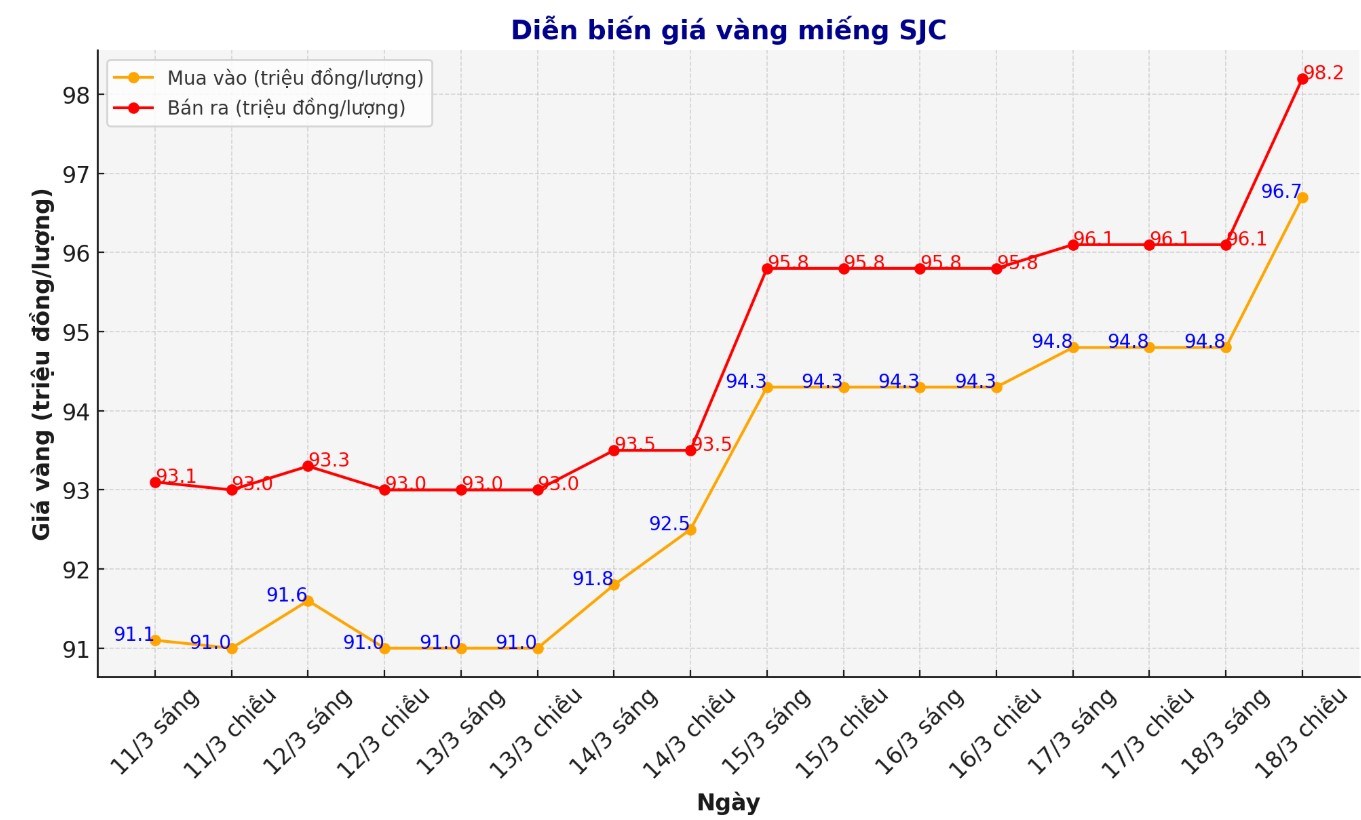

Updated SJC gold price

As of 5:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND96.7-98.2 million/tael (buy - sell), an increase of VND1.9 million/tael for buying and VND2.1 million/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at VND96.7-98.2 million/tael (buy - sell), an increase of VND1.9 million/tael for buying and an increase of VND2.1 million/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 96.7-98.2 million VND/tael (buy - sell), an increase of 1.9 million VND/tael for buying and an increase of 2.1 million VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

