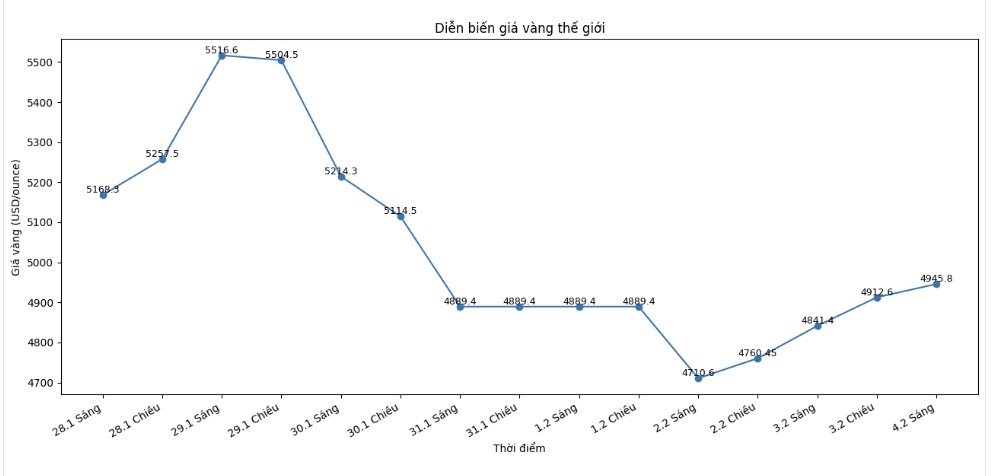

According to Kitco, after a deep decline last Friday (January 30) - when gold futures prices at one point fell to a daily low of 4,423 USD/ounce and then recovered and closed at 4,907 USD/ounce, equivalent to a decrease of 503 USD (9.3%) - selling pressure continued to last until Tuesday, bringing prices back to the 4,423 USD/ounce mark.

However, strong buying pressure today pushed gold prices up more than 6%, with the April gold futures contract jumping to 4,761 USD/ounce, up about 280 USD per ounce. This is the largest daily increase (in percentage) of April gold futures since March 2009.

The previous strong sell-off mainly stemmed from US President Donald Trump's nomination of Mr. Kevin Warsh to the position of Chairman of the US Federal Reserve (Fed). Investors assess Mr. Warsh as the most "hawkish" candidate among options, causing the attractiveness of safe-haven gold to decline, although there are still expectations that he will support long-term interest rate cuts.

Investors are currently concerned that the Fed under its new leadership may pursue a tighter policy on the balance sheet.

Instability increased further when the US Bureau of Labor Statistics (BLS) announced on Monday that the January non-farm payroll report - an economic indicator of particular market interest - would be postponed due to a partial federal government shutdown. This disruption increased volatility in financial markets.

Meanwhile, geopolitical tensions continue to be a factor supporting demand for precious metals. Expected talks between the US and Iran on Friday, along with Ukraine preparing for a new round of peace talks after recent Russian attacks, are keeping global risk sentiment at a high level.

The strong increase in today's session ended the two consecutive declining sessions and is considered an important turning point. The previous sell-off "swept away" a large amount of value in the gold and silver market, but it seems that key support zones have been found.

Mr. Michael Hsueh - a metal analyst at a bank, commented on Monday: "The thematic drivers of gold are still positive and we believe that the reasons for investors to hold gold and precious metals have not changed. Current conditions do not show a sustainable reversal of gold prices.

Despite recent fluctuations, gold is still assessed to have room to continue to rise, with potential resistance levels possibly heading towards the $6,000/ounce zone" - Gary Wagner - a commodity broker and market analyst - told Kitco.

See more news related to gold prices HERE...