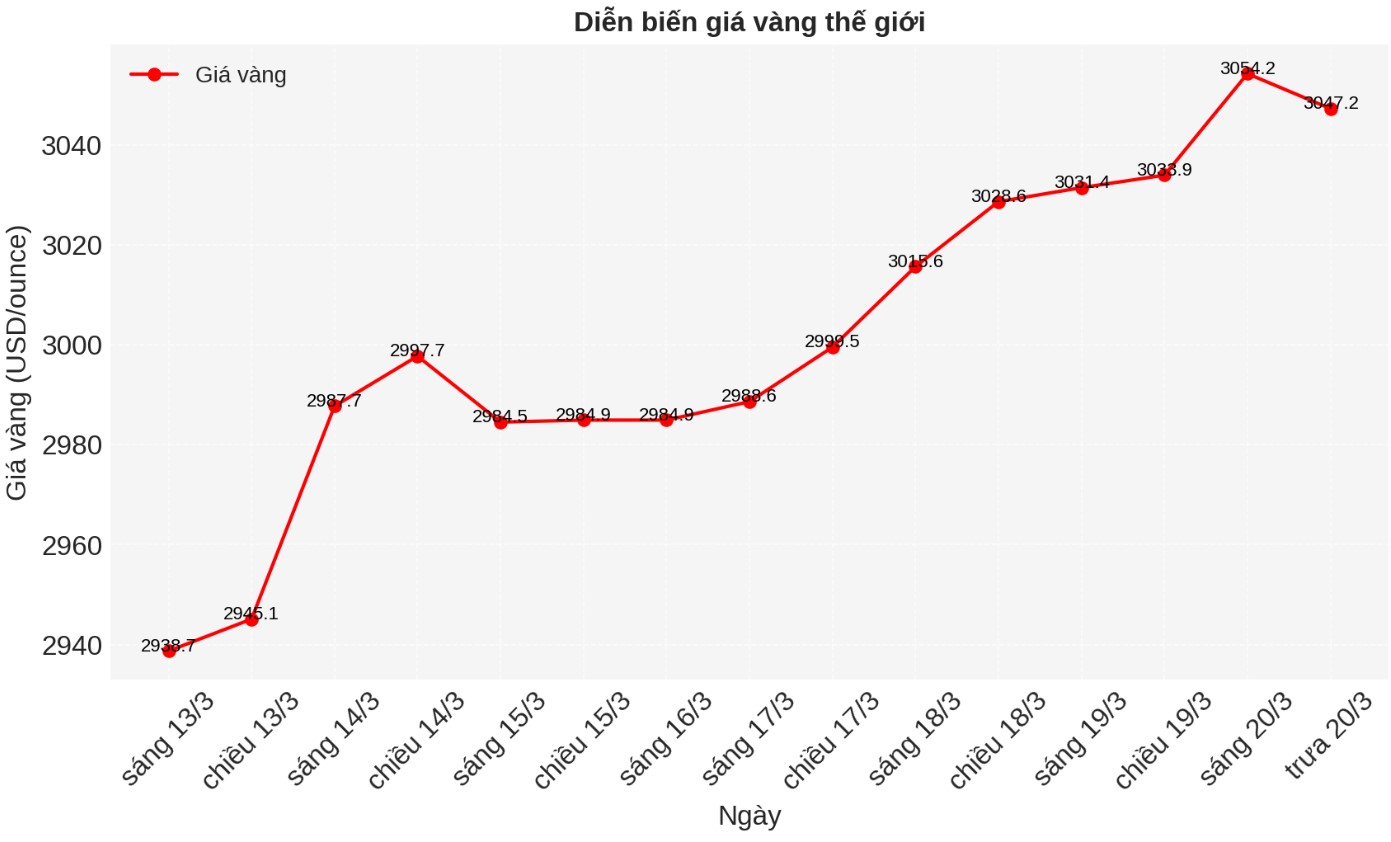

At 5:20 a.m. GMT, spot gold rose 0.1% to $3.050.94/ounce, after hitting a record high of $3,057.21/ounce. US gold futures increased by 0.6% to $3,059.5 an ounce.

According to Dick Poon - General Director of Heraeus Metals Hong Kong Limited, gold is being supported "due to many factors such as market uncertainty, geopolitical tensions, a weak USD and expectations of interest rate cuts".

On Wednesday, the FED kept interest rates unchanged in the 4.25%-4.50% range as previously predicted. Planners expect two rate cuts of 0.25 percentage points by the end of 2025. Low interest rates are a favorable environment for gold - a non-interest-bearing asset.

Fed Chairman Jerome Powell said that US President Donald Trump's initial policies, including imposing widespread import tariffs, seem to have slowed down the US economy and caused inflation to increase, at least in the short term.

Donald Trump's tax imposition has increased trade tensions, causing inflation to increase and negatively affecting economic growth.

Uncertainty over tariffs, the possibility of interest rate cuts and escalating tensions in the Middle East have contributed to gold's increase. Since the beginning of 2025, gold has recorded 16 record highs, including 4 times surpassing the $3,000/ounce mark.

Geopolitical and economic uncertainties continue to strengthen golds role as a store of value.

"Currently, the appeal of gold as a safe haven asset and an inflation hedge continues to increase due to geopolitical and tariff concerns. We are still optimistic about the outlook for gold," said Christopher Wong, foreign exchange strategist at OCBC.

However, Nicholas Frappell - Director of Global Organizing Market at ABC Refinery - said that a price adjustment is likely to come after a strong increase in gold in the first quarter of 2025.

"However, the previous adjustments have been short-lived and the buying pressure is still very strong... The $3,090-3,100/ounce zone could be the resistance level," Frappell said.

Spot silver prices rose 0.15% to 33.84 USD/ounce, platinum increased 0.2% to 995.00 USD/ounce, while palladium decreased 0.2% to 956.35 USD/ounce.