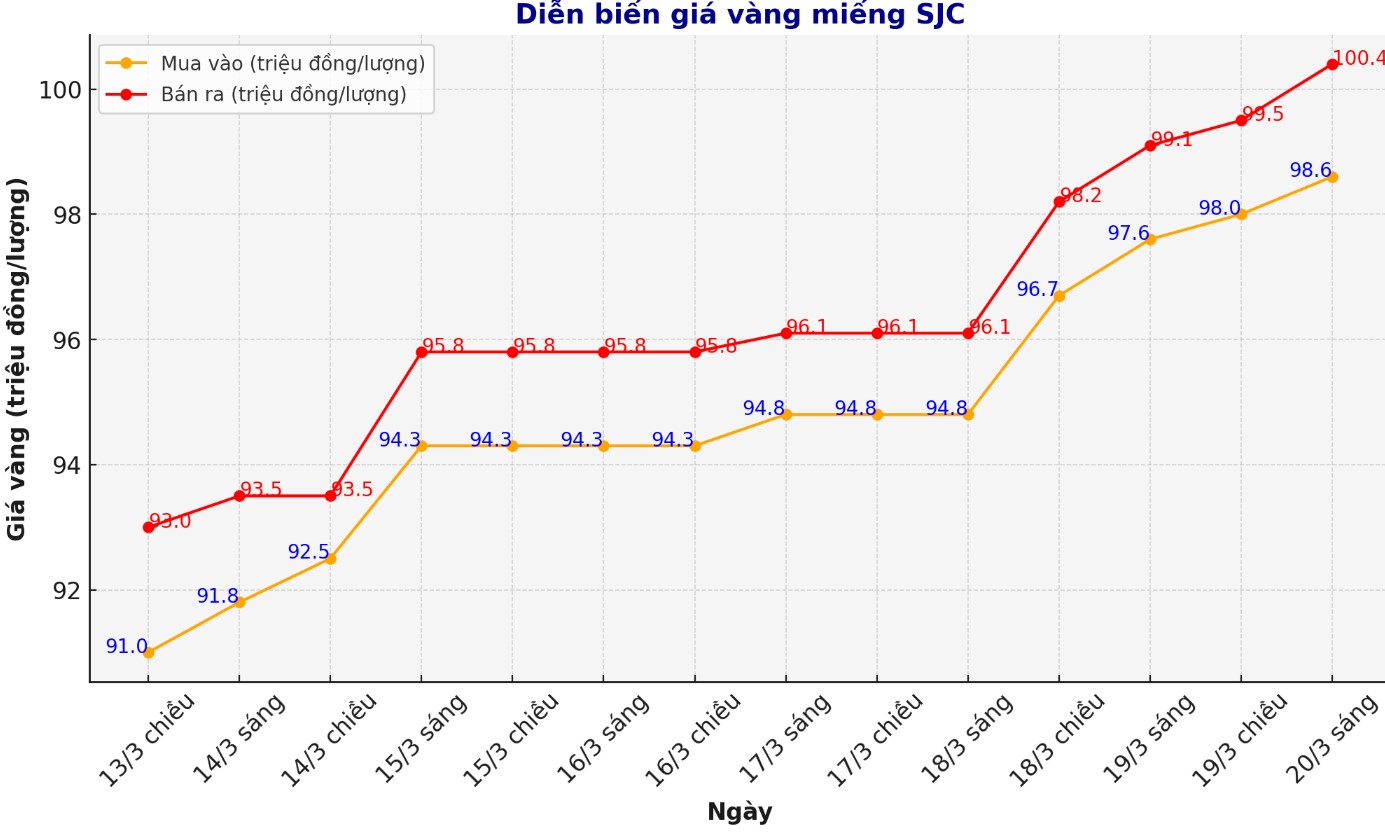

Updated SJC gold price

As of 8:45 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 98.6-100.4 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 1.3 million VND/tael for selling. The difference between buying and selling prices is at 1.8 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 98.6-100.4 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 1.3 million VND/tael for selling. The difference between buying and selling prices is at 1.8 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 98-99.5 million VND/tael (buy - sell), an increase of 900,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 1.5 million VND/tael.

