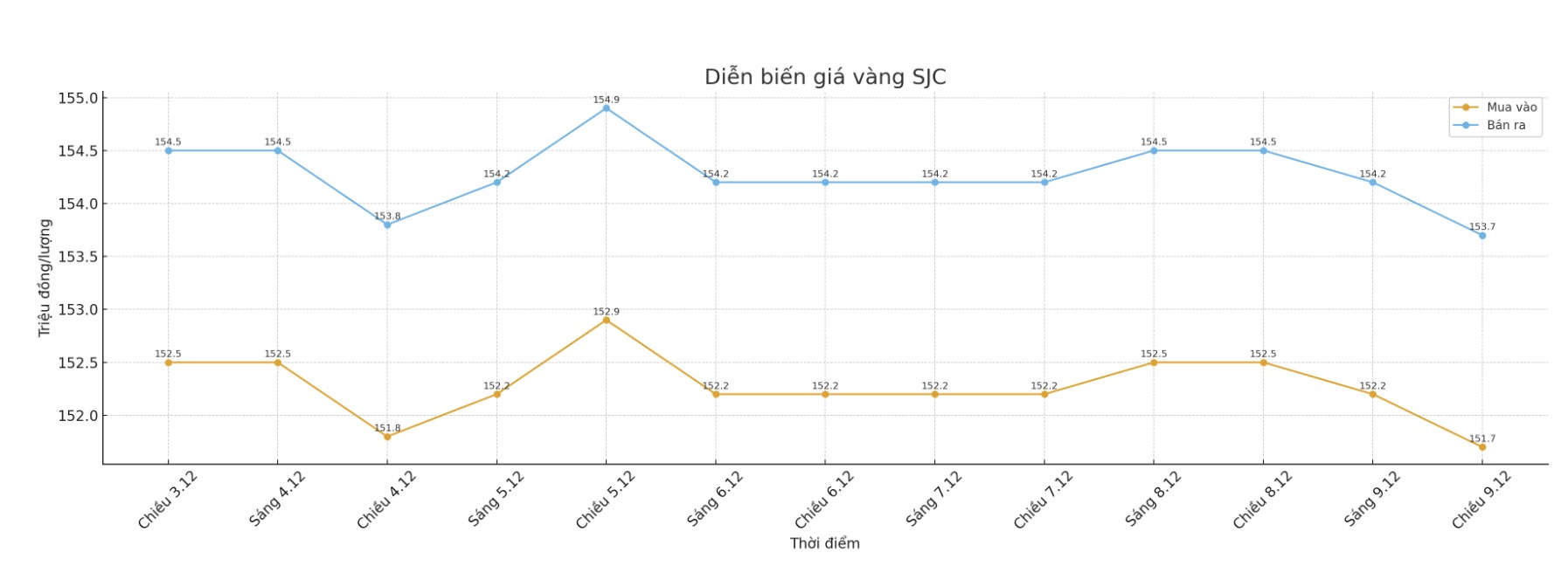

SJC gold bar price

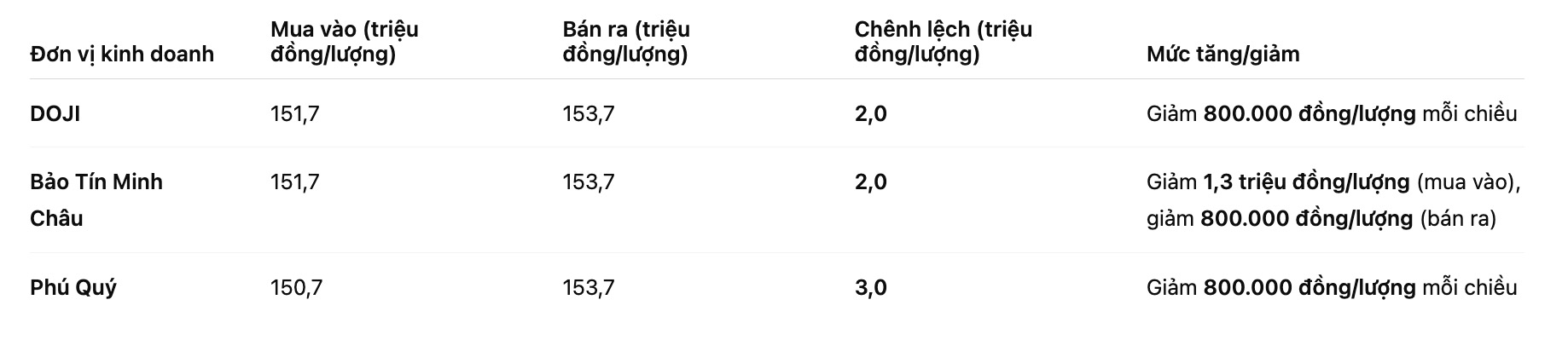

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 151.7-153.7 million VND/tael (buy in - sell out), down 800,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 151.7-153.7 million VND/tael (buy - sell), down 1.3 million VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 150.7-153.7 