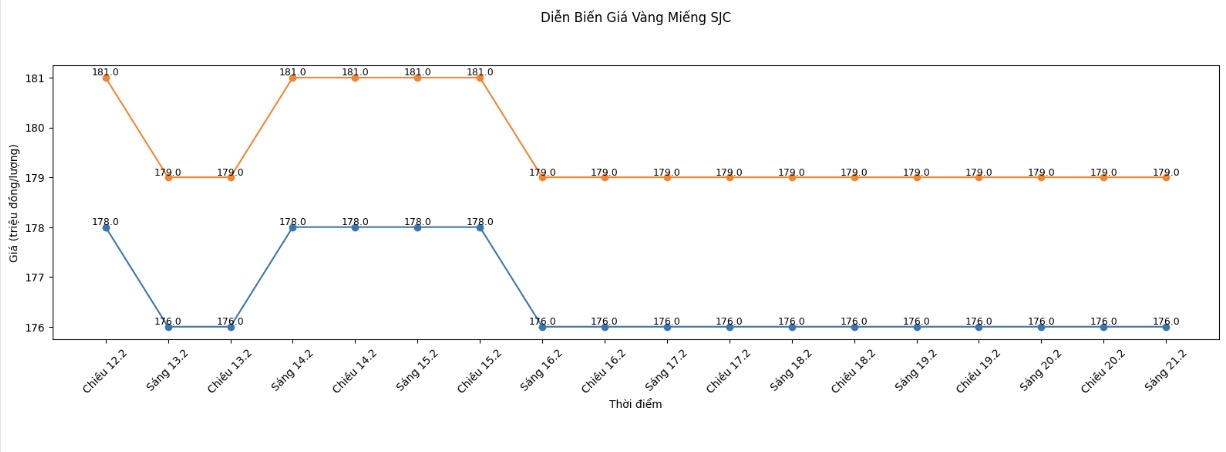

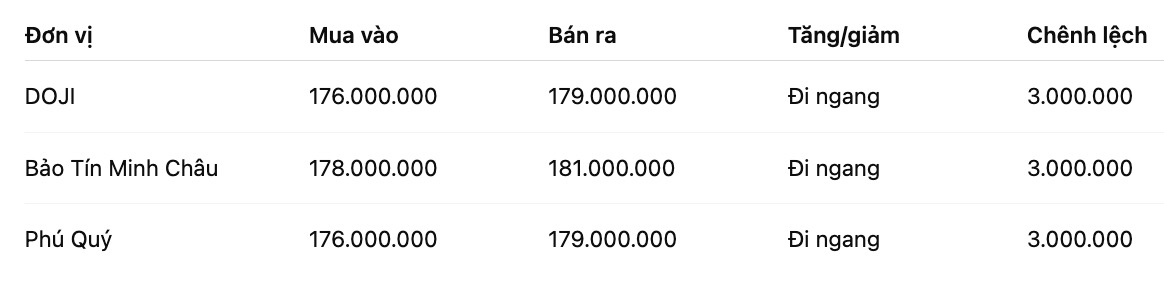

SJC gold bar price

As of 9:00 AM, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176-179 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

