Mr. Gary S. Wagner - commodity brokerage and market analyst at Kitco - said that the precious metal market continues to show remarkable strength. This persistent rally reflects both confirmed technical signals and fundamental factors supporting the long-term weakness of the US dollar, creating an attractive picture for investors watching the traditional Asset Group.

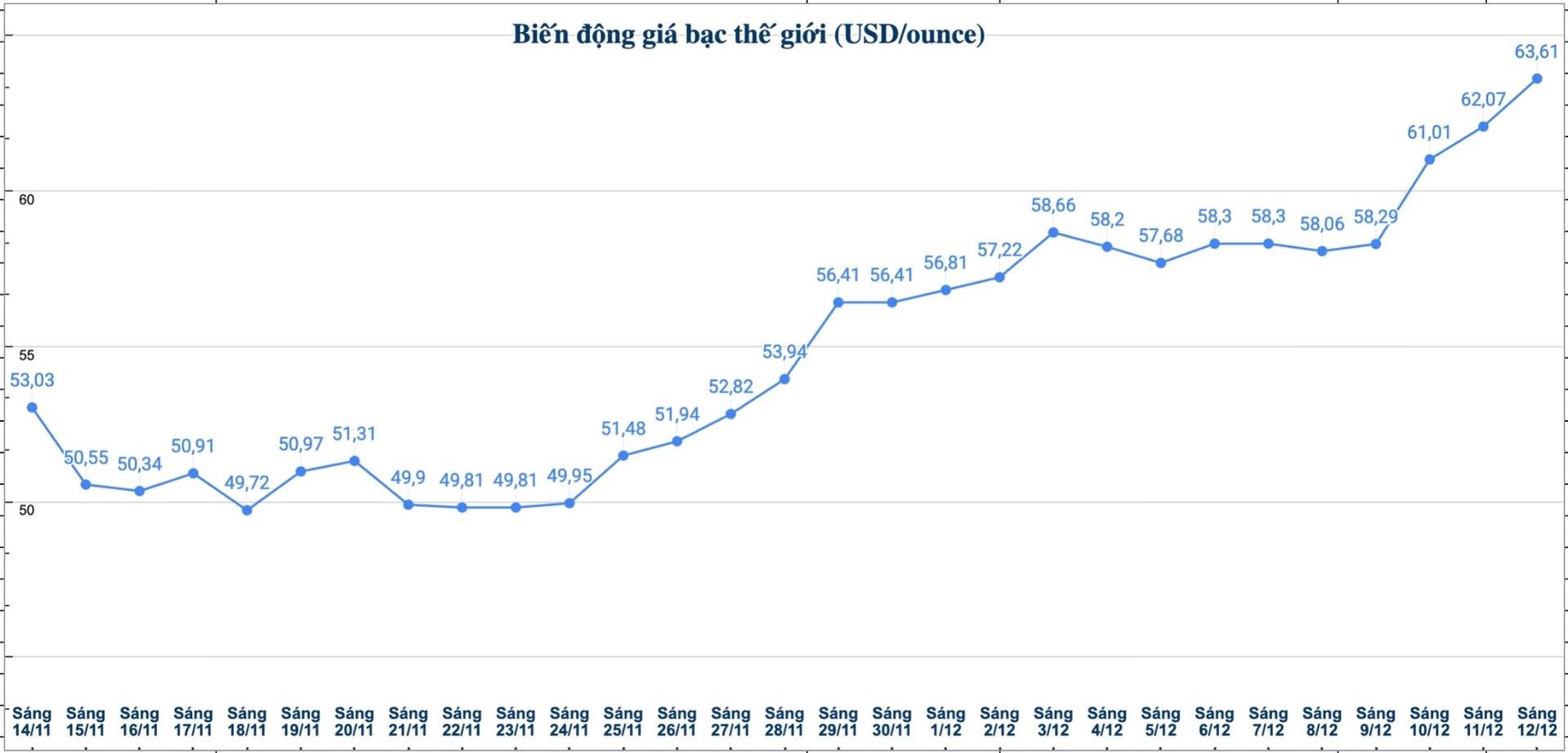

Experts note the appearance of a strong candle model on the silver chart, expressed in three consecutive sessions where prices have closed higher than the previous session. This is a signal that buying power is overwhelming and often predicts that prices will only temporarily stagnate for a short time before continuing to increase and the market has developed correctly.

After the signal was confirmed last Tuesday, silver prices moved sideways for four days to take the momentum, then entered a series of strong increases for three consecutive sessions since Tuesday this week, bringing prices to historical highs.

In the most recent trading session, silver futures recorded outstanding strength, increasing by 1.79 USD, equivalent to 2.89%, to 63.99 USD/ounce. Previously, in the session, the white metal set a historic milestone when it hit a new record of 64.72 USD. This development not only strengthens the predictable value of the "three white soldiers" model, but also shows that the cash flow is still very strong throughout this increase.

