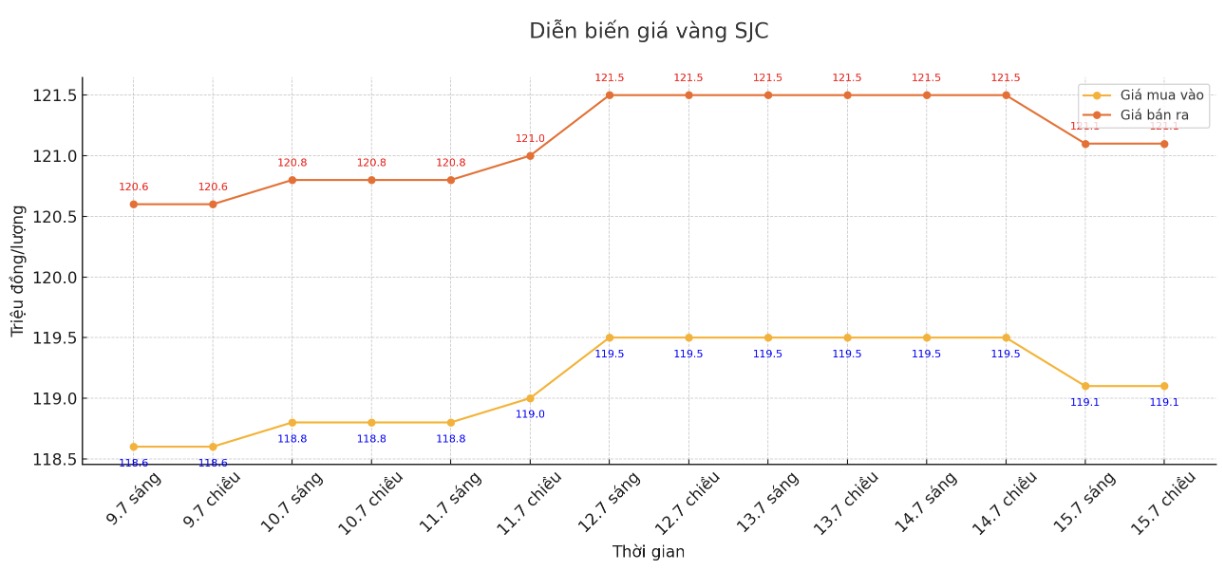

SJC gold bar price

As of 6:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.1-121.1 million/tael (buy in - sell out); down VND 400,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 119.1-121.1 million VND/tael (buy - sell); down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND 119.1-121.1 million/tael (buy in - sell out); down VND 400,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 118.4-121.1 million/tael (buy in - sell out); down VND 400,000/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

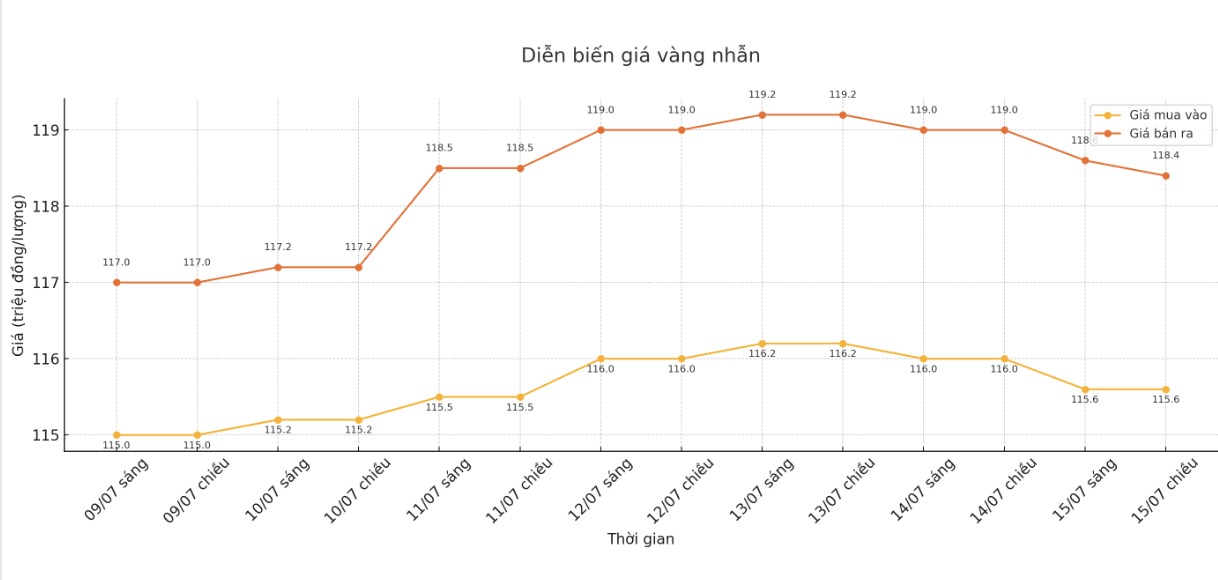

9999 gold ring price

As of 6:00 p.m., DOJI Group listed the price of gold rings at 115.6-118.4 million VND/tael (buy - sell), down 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.8-118.8 million VND/tael (buy - sell), down 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115-118 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