million VND/tael (buy - sell), down 800,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

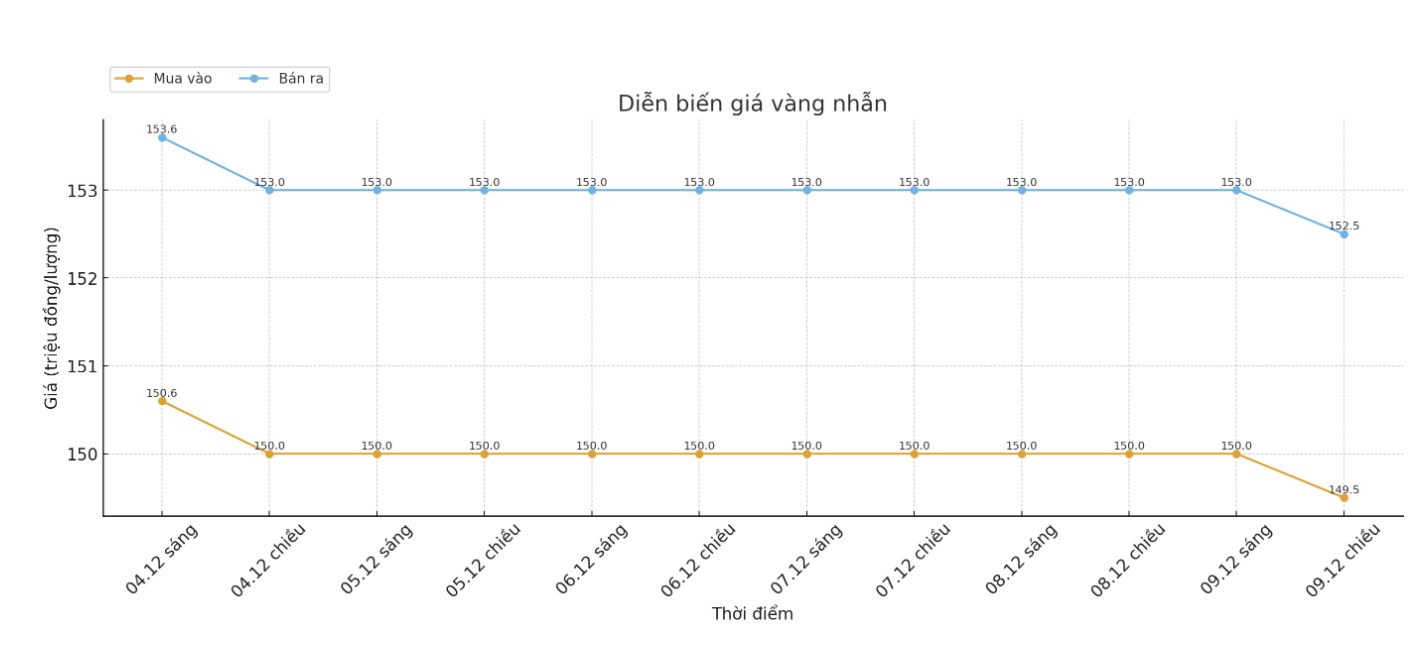

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 149.5-152.5 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150.5-153.5 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 149.5-152.5 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

