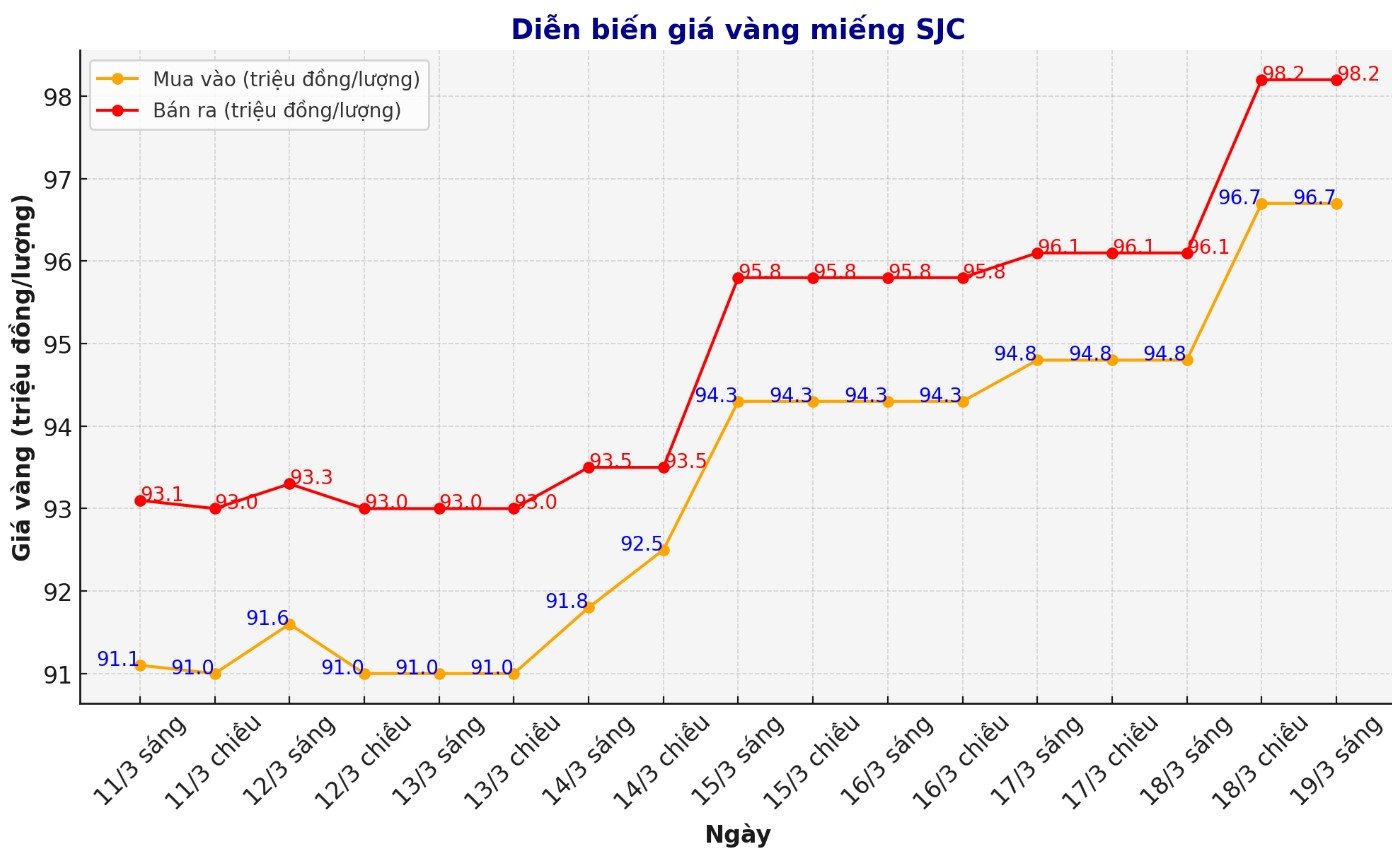

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND96.7-98.2 million/tael (buy - sell), an increase of VND1.9 million/tael for buying and VND2.1 million/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at VND96.7-98.2 million/tael (buy - sell), an increase of VND1.9 million/tael for buying and an increase of VND2.1 million/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 96.7-98.2 million VND/tael (buy - sell), an increase of 1.9 million VND/tael for buying and an increase of 2.1 million VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

