Gold prices continue to rise

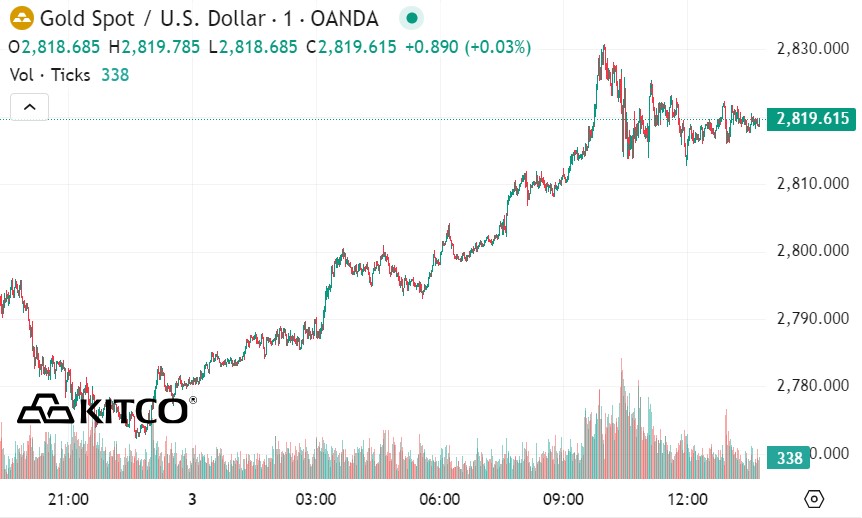

Gold prices continued to perform positively amid tariff concerns, with spot gold hitting an all-time high of $2,830.75 an ounce at 10:00 p.m. on January 3, 2025 (Vietnam time).

Gold prices are posting healthy gains as safe-haven demand is boosted. Markets are becoming more uncertain as the US prepares to impose tariffs on major trading partners on Tuesday.

The first round of tariffs promised by US President Donald Trump will take effect on Tuesday, affecting Canada, Mexico and China. This has increased concerns in the market, causing turmoil not only in stocks and financials but also in Bitcoin.

According to Jim Wyckoff - senior analyst at Kitco, the US Federal Reserve (FED) models to assess the impact of tariffs during Donald Trump's first term show that this could cause GDP to decrease by 1.2% and increase core inflation by about 0.7%.

Major overseas markets saw Nymex crude oil futures rise, trading around $74.50 a barrel. The yield on the 10-year US Treasury note is currently at 4.55%.

April gold futures maintain their bullish momentum and near-term technical advantage. The rally has taken prices close to key resistance levels, with buyers targeting a break above $2,900 an ounce. On the other hand, sellers are targeting a break below key support at $2,760.20, the low of the week.

The flow of physical gold from the UK to the US continues

Gold demand in China is showing signs of a strong recovery even as physical flows from the UK to the US continue. Meanwhile, there are signs that silver demand in the solar industry may have peaked, according to precious metals analysts at Heraeus.

In their latest update on precious metals, analysts said Chinese wholesalers appear to be expecting consumer demand for gold to increase.

"Withdrawals from the Shanghai Gold Exchange (SGE), a key indicator of wholesale and refining demand, typically increase in December and January as manufacturers stock up ahead of the Lunar New Year, which falls on January 29, 2025," the analyst said.

"Consumer demand also tends to be seasonal. Despite a strong start to 2024, total gold withdrawals for the year were the lowest on record (excluding 2020), at just 1,450 tonnes. This comes amid a continued slowdown in China's jewellery industry, reflected in year-on-year declines in sales at major retailers such as Richemont, Chow Tai Fook and Chow Sang Sang. However, with December 2024 withdrawals up 23% month-on-month, January withdrawals are still likely to be in line with the historical average of 190 tonnes (based on SGE data since 2016)," the analysts said.

"The December increase suggests that, albeit at a lower level than in 2024, consumer demand in China could pick up in the first quarter of this year. However, the evolution of consumer demand is partly dependent on gold prices. Gold prices have risen every week since the beginning of the year, even hitting a new record high in US dollars last week. This could offset the positive impact from the Lunar New Year gift cycle," they wrote.

Both the US Federal Reserve (FED) and the European Central Bank (ECB) adjusted policy in line with market expectations last week, with the FED keeping interest rates unchanged while the ECB cut them by 25 basis points. Meanwhile, gold prices continued to hit record highs over the weekend.

"However, US gold futures are still trading at a positive premium to spot prices and hit a record high of $2,853 an ounce on the March contract," analysts noted.