Update SJC gold price

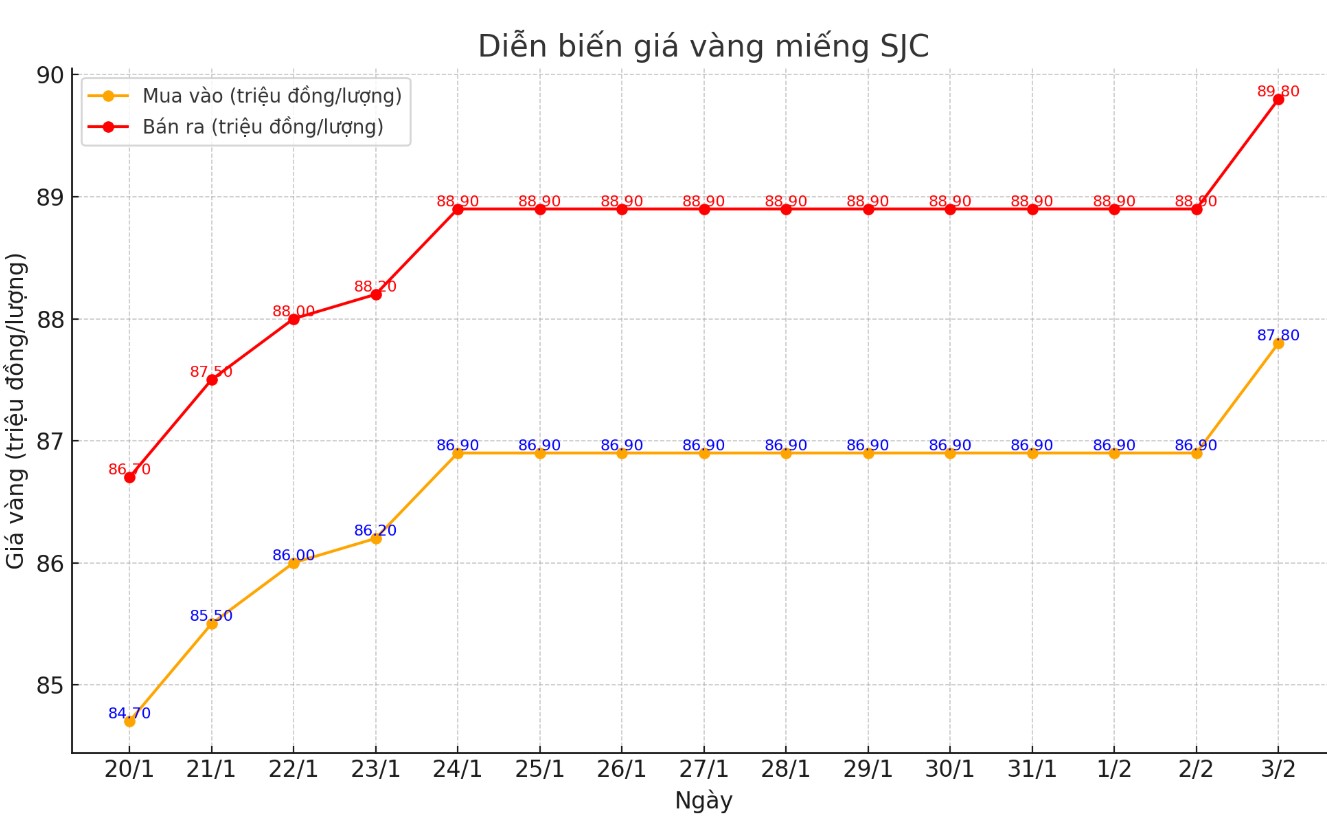

As of 6:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND87.8-89.8 million/tael (buy - sell); an increase of VND1 million/tael for both buying and selling compared to the close of the previous trading session.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars was listed by DOJI Group at 87.8-89.8 million VND/tael (buy - sell); an increase of 1 million VND/tael for both buying and selling compared to the close of the previous trading session.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

