Over the past week, the CME FedWatch tool has gradually weakened confidence in the possibility of the Fed cutting interest rates in September.

A week ago, the tool (which was based on the position of futures traders, often giving quite accurate forecasts about the possibility of interest rate changes in the next 16 months) still showed that there would be a near-certain cut.

Fed Chairman Jerome Powell's speech at Jackson Hole this time has a big impact on the US economy and partly the global economy.

Meanwhile, the probability of a September rate cut has fallen to just 75% from almost certain levels last week. It is this lack of expectations for monetary policy easing that has become the strongest obstacle for gold.

It is likely that the annual meeting organized by the FED Kansas City branch will not " announce" the interest rate cut. Anyone familiar with Powell knows that he always emphasizes his reliance on data and traders will scrutinizing every word, tone, and even his body language to guess what he really wants to convey.

The real reason why the September cut is no longer considered a thing certain originated from the July meeting minutes, in which only two members voted to support the rate cut.

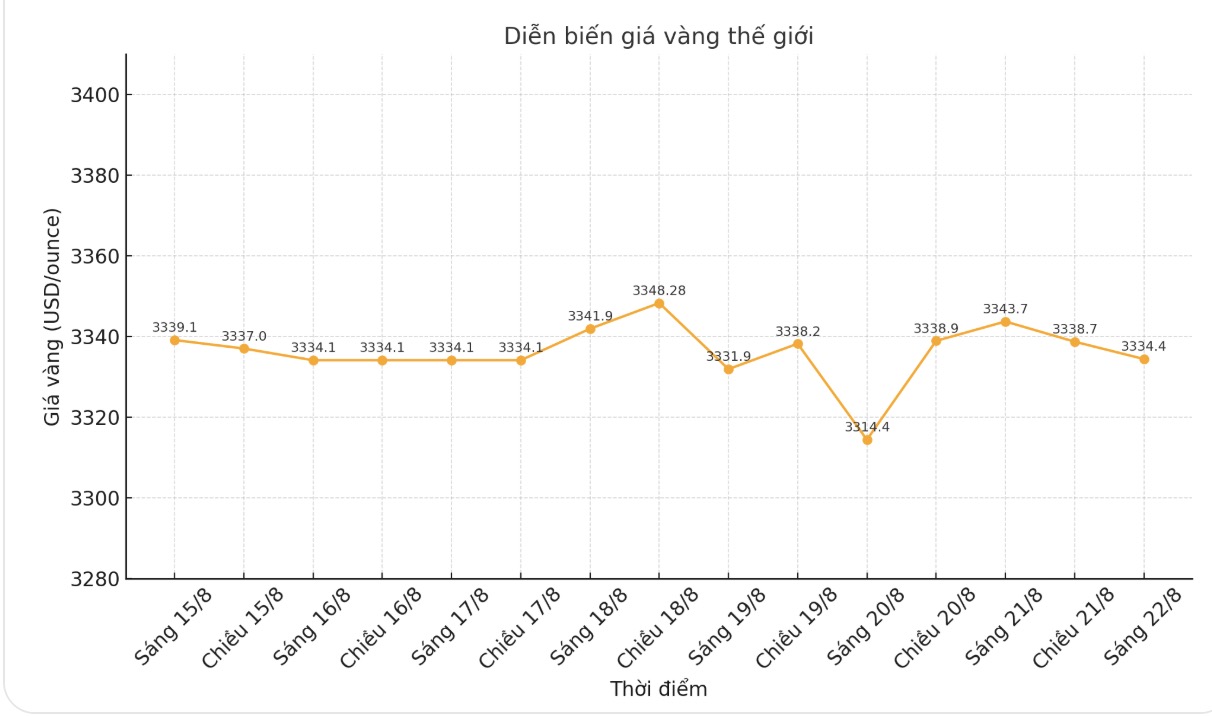

Therefore, gold will continue to face many difficulties, regardless of what Mr. Powell says tomorrow. In fact, on the price chart, gold has had 6 sessions of decline in the last 9 sessions.

In just the past 10 days, gold futures have lost more than $100 worth, currently fluctuating around $3,384.50/ounce.

However, gold's continued near-record strength shows incredible resilience since reaching its first historical peak on April 22. Since then, gold has fallen just about 3.9%.

More than 80 days ago, gold surpassed the $3,300/ounce mark for the first time and over the past 90 days, despite a series of pressures, gold has remained steady.

The core factors driving gold are still positive, so regardless of tomorrow's speech, gold is likely to maintain the current trend, at most only adjust slightly and in the short term. As long as the $3,300/ounce support zone has not been broken, gold still has up potential.

See more news related to gold prices HERE...