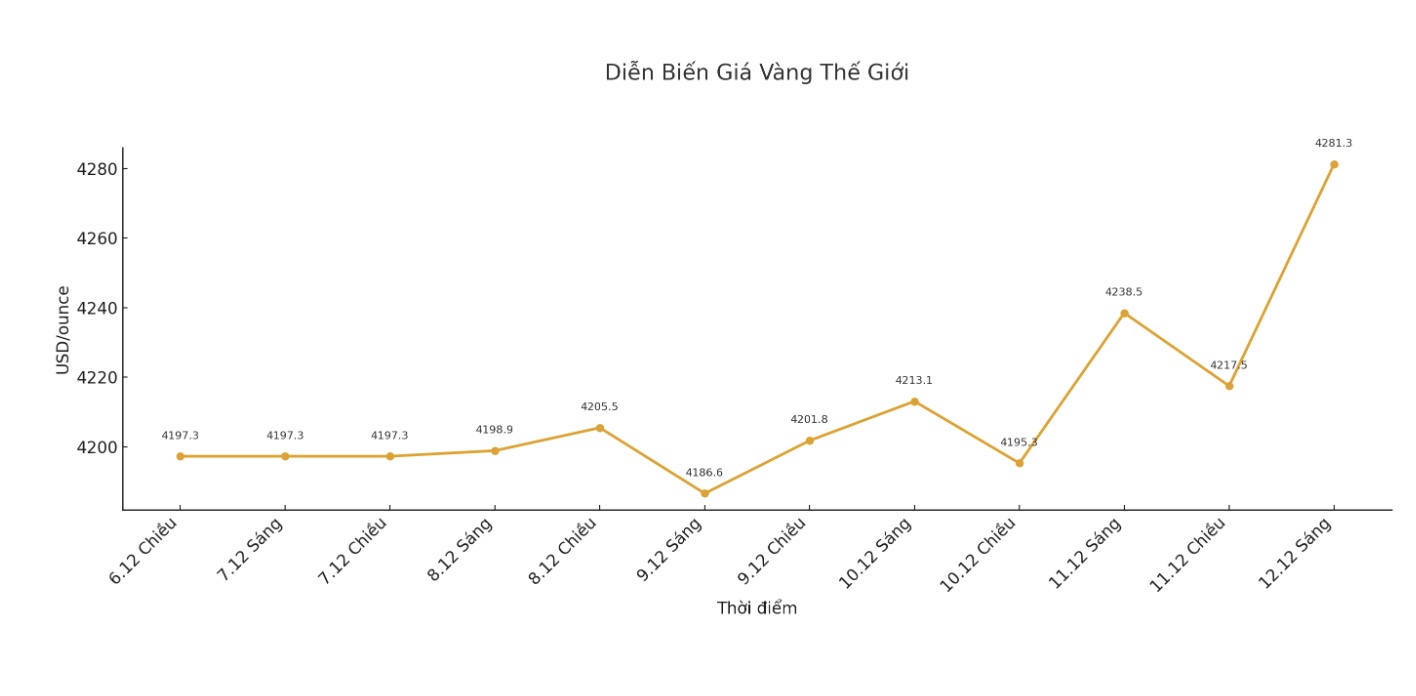

While silver attracted attention with its new peak, gold also recorded an impressive increase. The yellow precious metal has reached its highest level since October 25, with the February futures contract increasing by 51.2 USD, equivalent to 1.20%, to 4,309.50 USD/ounce. This increase puts gold on track to return to the record set on October 20 at $4,436 USD.

The synchronization of gold and silver shows that the market forces are broader, not just from individual metals. Gold's steady climb towards the old peak shows that the foundation factors supporting the precious metal are still solid - a sign that the current increase may have room to continue.

The fundamental factor driving the precious metals market's increase is very clear: The prolonged weakness of the USD. The greenback recorded the third consecutive week of decline, creating a favorable environment for goods priced in USD. Over the past three weeks, the Dollar Index has fallen 1.95%, and for the remaining trading session of this week, the accumulated decline could well exceed 2%.

The USD- precious metal relationship has been verified. As the USD weakens, gold and silver become cheaper for investors holding other currencies, thereby stimulating international demand. At the same time, the precious metal is also more attractive as a store of value asset when confidence in the USD declines. The consecutive decline of the USD for three weeks shows that this is not only a short-term fluctuation but may reflect a change in expectations for monetary policy, fiscal policy or the US economic context.

The synthesis of technical and foundational factors shows that the precious metal's rally still maintains a solid structure. The confirmation of technical models, combined with the prolonged weakness of the USD and signals from the gold- silvery ratio, is creating a favorable context for continued upward momentum in the short term.

However, investors need to be cautious with signs of trend exhaustion, especially from the gold- silwer ratio. Although the current momentum is still strong, approaching historical rates in the 62-65 range could be a warning that risks are increasing. At these levels, the probability of an increased correction is increasing, and the reason for the defense to become more convincing.

At the moment, the easiest direction for gold and silver is still up, thanks to the weakening of the USD and technical models to reinforce the trend. Investors should continue to closely monitor the gold- silver ratio, as this could be the earliest and most reliable indicator that the current increase is reaching a natural end.

See more news related to gold prices HERE...