S&P Global said on Thursday that the preliminary purchasing managers' index (PMI) of the manufacturing sector increased to 53.3 in August, from 49.8 in July.

This result is higher than the expectations of economists, who predict that the index will remain almost unchanged. The report also noted that the index reached a 39-month high.

After almost stagnating in July, new orders in the commodity manufacturing sector also increased in August, with the highest growth rate since February 2024, mainly due to increased domestic demand, and supported by the largest increase in commodity exports in the past 15 months, the report said.

Meanwhile, the US service sector maintained its pace. The service PMI reached 55.4, almost unchanged from 55.7 in July, the report said. The data beat forecasts, with analysts expecting the PMI to fall to 54.2.

A sustained expansion has been noted in the service economy, although business growth rate has decreased slightly compared to the highest level since the beginning of the year in July, according to the report.

The composite index rose to 55.4, from 55.1 in July.

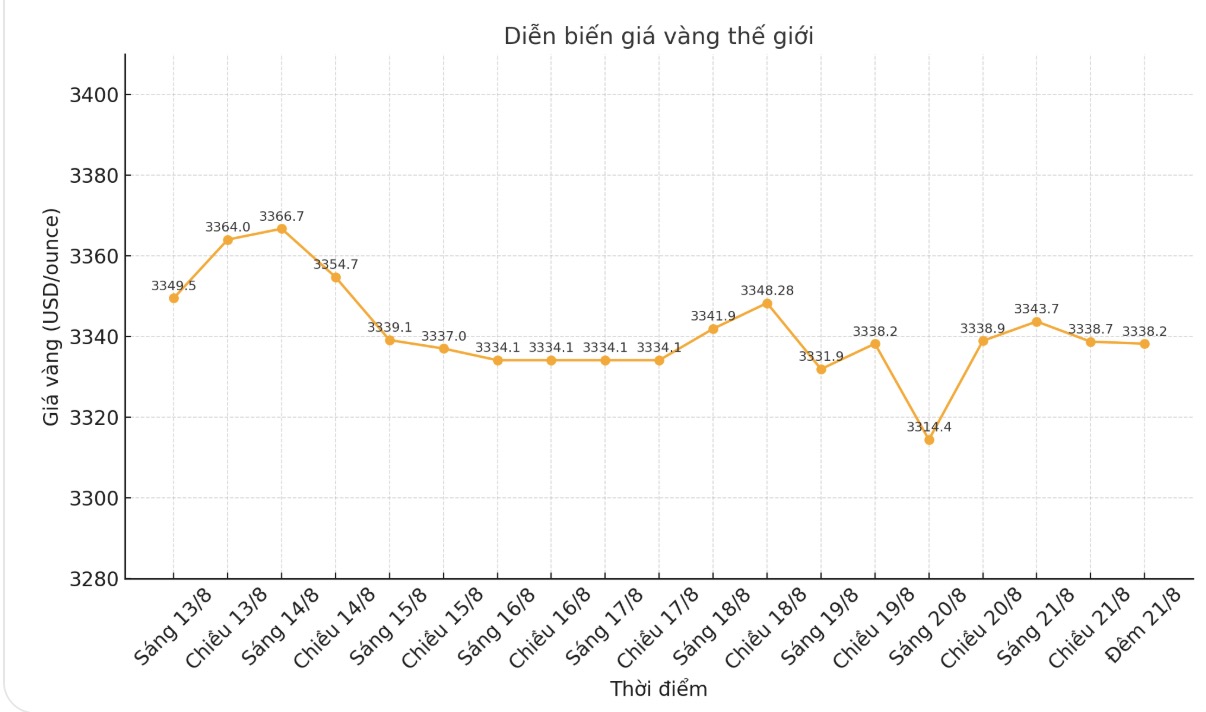

Despite stronger-than-expected economic data, the gold market still maintains an important support level of over 3,300 USD/ounce, despite initial selling pressure. The last spot gold price was recorded at 3,336.80 USD/ounce, down 0.26% on the day.

Chris Williamson - Chief Economist at S&P Global Market Intelligence - commented that the recovery in economic activities is a positive signal for growth in the third quarter.

The data shows that the economy is growing at 2.5% annually, higher than the average of 1.3% in the first two quarters of the year.

Companies in both manufacturing and services have reported stronger demand, but are struggling to meet sales growth, causing the fastest increase in outstanding orders since the period of capacity limitations due to the pandemic in early 2022," he said in the report.

However, the increase in operations also comes with higher costs. The report said that the average price for goods and services increased at the strongest rate since August 2022 when companies shifted higher costs to customers.

The increase in the selling price of goods and services shows that consumer inflation will continue to exceed the Fed's 2% target in the coming months. In fact, combined with increased business and recruitment activities, the price increase recorded in the survey puts PMI in the zone that tends to increase interest rates instead of cutting, based on the historical relationship between these economic indicators and the FOMC's policy decision, Mr. Williamson emphasized.

See more news related to gold prices HERE...