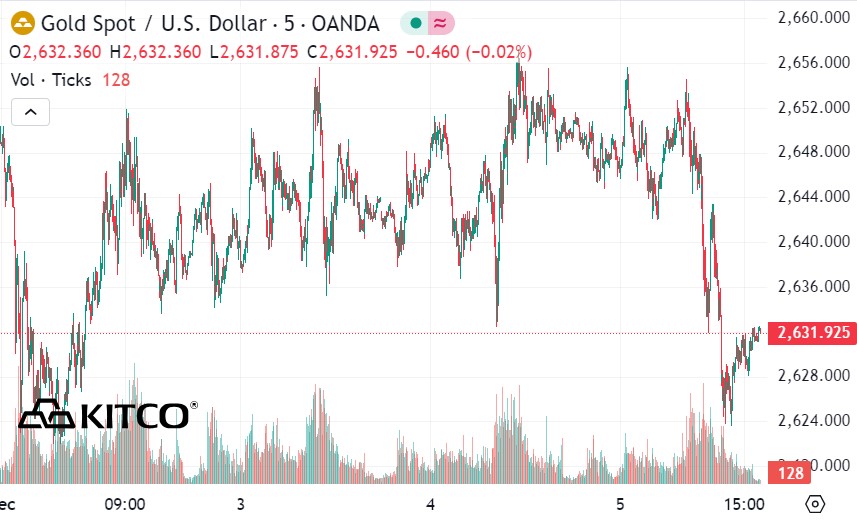

Early this morning, the world gold price suddenly dropped sharply after many sessions of tug-of-war. As of 5:20 a.m. (Vietnam time), the world gold price listed on Kitco was at 2,631.9 USD/ounce, down 23 USD/ounce compared to the beginning of the previous trading session.

According to Kitco, the victory of US President Donald Trump and his focus on his "America First" policies, aimed at supporting the economy and a stronger US dollar, has caused global gold investors to reduce their participation in this precious metal.

However, according to the latest report from the World Gold Council (WGC), North American investors continued to buy gold exchange-traded funds (ETFs) over the past month.

In its monthly ETF flows report, the WGC noted that the global gold market experienced a strong liquidation, with 28.6 tonnes of gold worth $2.1 billion withdrawn from the ETF market in November.

Analysts found Europe to be the region hardest hit by the global slump. European-listed funds saw outflows of 26.3 tonnes of gold worth $1.9 billion, the first monthly outflow from the region since April.

“The euro and sterling continued to weaken on poor economic data and the dollar hit a yearly high. Similar to trends seen in previous months, this dynamic led to outflows related to exchange rate hedging products,” the analysts said in the report.

At the same time, they note that persistent inflation has created uncertainty about the European Central Bank's monetary policy and its current easing cycle.

The North American market was the only region to see growth in gold over the past month, with funds recording inflows of 0.8 tonnes, worth $79 million.

“Despite a major correction in investment sentiment following the US election results, which weighed on gold prices, the region reported inflows, driven largely by increased demand from Canada. The US saw outflows in the first half of the month, but recovered towards the end of the month as markets began to price in a weaker US dollar and lower yields following Scott Bessent’s nomination as US Treasury Secretary,” the analysts said.

The WGC reported that Asian-listed funds saw outflows of 2.2 tonnes of gold worth $145 million, ending a 20-month streak of inflows.

Analysts said China was the country with the largest outflows as domestic gold prices fell sharply, causing investors to lose interest. Moreover, despite the volatility in the stock market, it continued to attract investors' attention, reducing interest in gold.

WGC noted that funds in India saw inflows due to growing consumer optimism.

Although the gold market has been quite volatile in recent weeks, WGC analysts see signs of stability. The market has recently held key support around $2,600/ounce.

“We believe demand has found support due to expectations of lower yields, continued high geopolitical risks and uncertainty around the implementation of future policy changes and the global impact under the Trump administration,” they said.

See more news related to gold prices HERE...