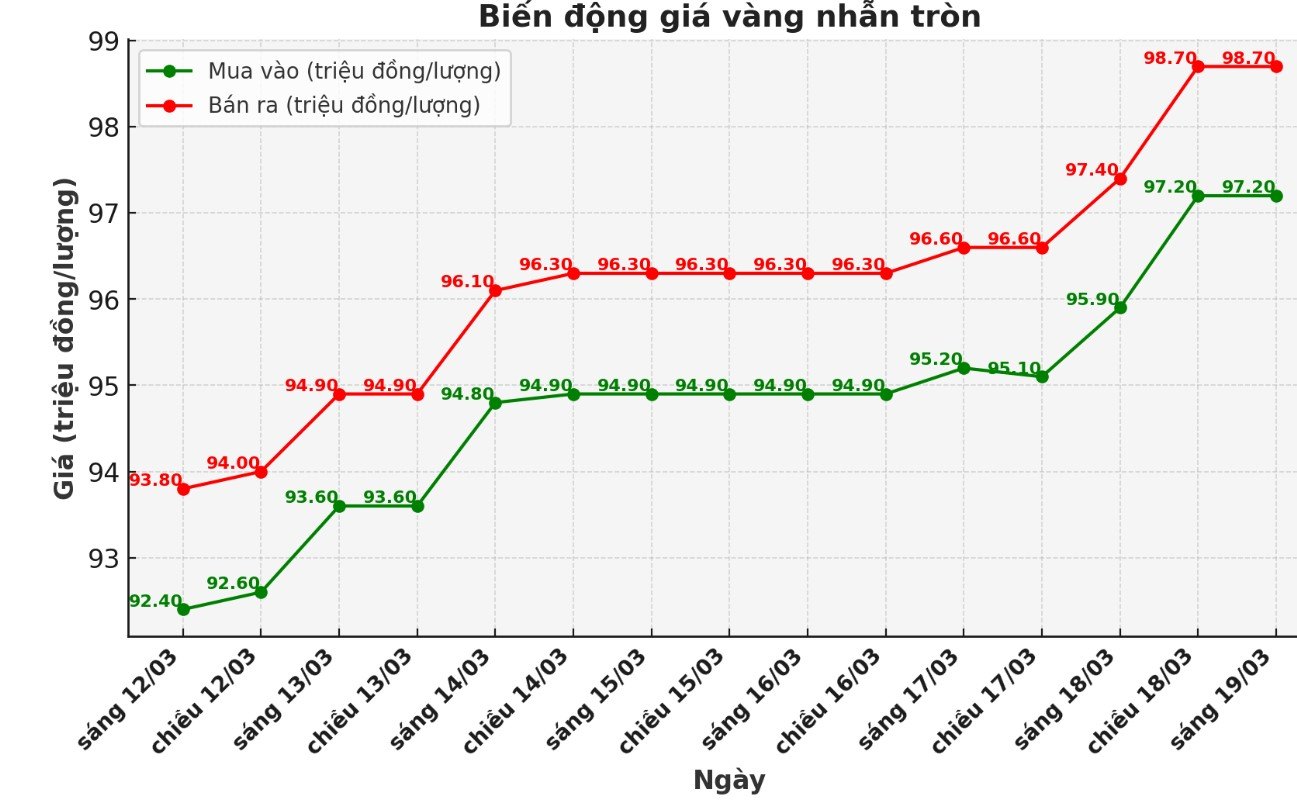

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 97.2-98.7 million VND/tael (buy in - sell out); an increase of 2.1 million VND/tael for both buying and selling. The difference between buying and selling is listed at 1.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 97.52-98.80 million VND/tael (buy - sell); an increase of 2.32 million VND/tael for buying and an increase of 2 million VND/tael for selling. The difference between buying and selling is 1.28 million VND/tael.