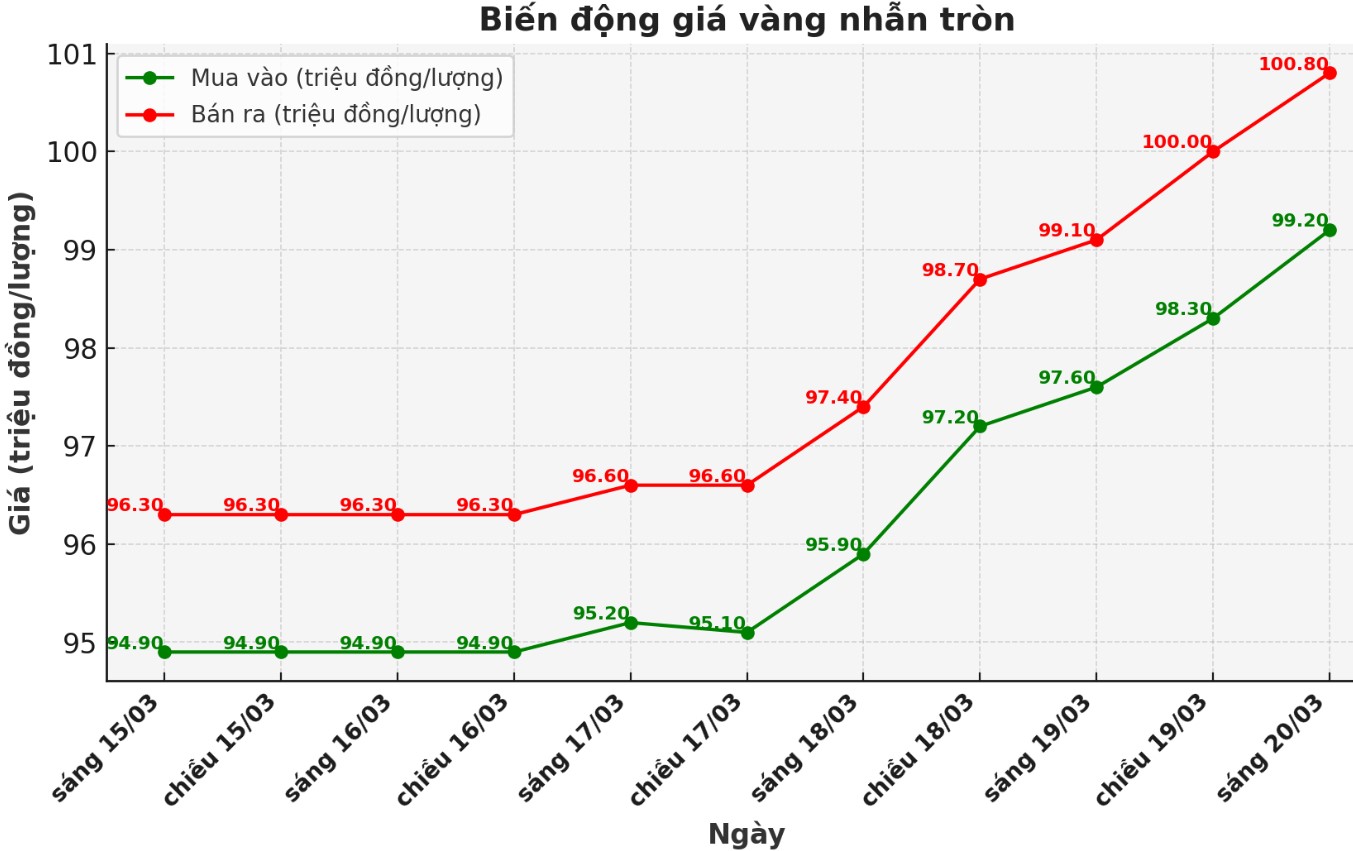

9999 round gold ring price

As of 8:50 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 99.2-100.8 million VND/tael (buy - sell), an increase of 1.6 million VND/tael for buying and an increase of 1.7 million VND/tael for selling. The difference between buying and selling is listed at 1.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 98.35-100 million VND/tael (buy - sell); increased by 700,000 VND/tael for buying and increased by 800,000 VND/tael for selling. The difference between buying and selling is 1.65 million VND/tael.