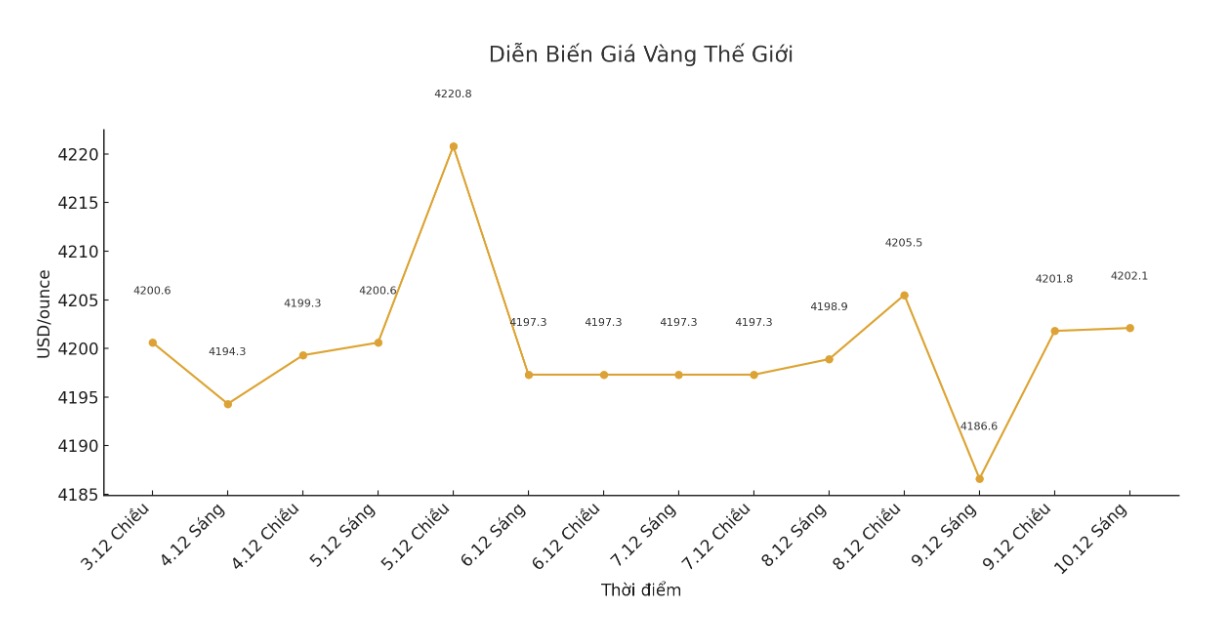

World gold price

The world gold price was listed at 1:05, at 4,202.1 USD/ounce, down 13 USD compared to a day ago.

Gold price forecast

Gold prices increased in the midday trading session in the US. Silver prices rose sharply and set a new record high, reaching $61.055/ounce under the month-long Comex silver contract as of the time of writing.

Technical buying activity has been seen in both metals today, as both short-term and long-term price charts have maintained a strong uptrend. Gold for February futures rose $26.10 to $4,244.4. March silver futures rose $0.725, to $29. 13.

The Federal Open Market Committee (FOMC) of the Federal Reserve began its monetary policy meeting this morning, scheduled to end on Wednesday afternoon with a statement from the FOMC and a press conference by Fed Chairman Jerome Powell. The market is pricing in a 90% chance that the Fed will cut interest rates by 0.25% this week.

However, there are growing expectations that the FOMC statement and Chairman Powell's speech may have a more hawlish tone largely due to concerns about persistent inflation. The US October and November production inflation reports, which were expected to be released this week, were postponed to January, further increasing the uncertainty surrounding local inflation.

US stock indexes increased slightly in the middle of the afternoon, mainly temporarily suspended before the results from the FOMC.

Technically, the next bullish price increase for February gold futures is to reach a close above the solid resistance level at the peak of the contract, also a record level, 4,433 USD/ounce. The closest downside target for the bears is to pull prices below the strong technical support zone at $4,100/ounce.

The first resistance level was determined at 4,285.00 USD/ounce, followed by 4,300 USD/ounce. The first support level was at the night low of $4,197.8/ounce, followed by $4,150.00/ounce.

In outside markets, the USD index increased slightly. Crude oil prices are weaker, trading around 58.25 USD/barrel. The yield on the 10-year US Treasury note is around 4.15%.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...