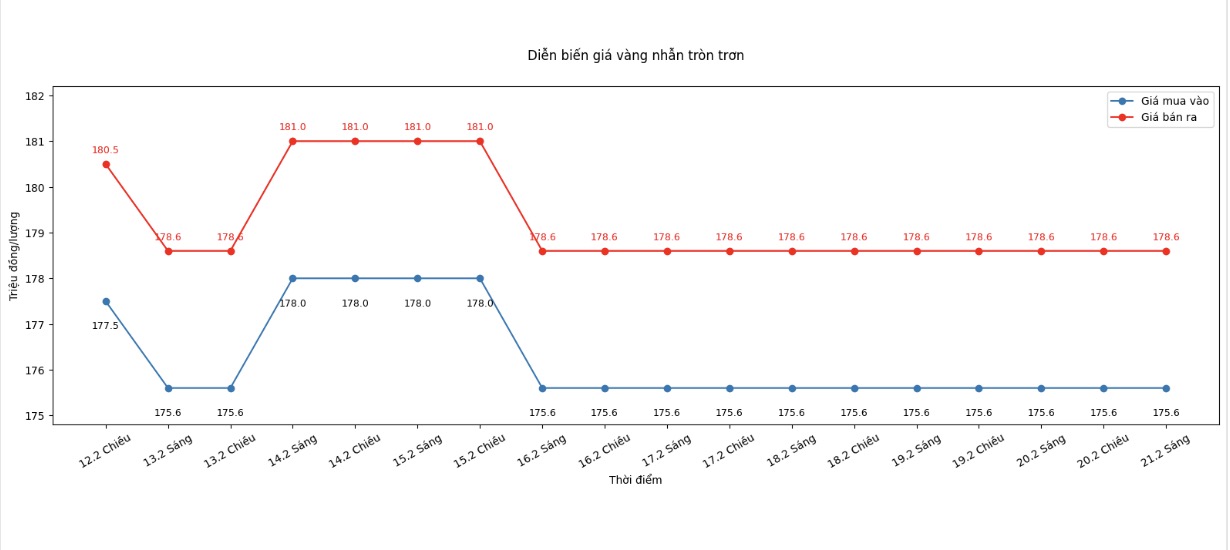

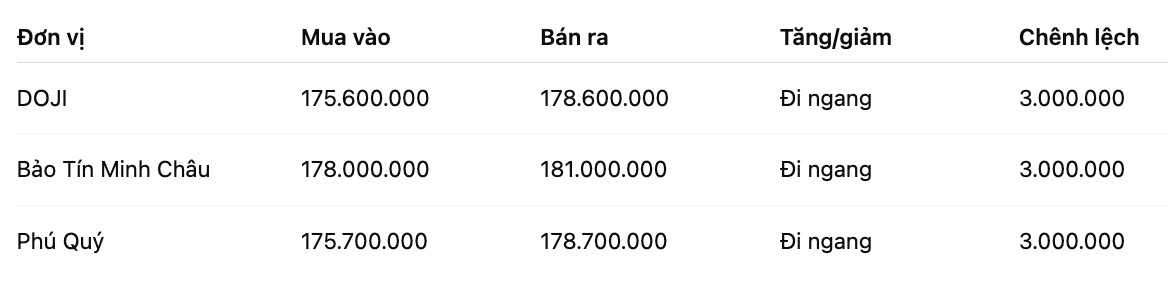

9999 gold ring price

As of 9:00 AM, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), unchanged in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

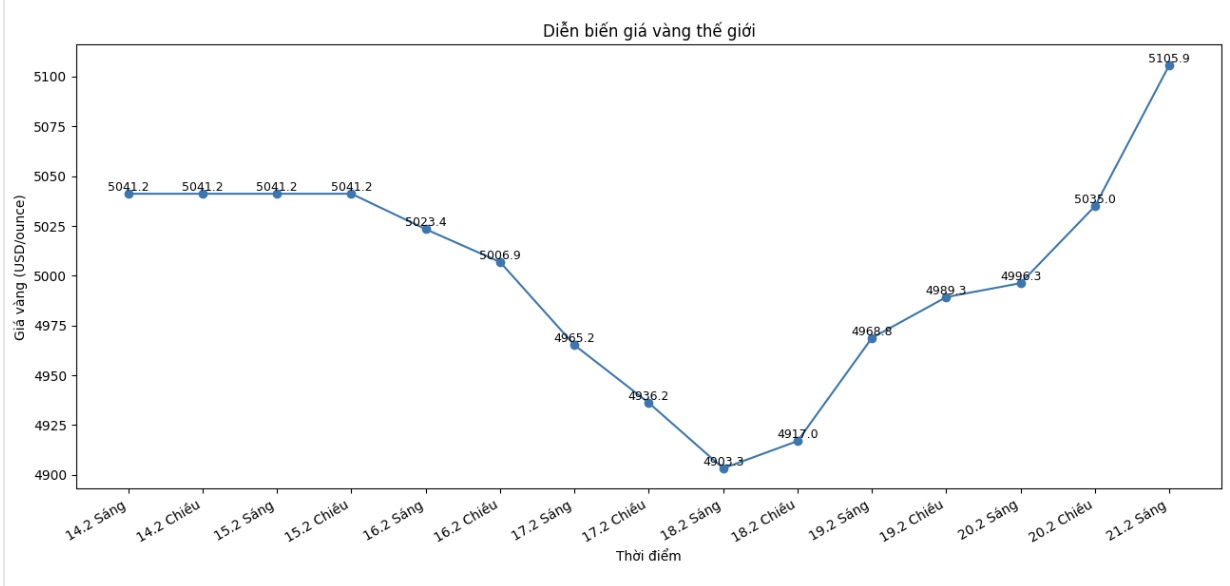

World gold price

At 9:11 am, world gold prices were listed around the threshold of 5-105.9 USD/ounce, up 109.6 USD compared to the previous day.

Gold price forecast

After a stormy trading week, the gold market entered a forecasting phase with the focus being geopolitical risks, the diễn biến of the USD and a series of US economic data to be released soon.

Gold and silver prices simultaneously surged sharply at the end of the week, as safe-haven demand returned. The main reason came from escalating tensions in the Middle East, in the context that the US is said to be approaching the risk of conflict with Iran.

According to Bloomberg, Washington has increased its large-scale military presence in the region, including two aircraft carriers and many fighters and refueling aircraft. This development immediately triggered a defensive mentality in global financial markets.

Notably, the USD maintained significant strength. The Dollar Spot Index rose nearly 1% in the week, recording the strongest increase in many months.

Investors are gradually reducing expectations that the US Federal Reserve (Fed) will soon cut interest rates, as concerns about inflation still exist and US economic data have not shown clear signs of weakening. The solid greenback somewhat limits the upward momentum of precious metals, creating a familiar state of tug-of-war between gold and the USD.

The energy market also contributes to increasing volatility. Nymex crude oil prices fluctuate around the six-month high, reflecting concerns about the risk of supply disruption. The scenario of a US-Iran conflict, if it occurs, could affect traffic through the Strait of Hormuz – a strategic shipping route for global oil. High oil prices often lead to increased inflation expectations, thereby indirectly supporting gold.

In terms of data, investors will be following important US reports next week, especially consumer confidence and the producer price index (PPI). These figures may reshape monetary policy expectations, a factor that is strongly dominating the short-term gold trend.

The latest survey on Wall Street shows that optimistic sentiment is prevailing. Most experts believe that gold is likely to challenge and stay above the 5,100 USD/ounce zone if geopolitical tensions have not cooled down. Meanwhile, individual investors continue to lean towards the scenario of a third consecutive week of price increase.

However, analysts also warn of the risk of technical correction after a hot increase. Strong fluctuations, high buying-selling spreads and unpredictable reactions from the USD may cause the market to experience significant fluctuations. In this context, cautious strategies and tight risk management are still recommended.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...