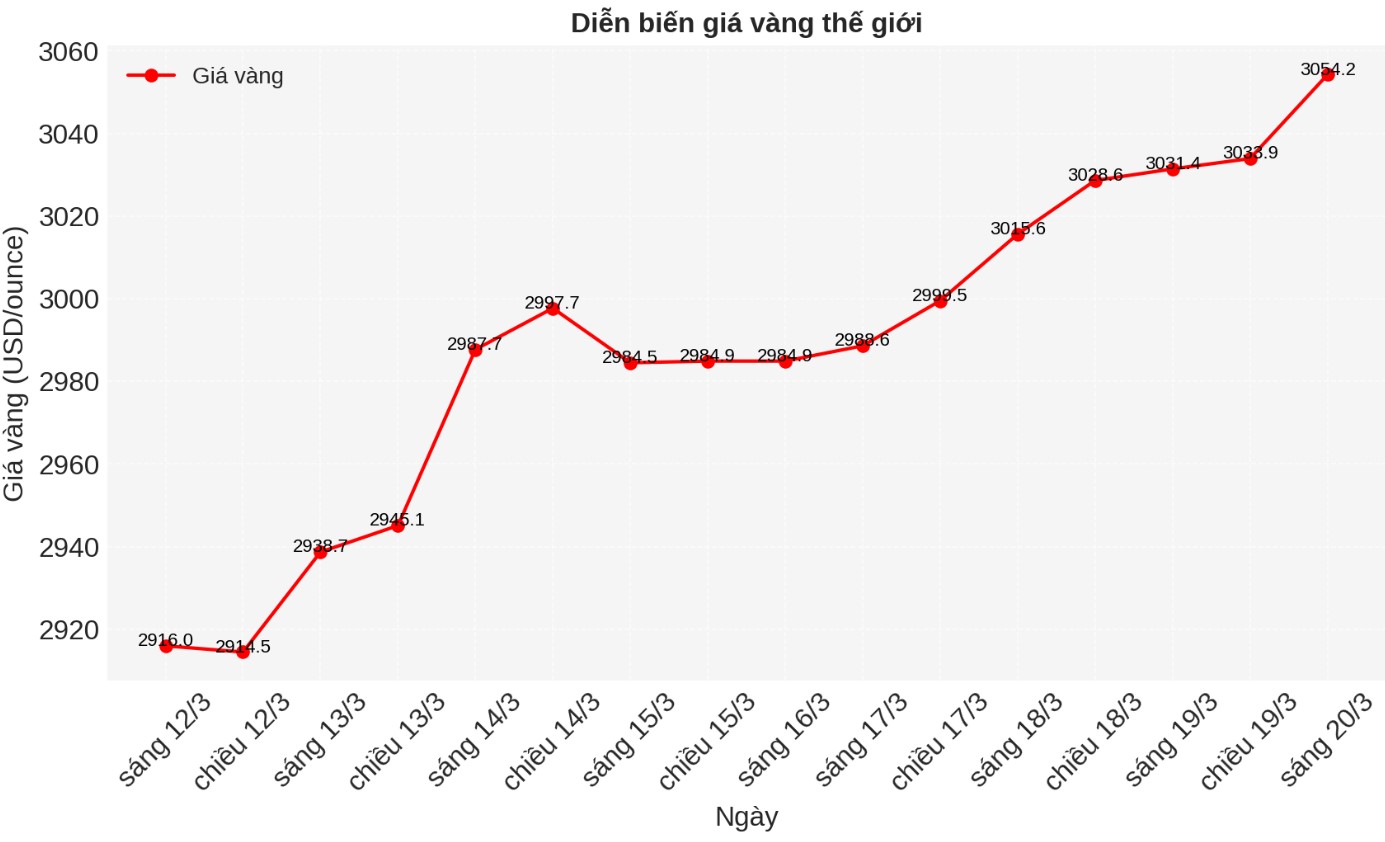

World gold price

At 8:30 a.m. on March 20, the world gold price listed on Kitco was around the all-time high of 3,054.2 USD/ounce, up 22.8 USD/ounce compared to the beginning of the trading session yesterday morning.

Gold price forecast

World gold prices increased in the context of the USD decreasing. Recorded at 8:30 a.m. on March 20, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.005 points (down 0.05%).

Gold prices are anchored high but there is no clear trend as the FED maintains a neutral monetary policy, although raising inflation forecasts and lowering growth prospects.

As expected, the US Federal Reserve (FED) kept interest rates unchanged in the range of 4.25% - 4.50% and did not provide many instructions on monetary policy.

According to the latest interest rate forecast, the FED expects interest rates to be at 3.9% by the end of the year, unchanged from the previous forecast. The interest rate is expected to fall to 3.4% in 2026 and 3.1% in 2027.

Although not in a hurry to cut interest rates, the FED has adjusted the pace of narrowing the accounting balance sheet. From April, the Commission will slow down the pace of cutting stock holdings by lowering the monthly repurchase limit for Treasury bonds from $25 billion to $5 billion. The committee will maintain the monthly repurchase limit for corporate debt and mortgaged securities at $35 billion, the Fed said.

Daniel Ghali - senior commodity strategist at TD Securities commented that if last year, the central bank was the main purchasing force driving gold prices up, now the main driving force has shifted to currency depreciation and risk-off sentiment.

Gold buying by central banks is a long-term trend. Since 2010, the number of central banks buying gold has increased. The reasons they buy gold are also very different, said Ghali.

He gave an example of the downward trend in dependence on the US dollar since sanctions on Russia were imposed, as well as the desire of many countries to diversify their assets and reduce dependence on the US dollar. However, I think the main reason for the increase in gold purchases this year is to prevent the risk of currency depreciation.

We have started the year with a strong increase in the USD. It sounds counterproductive, but if a country wants to reduce its dependence on the US dollar, it can take advantage of strong US dollar times to sell USD-denominated assets and buy non-USD assets, including gold. In that way, the pressure of currency depreciation is actually a factor that is driving central banks' gold purchases this year, he said.

However, the value of the US dollar has weakened significantly recently, along with a decline in the US stock market, causing the upward momentum of gold to once again change.

The US dollar has weakened significantly in recent weeks, so we believe that the mystery buying activity we call mystery buying has declined. But the interesting thing about gold prices this year is that you have the perfect variety of gold buying drivers, said Ghali.

See more news related to gold prices HERE...