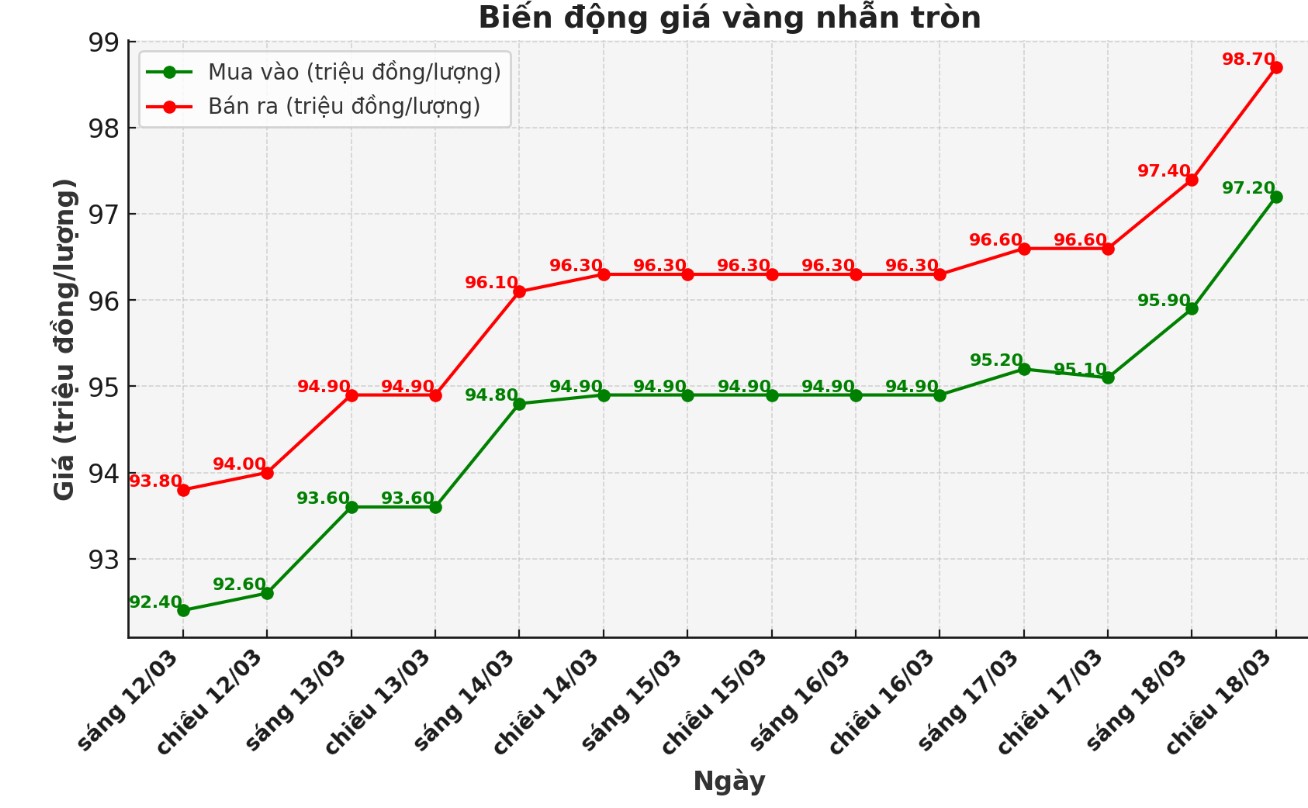

9999 round gold ring price

As of 5:30 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 97.2-98.7 million VND/tael (buy in - sell out); an increase of 2.1 million VND/tael for both buying and selling. The difference between buying and selling is listed at 1.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 97.52-98.80 million VND/tael (buy - sell); an increase of 2.32 million VND/tael for buying and an increase of 2 million VND/tael for selling. The difference between buying and selling is 1.28 million VND/tael.