9999 round gold ring price

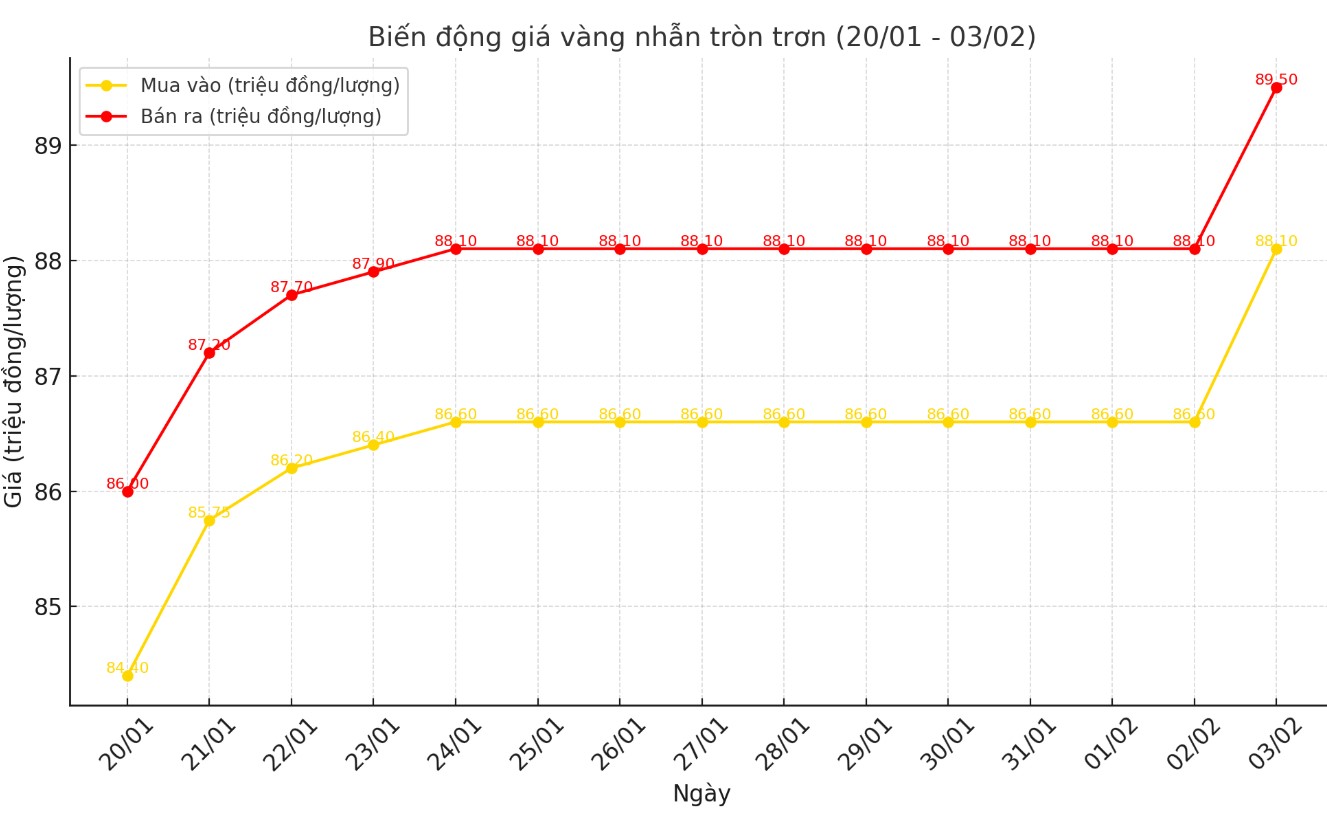

As of 6:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 88.1-89.50 million VND/tael (buy - sell); an increase of 1.5 million VND/tael for buying and an increase of 1.4 million VND/tael for selling compared to the closing price of yesterday's trading session.

Bao Tin Minh Chau listed the price of gold rings at 87.8-89.75 million VND/tael (buy - sell), an increase of 1.2 million VND/tael for buying and an increase of 850,000 VND/tael for selling compared to the closing price of yesterday's trading session.

World gold price

As of 6:25 p.m., the world gold price listed on Kitco was at 2,799.1 USD/ounce, up 1.2 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

The world gold price has been fluctuating continuously over the past 24 hours, while the USD index has increased. Recorded at 6:25 p.m. on February 3, the US Dollar Index, which measures the greenback's fluctuations against 6 major currencies, was at 109.295 points (up 1%).

