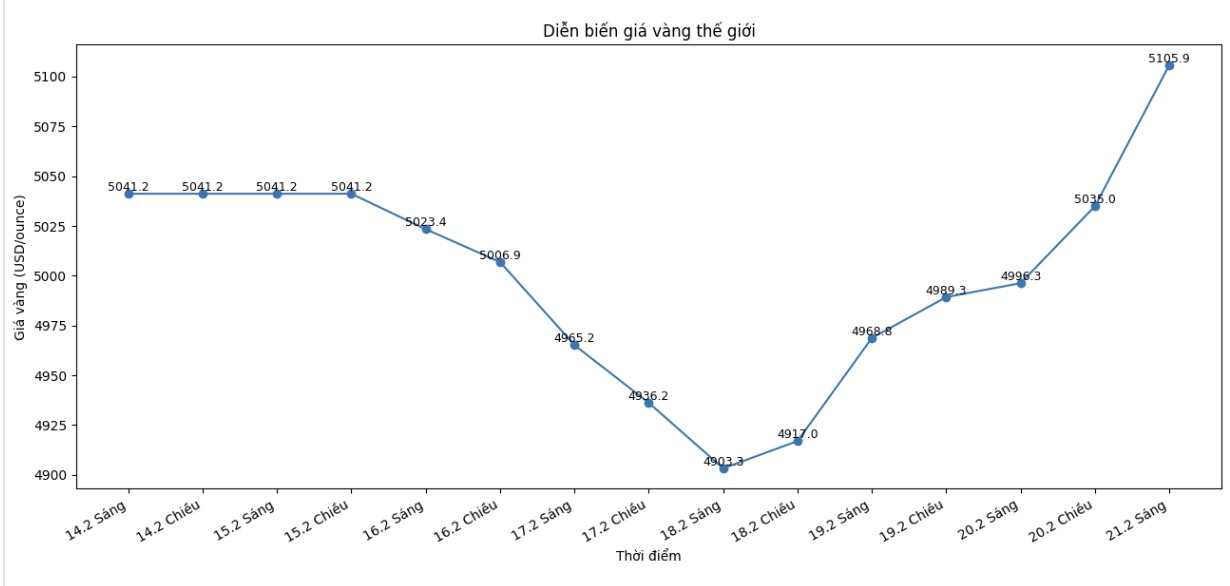

After a relatively quiet trading week, gold prices regained the 5,100 USD/ounce mark before the end of the week, as investors turned to the precious metal as a "safety" to hedge against risks from geopolitical instability and the risk of chaos in the Middle East if a US-Iran conflict breaks out.

The rebound of gold exceeding this important psychological threshold takes place in the context of US President Donald Trump declaring that Iran has 10 days to reach a nuclear agreement with the US, otherwise there will be "bad things".

However, analysts believe that the attractiveness of safe haven for gold is still quite limited to date, as the price of the precious metal is expected to only increase modestly by about 0.5% in the week.

Lukman Otunuga - senior analyst at FXTM - commented: "Investors are cautious after Mr. Trump warned Iran to reach an agreement on its nuclear program within 10-15 days. Concerns about a large-scale US attack could continue to support safe haven demand.

Ole Hansen - Head of Commodity Strategy at Saxo Bank, said that the weak reaction of gold when it revolved around the 5,000 USD/ounce mark shows that the market is still skeptical about the true purpose of this military move.

The gold market lacks response, continuing to fluctuate around 5,000 USD, reflecting doubts whether this is just a "hint" to force Iran to concede, or whether Mr. Trump is really ready to face domestic economic consequences, especially when gasoline prices may increase sharply if conflict occurs," he said.

In a report released on Friday, Bernard Dahdah - a precious metals analyst at Natixis, predicted that gold prices could increase by 15% if the US attacks Iran.

Most of the increase will occur in the first few weeks. Then, the price may cool down as the market gradually assesses the impact and adapts to the situation" - he said. "In the context of prices going sideways, gold may jump to $5,500 - $5,800/ounce in the two weeks after the conflict breaks out.

Meanwhile, Razan Hilal - market analyst at Forex. com, believes that the risk of a new conflict in the Middle East is just one of many factors supporting gold.

Risk avoidance sentiment still dominates global markets. Concerns about volatility in the AI sector, rising geopolitical tensions and US-Biddle East relations continue to boost demand for defensive assets. This environment maintains bottom-fishing buying power for gold and silver," she said.

Besides its role as a safe haven asset, gold is also benefiting as a monetary asset after the latest US economic data showed weak growth and persistent inflation.

The US Bureau of Economic Analysis (BEA) said that the first estimate shows that Q4 GDP increased by 1.4%, a sharp decrease compared to the 4.4% of Q3.

At the same time, BEA said core inflation remained at nearly 3% at the end of the year.

Experts believe this is a favorable environment for gold, as economic weakness may force the US Federal Reserve (Fed) to cut interest rates, even when inflation is still high. This will pull real yields down, thereby reducing the opportunity cost of holding gold - an unprofitable asset.

However, the outlook for US monetary policy is still unclear. The minutes of the Fed meeting in January show that the agency is still cautious about easing interest rates.

Data to monitor next week

US consumer confidence; President Trump's State of the Union Address.

Number of weekly jobless claims.

US Producer Price Index (PPI).