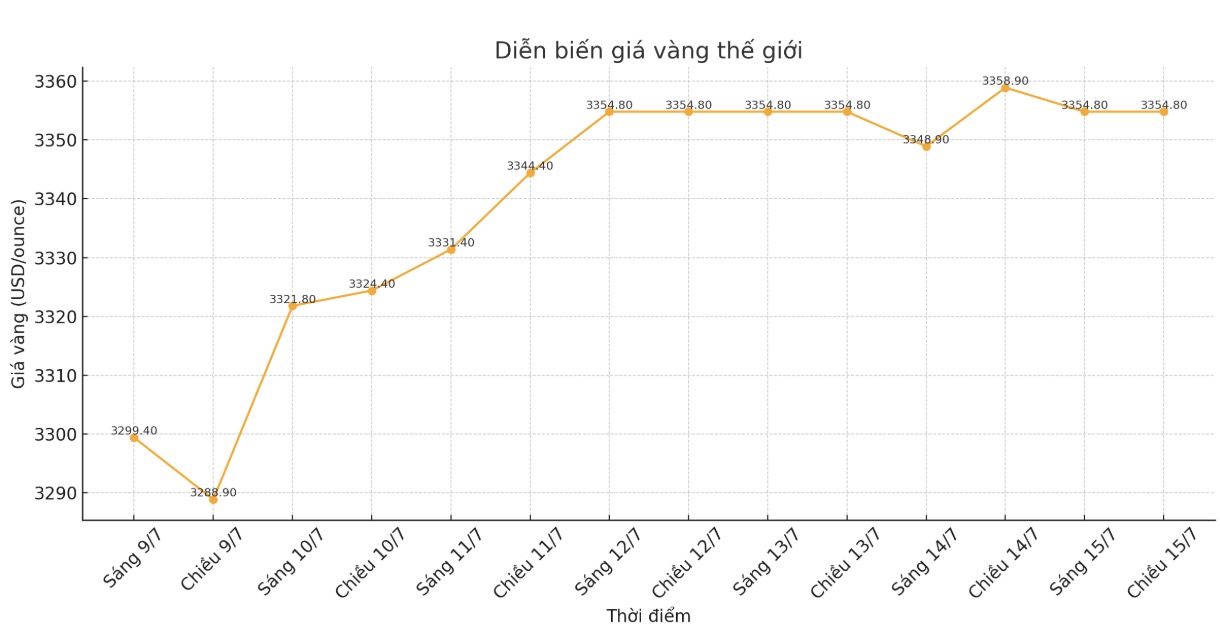

World gold price

The world gold price was listed at 6:10 p.m. at 3,358.9 USD/ounce, down 11.3 USD/ounce compared to 1 day ago.

Gold price forecast

World gold prices tend to decrease but remain high. The reason is that concerns about the global trade war have boosted demand for safe-haven assets, while investors are waiting for an important report on US inflation.

The USD Index (DXY) fell 0.1%, making gold cheaper for buyers holding other currencies.

Han Tan, a market analyst at Nemo.Money, said: Gold prices are rallying as bulls take advantage of a slight weakness in the US dollar today. Gold is supported by many factors, from expectations of the US Federal Reserve (FED) cutting interest rates, threats of US President Donald Trump to impose taxes, to prolonged geopolitical and economic risks".

The European Union on Monday accused the US of resisting efforts to reach a trade deal and warned of retaliatory measures if no deal was reached to avoid the sanctions Trump threatened to impose from August 1.

Trump escalated his trade war on Saturday, declaring a 30% tariff on most imports from the EU and Mexico, after issuing similar warnings to other trading partners.

Meanwhile, the US consumer price index (CPI) report will be released at 12:30 GMT, expected to provide investors with more information on the Fed's upcoming policies.

US consumer inflation in June is likely to increase, opening a price increase due to the impact of tariffs that the FED is still cautiously monitoring before resuming the interest rate cut cycle. Currently, the market expects the FED to cut interest rates by a total of 48 basis points from now until the end of the year, starting from October.

If the current gold- silver price ratio is maintained, when gold prices surpass $3,440/ounce, silver prices will surpass $40/ounce, said Nitesh Shah, commodity strategist from WisdomTree.

In other precious metals, spot silver rose 0.4% to $28.28 an ounce, after hitting its highest level since September 2011 in a trading session on Monday. platinum rose 0.8% to $1,373.85 an ounce, while palladium rose 0.2% to $1,195.59/ounce.

Economic data to watch next week

Tuesday: US Consumer Price Index (CPI), Empire State manufacturing survey.

Wednesday: US Producer Price Index (PPI).

Thursday: Retail sales, Philly Fed manufacturing survey, US weekly jobless claims.

Friday: Newly started houses, University of Michigan preliminary consumer confidence index.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...