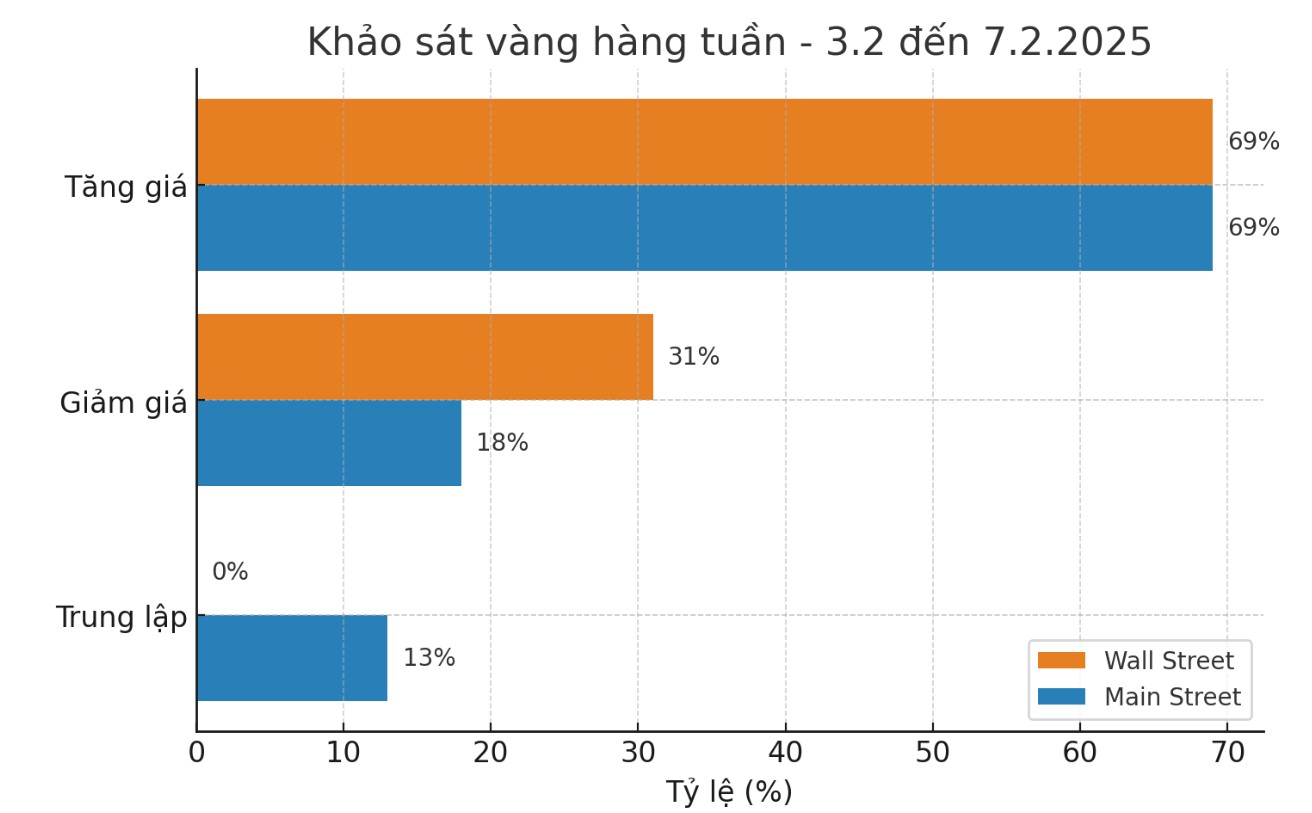

The latest Kitco News weekly gold survey shows that industry experts remain bullish on the precious metal, while retail investors also see higher prices in the near future.

Nine experts, or 69%, expect gold prices to surpass this week’s record this week. Four experts, or 31%, predict gold prices will fall. None expect gold to trade sideways or consolidate this week.

Gold prices came under pressure but still outperformed the S&P 500 as markets reacted to the global trade war. Despite the selling pressure, gold remains an attractive safe-haven asset as tariffs imposed by U.S. President Donald Trump rattle equity investors, some analysts said.

Selling pressure intensified after the US implemented a 25% tariff on imports from Mexico and Canada on Saturday. In addition, the US also imposed a 10% tariff on goods imported from China.

In response, the Canadian government imposed 25% tariffs on $30 billion worth of US imports starting Tuesday. Canada is also preparing to increase tariffs on $125 billion worth of US imports in the next three weeks. Meanwhile, Mexico said it was preparing to impose 25% tariffs on US imports and would release a list on Monday. China has not retaliated but said it will take the case to the World Trade Organization (WTO).

Commodity analysts say the gold market could see volatility in the short term, as the precious metal is caught between its role as a safe-haven asset and the negative impact of a strong dollar and higher US interest rates.

“The increase in inflation in the US due to these tariffs and subsequent measures will be faster and larger than initially expected. In this context, the possibility of the Fed cutting interest rates in the next 12 to 18 months is almost gone,” Paul Ashworth, chief North American economist at Capital Economics, said in a report over the weekend.

Fixed income analysts at TD Securities believe the Fed will not adjust interest rates in the first half of this year due to uncertainties about the economic impact of tariffs.

“The Fed’s main direction is to maintain its current tight monetary policy. In other words, the Fed can continue to delay its interest rate cut plan if necessary. The nature of this tariff shock is stagflation. The economy will initially see a rapid impact on consumer prices, but in the long term, the impact of slowing growth will gradually become more evident.

“We forecast that US GDP could decline by 0.2-0.3 percentage points next year. Fed officials will have to assess which factor will dominate the medium term and the optimal policy decision remains unclear,” TD Securities said in a report.

See more news related to gold prices HERE...