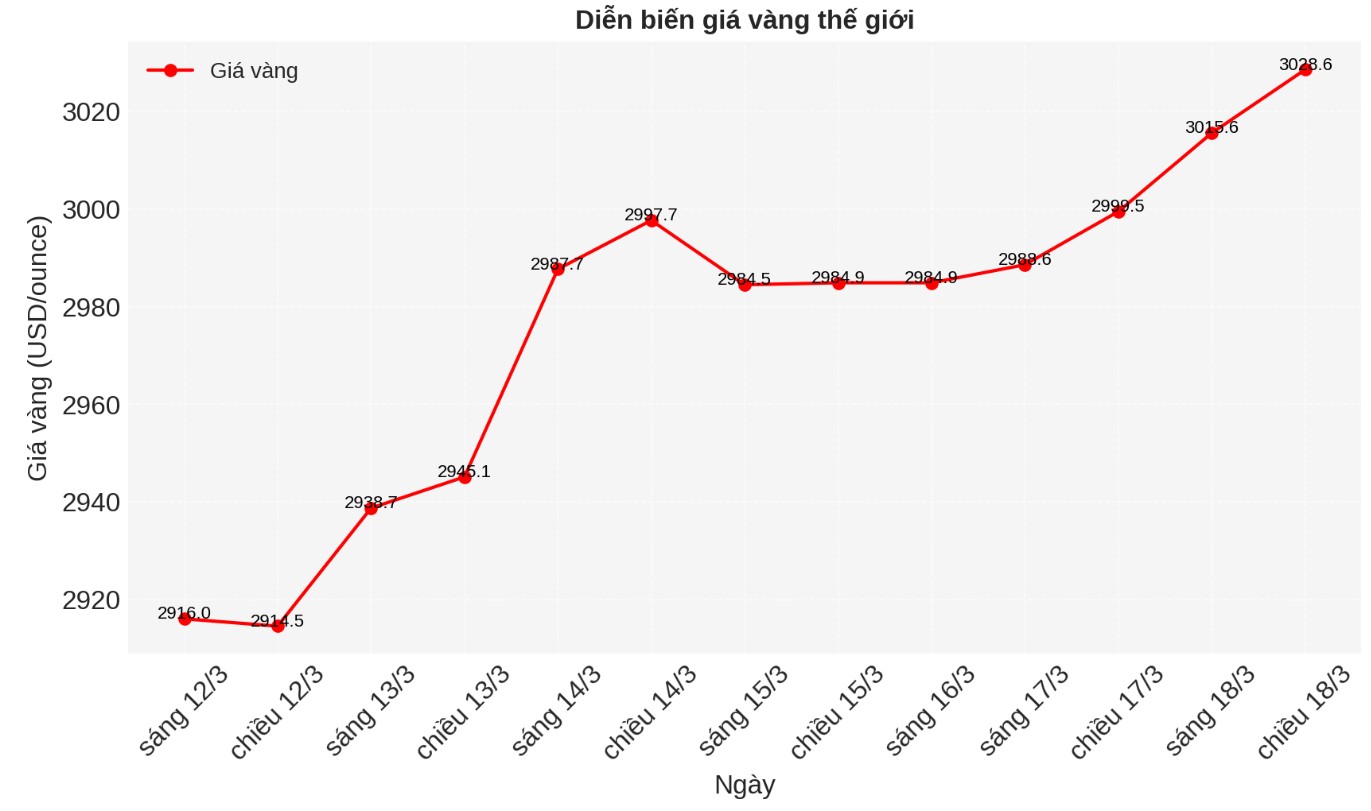

World gold price

This afternoon, world gold prices continued to break a new peak, reaching 3,028.6 USD/ounce.

Gold price forecast

World gold prices increased in the context of the USD decreasing. Recorded at 5:30 p.m. on March 18, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 102.902 points (down 0.1%).

According to Kitco, gold prices may continue to increase as an important part of the market is changing momentum, while another part has just begun to join.

Robert Minter - ETF Strategy Director at abrdn (a UK-based global asset management company) said that demand from central banks will continue to support the long-term upward trend of gold prices. He predicted that gold prices could reach $3,300/ounce this year.

Minter emphasized that demand from investors is becoming the main driver in the market.

"Investors are buying more gold through ETFs, thanks to lower interest rates and as part of a strategy to deal with economic stagnation," he said.

According to data from the World Gold Council (WGC), last month, ETFs in North America attracted 72.2 tons of gold, worth $6.8 billion. This is the highest monthly inflows for the region since July 2020, and a record high in February.

This trend continued in March. Data from the WGC showed that global ETF holdings increased by 32.7 tons of gold last week, of which ETFs in North America attracted 22.6 tons of gold.

Experts say that although ETF capital flows are increasing, there is still much room to expand because the total global gold holdings are currently about 20% lower than the peak in 2020.

Chris Mancini, portfolio manager at Gabelli Gold Fund (GOLDX), told Kitco News: "The gold ETF is finally starting to attract cash flow after years of withdrawals. This is important because ETFs are the supply and demand for gold as a frontier material.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...