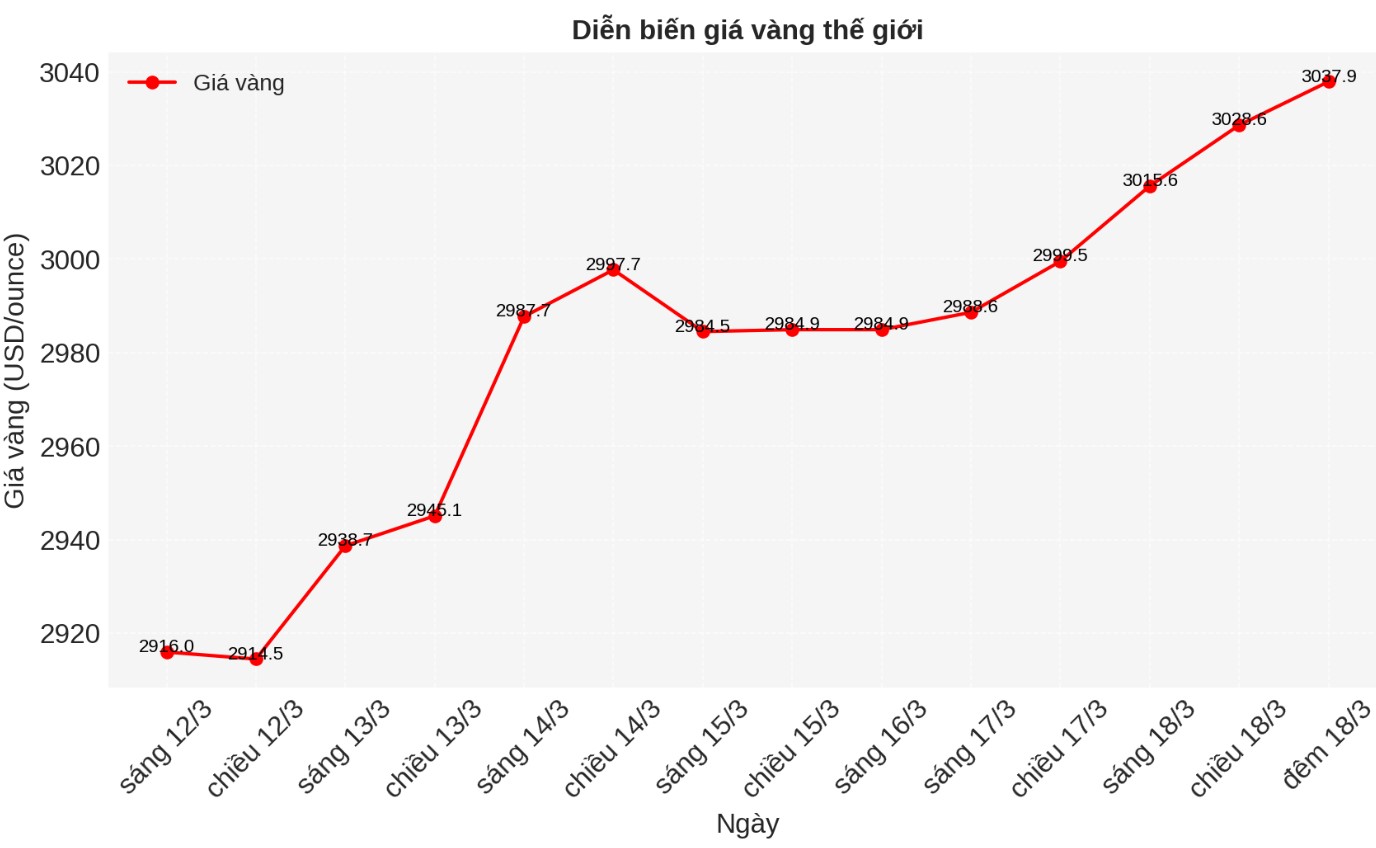

World gold price

As of 11:34, the world gold price listed on Kitco increased sharply to 3,037 USD/ounce. This is an all-time high, unprecedented in the trading history of this precious metal.

Gold price forecast

World gold prices skyrocketed in the context of the USD decreasing. Recorded at 11:47 p.m. on March 18, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 102.952 points (down 0.06%).

According to Kitco, gold prices increased sharply and reached an all-time high due to concerns about the global trade war, new geopolitical developments, positive technical trends and expectations that the US Federal Reserve (FED) will loosen monetary policy. Gold contracts in April increased by 34.5 USD, to 3,040.9 USD/ounce. May silver futures also rose $0.442 to $34.75 an ounce.

Israel conducted airstrikes across the Gaza Strip on Tuesday morning. The surprise attack broke the ceasefire maintained since January and sent the 17-month war on the brink of resuming. Over the weekend, the US attacked Houthi targets in the Middle East and said it would continue airstrikes.

According to the Houthi-controlled Department of Health, US airstrikes on March 15 killed at least 23 people and injured more than 20. In a post on the social network Truth Social, Mr. Donald Trump affirmed that the US will deploy "overwhelming fire" against the Houthis "until the target is achieved".

Barron's newspaper swerved: "Buffett and gold dominate as the S&P 500 struggles in Donald Trump's market". The article says that like gold, Berkshire Hathaway shares are also a safe haven asset. The group's stock hit a record high in the third trading session.

The most important economic event this week is the Federal Open Market Committee (FOMC) meeting, which began on Tuesday morning and ended on Wednesday afternoon with a statement and press conference by Fed Chairman Jerome Powell. Investors do not expect the Fed to change interest rates at this meeting, but will closely monitor the expressed expressed expressed in the FOMC statement and Mr. Powell's statement. The Wall Street Journal published a headline: Powell faces a dual threat from economic chaos and political tensions.

Gold contracts in April are still holding a short-term technical advantage. The next target for buyers is to get the closing price above the resistance level of 3,100 USD/ounce.

On the contrary, the target for the sellers is to pull the price below the support level of 2,900 USD/ounce. The first resistance level was determined at the peak of the overnight contract at 3,047.5 USD/ounce, followed by 3,050 USD/ounce. First support was an overnight low of $3,008.20 an ounce.

In outside markets, Nymex crude oil futures were weaker, trading around $67.25/barrel. The yield on the 10-year US Treasury note is currently around 4.31%.

The world gold price reaching a new peak of 3,037.8 USD/ounce could have a strong spillover effect on the domestic gold market. According to the law, domestic gold prices often fluctuate according to international trends, especially gold rings - the segment that responds sharply to supply and demand and investment psychology.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...