Experts have positive forecasts on short -term gold price

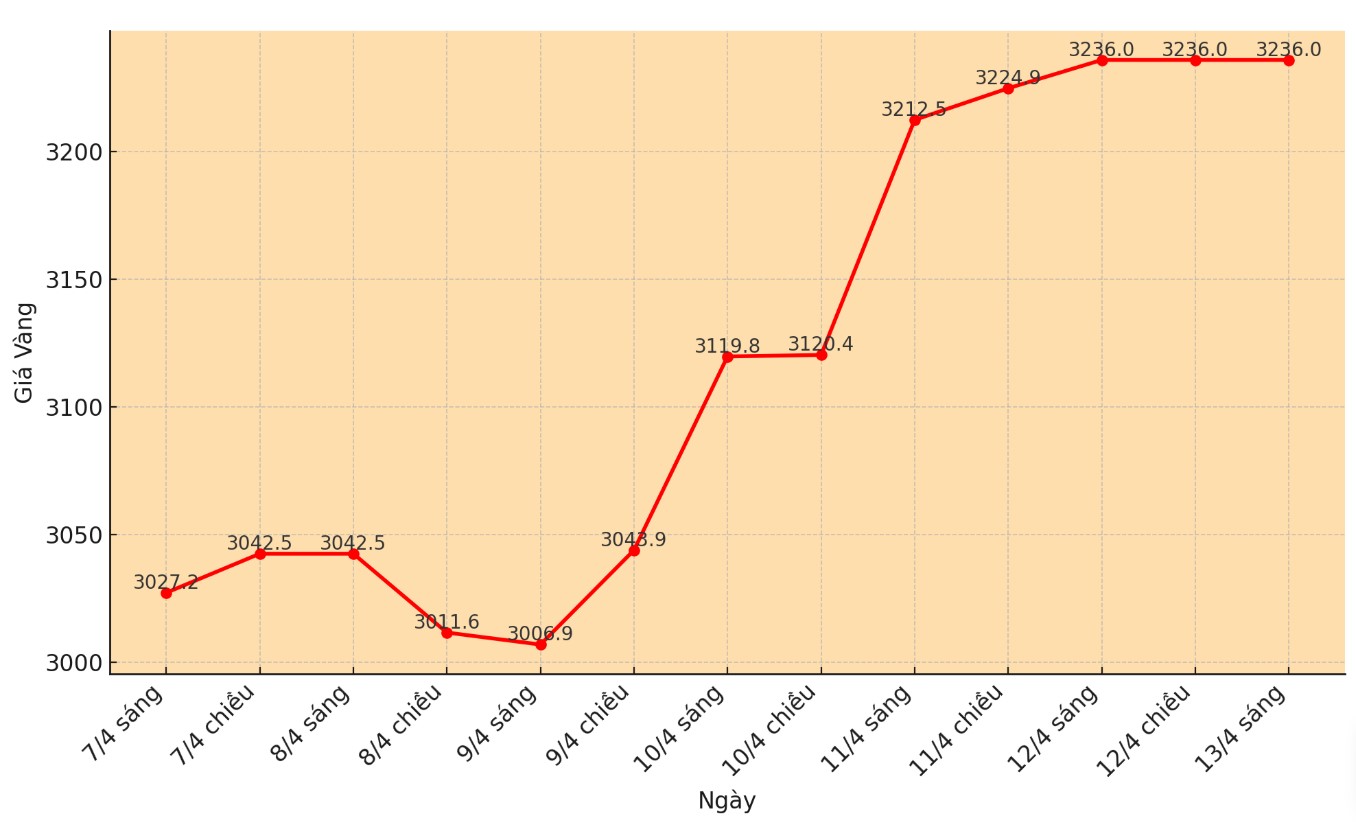

Adrian Day - Adrian Day Asset Management - said the current gain momentum was very clear. He said recent adjustments only lasted in a short time and was quickly bought back.

"Gold is attracting great attention from investors, and the motivation for price increase is still very strong," he said.

Sharing the same opinion, James Stanley - a high -level market strategist at Forex.com also maintained an optimistic view of gold. "I have kept a positive stance in gold for a long time and has no reason to change," he said. According to Stanley, the current development shows that it should not be contrary to the increase in gold.

According to Pavilonis, the biggest risk for gold is now the possibility of the US Federal Reserve (Fed) interfering with the bond market - but this ability is not high now.

However, Pavilonis warned that if the long -term yield dropped sharply, gold could be subject to adjustment or short -term profit. "I think the increase in golden trend will not be easily reversed, unless there is an intervention that manipulates as a sharp increase in deposit fees on the exchanges, like it happened in 2010," - he added.

Pavilonis also said that European governments selling US bonds recently were not an act of retaliation, but from the domestic financial demand.

"Europe has not grown for the past 5–6 years since the Covid -19 pandemic. The sale of bonds is like withdrawing savings to overcome damage in the economy," he explained.

This expert recommends that investors should use the defense tool for gold -buying positions in the next few months, when the market is entering the stage of major structural changes.

"If the gold plummeted in 2,500 - 2,700 USD/ounce, it was likely to appear significant new buying force," Pavilonis emphasized.

Colin Cieszynski - Patriarchal strategist at Sia Wealth Management - said he was also optimistic about gold next week, when the dollar tends to weaken and the instability factors have not shown signs of ending.

Rich Checkan - President and CEO at Asset Strategies International is expected to have short -term profit after a sharp increase, but that does not change the general trend. "Gold is motivating to increase prices clearly and still have room to continue to go up in the near future" - he said.

Gold price can reach 5,000 USD/ounce if this happens

Adam Button - Head of Monetary Strategy at Forexlive.com - warns that the US economy is in a difficult situation. According to him, investors are looking for safe shelter and gold is meeting that demand.

"The market is reflecting concerns about one or more risks at the same time, inflation increases, growth growth or labor productivity decreases. All can occur simultaneously" - he said.

Another noteworthy factor, according to the button, is the recent decision of the US Supreme Court - allowing the president to dismiss independent agencies. This can pave the way for direct intervention to the central bank. "If Mr. Trump fired Fed President Jerome Powell, gold price could be up to 5,000 USD/ounce," he predicted.

"Currently, all indicators on the market show that gold is a beneficial asset. Investors are reacting to the instability ahead by increasing gold holding" - Button concluded.