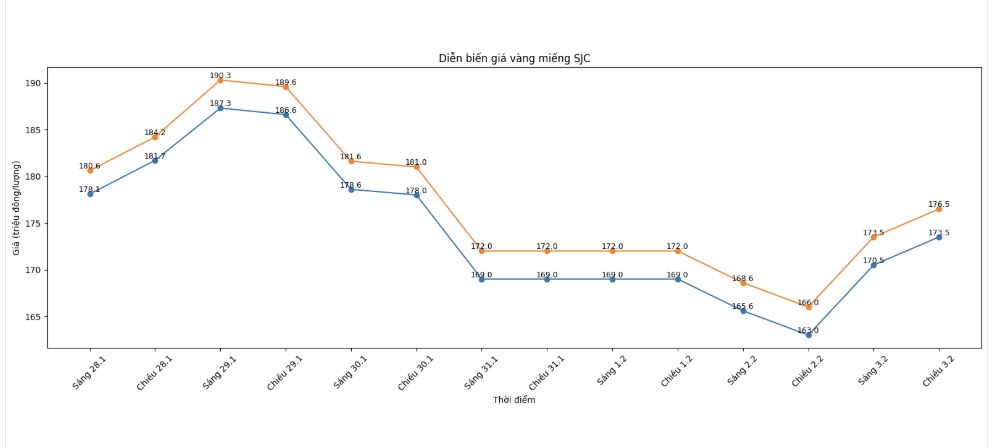

SJC gold bar price

As of 6:30 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 173.5-176.5 million VND/tael (buying - selling); an increase of 10.5 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 173.5-176.5 million VND/tael (buying - selling); an increase of 10.5 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 173.5-176.5 million VND/tael (buying - selling); an increase of 10.5 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

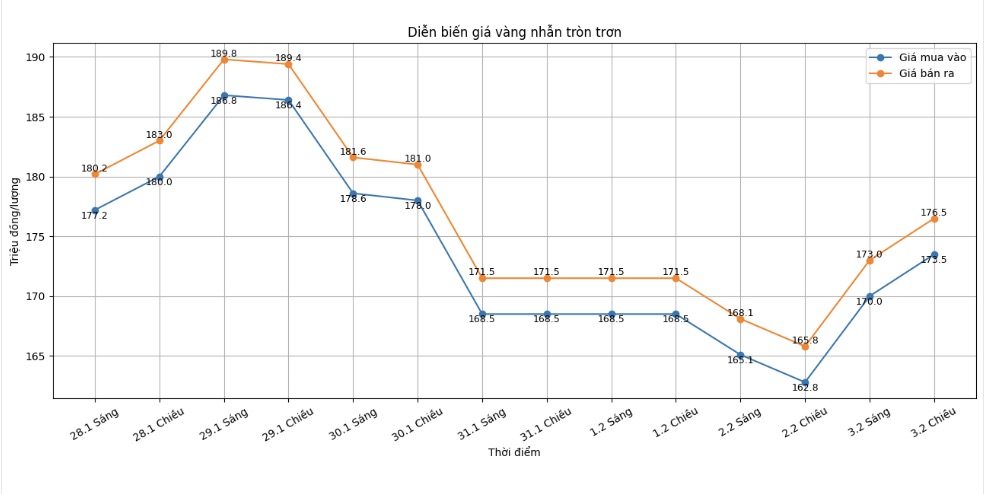

9999 gold ring price

As of 6:40 PM, DOJI Group listed the price of gold rings at 173.5-176.5 million VND/tael (buying - selling); an increase of 10.7 million VND/tael in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 173.5-176.5 million VND/tael (buying - selling), an increase of 9 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of gold rings at 173-176 million VND/tael (buying - selling), an increase of 10 million VND/tael in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

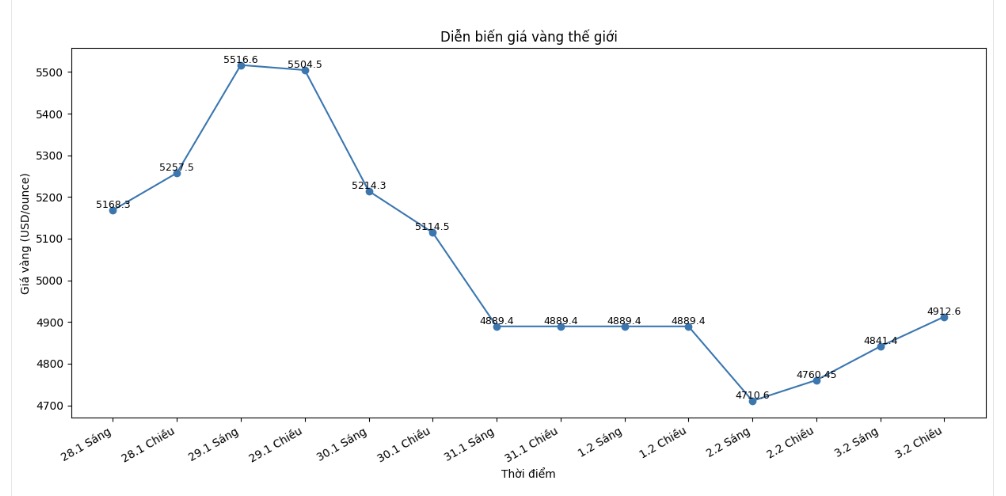

World gold price

At 7:50 PM, world gold prices were listed around the threshold of 4, 912.6 USD/ounce; up 152.2 USD compared to the previous day.

Gold price forecast

After a deep decline that caused much concern for investors, the global gold market is entering a "strength test" phase after a prolonged hot streak from the end of 2025. This development makes short-term sentiment more cautious, but many international analysis organizations believe that this is a necessary correction, instead of a signal of trend reversal.

According to Metals Focus, the extremely strong fluctuation of gold prices in recent sessions reflects the previous rapid increase. Mr. Matthew Piggott - Director in charge of gold and silver of this organization - said that with rapid climbing speed and continuous new peaks, the market is unlikely to avoid a deep correction to rebalance supply and demand.

Notably, although gold prices at one point lost the important psychological milestone of 5,000 USD/ounce, bottom-fishing buying pressure quickly appeared, helping prices recover significantly from the low zone.

Metals Focus believes that current fluctuations do not weaken the role of gold as a safe haven asset. Most of the cash flow participating in the market is still long-term defensive, aiming to preserve asset value against monetary risks, public debt and geopolitical instability, instead of seeking short-term profits. In that context, adjustments are seen as an opportunity for physical demand to return, especially in large consumer markets.

From another perspective, Societe Generale analysts believe that the recent downward pressure mainly stems from the "leveragation" process in the financial market, when speculative positions are stretched in low liquidity conditions. The sharp drop in gold prices in a short time reflects technical factors and investment positions more than changes in fundamental factors.

This French bank emphasized that the medium- and long-term outlook for gold remains positive, as structural drivers such as fiscal deficit, high public debt and the trend of diversifying reserves away from the USD have not shown signs of reversal.

According to Societe Generale, considering the risk balance, gold's price increase potential in the whole year of 2026 is still significantly higher than the risk of price decrease, although the market may still fluctuate strongly in the short term.

Gold price data is compared to the previous day.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.

See more news related to gold prices HERE...