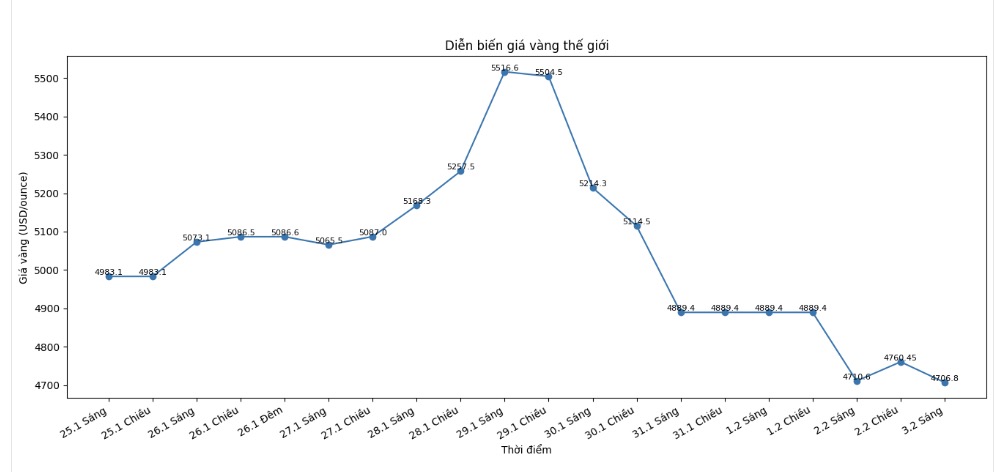

After recording the largest increase in a day in history, and almost immediately experiencing the strongest sell-off session of the day, gold prices have shown a level of volatility that is usually only seen in risky assets. However, Mr. Matthew Piggott - Director in charge of gold and silver at Metals Focus - said in an interview with Kitco News that these developments are not too unexpected and do not cause structural damage to the market.

With the recent rate of increase, an adjustment is inevitable," he said.

Gold has set a record number of all-time highs in the first weeks of 2026 - more than a dozen new peaks in less than three weeks - while silver at one point increased by 200% compared to the same period last year. According to Mr. Piggott, such extreme increases make a strong correction not only likely, but also necessary for market health.

Although gold prices could not maintain the initial support zone at the 5,000 USD/ounce mark, and selling pressure in the night pushed prices down to 4,402 USD/ounce, but then prices rebounded significantly from the bottom.

Although gold and silver are experiencing extreme volatility, Mr. Piggott believes that this price movement will not diminish the role of gold as a stable value storage channel - unlike the collapses that occurred in 1980 or 2011.

Most gold buyers today do not chase short-term profits," he explained. "They buy to protect their portfolios, prevent currency devaluation and geopolitical risks. Short-term volatility does not change that.

However, he also warned that strong price fluctuations could attract speculative capital flows of a "tourist" nature, thereby amplifying fluctuations in both directions. According to him, a complete picture of market participation can only be clear when data on ETFs and options are fully disclosed.

Material needs are still the main pillars

Despite strong fluctuations in the futures market, fundamental material demand remained at a steady level. The British research company said India continued to record strong material silver demand, as insurance premiums soared during Friday's adjustment.

Mr. Piggott believes that gold and silver can still be supported by FOMO sentiment (fear of missing opportunities), especially from investors who have been outside during last year's continuous price increases.

In the past year, there has been almost no adjustment" - Mr. Piggott said - "Now there is - and that's when material buyers are back".

Although large speculation and high options trading created a liquidity shock on Friday, Mr. Piggott emphasized that gold is still benefiting from solid fundamental demand, as central banks are forecast to continue net buying until the end of 2026.

Meanwhile, the proportion of gold allocation in the investment portfolio is still surprisingly low.

On average, this ratio is still only at a low one-digit level" - Mr. Piggott said - "Just increasing from 3% to 4% is enough to support gold prices at a significantly higher level.

He added that long-term investors - including pension funds, funding funds and family asset management offices - are still participating very limitedly, opening up great room for price increases if the level of participation is expanded.

Despite strong fluctuations, Mr. Piggott said Metals Focus did not change its core view after this adjustment. The company forecasts an average gold price of 5,500 USD/ounce by mid-year and about 5,800 USD/ounce for the whole year.

While some banks offer optimistic scenarios with gold prices ranging from 6,000 to 8,000 USD/ounce, Mr. Piggott emphasized that structural drivers - public debt, fiscal imbalances, dedollarization trends and geopolitical risks - are slow and unchangeable overnight.

These factors do not reverse in a moment" - he said - "They will take years to be removed." According to Mr. Piggott, the recent sell-off strengthened the market instead of weakening it.