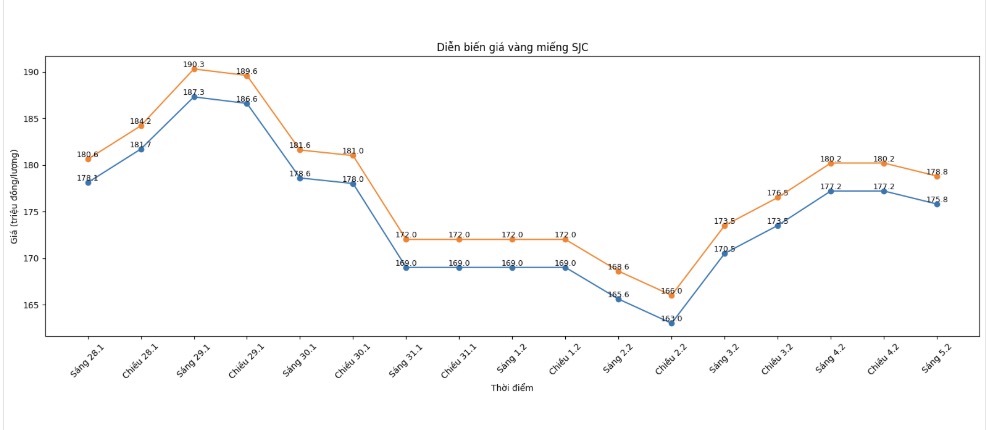

SJC gold bar price

As of 9:15 am, SJC gold bar prices were listed by DOJI Group at 175.8-178.8 million VND/tael (buying - selling), down 1.4 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 175.8-178.8 million VND/tael (buying - selling), down 1.4 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 175.8-178.8 million VND/tael (buying - selling), down 1.4 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

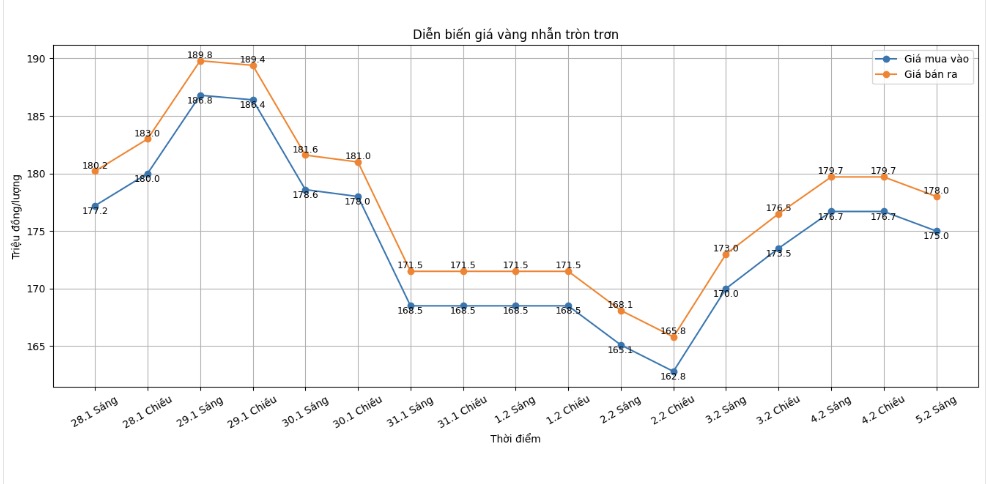

9999 gold ring price

As of 9:30 am, DOJI Group listed the price of gold rings at 175-178 million VND/tael (buying - selling), down 1.7 million VND/tael in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 175.8-178.8 million VND/tael (buying - selling), down 1.4 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of gold rings at 175.8-178.8 million VND/tael (buying - selling), down 1.4 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 2 to 3 million VND/tael, posing a risk of losses for investors.

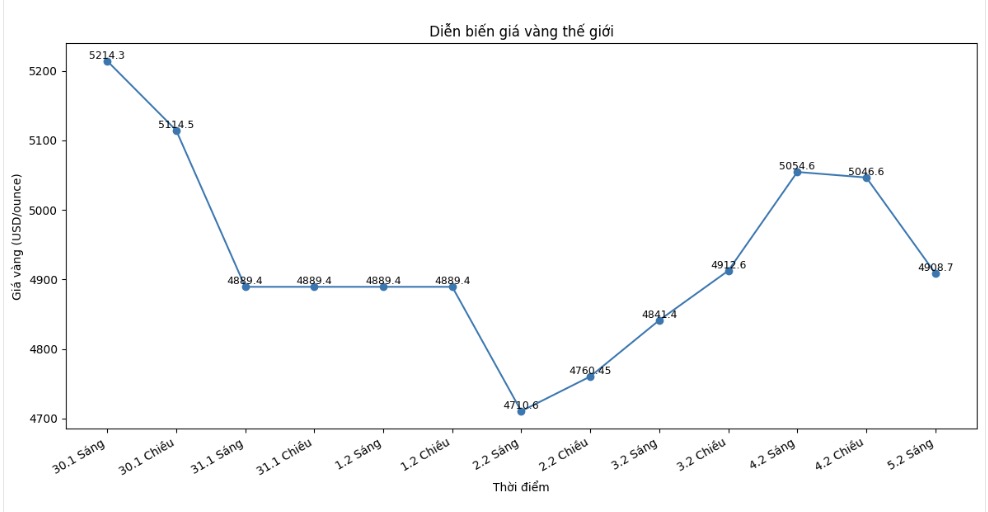

World gold price

At 9:20 am, world gold prices were listed around the threshold of 4,908.7 USD/ounce, a sharp decrease of 145.9 USD compared to the previous day.

Gold price forecast

After a quick recovery from the short-term bottom, world gold prices in today's session turned down again, showing that the market is still under significant adjustment pressure. This development reflects the cautious sentiment of investors in the context of price fluctuations maintaining at a high level, while supporting factors and risks continue to intertwine.

According to analysts, the previous deep decline activated bottom-fishing buying, helping gold prices rebound sharply in a short time. However, the rapid weakening of prices shows that the recent recovery is more technical than a sustainable trend reversal. Short-term profit-taking pressure is still present, especially when gold is trading at a record high price in history.

However, the medium and long-term outlook for the precious metal still receives support from a large part of financial institutions. Mr. Michael Hsueh - Head of Metal Research at Deutsche Bank - said that the underlying drivers of gold have not changed much. According to him, the need for risk hedging, prolonged geopolitical instability and pressure on key currencies continue to be important supporting factors, helping gold maintain its position in the investment portfolio, although short-term volatility may still be large.

In the opposite direction, many experts warn investors not to be subjective about the risk of deep correction. Mr. Mike McGlone - senior market strategist at Bloomberg Intelligence - said that the strong upward momentum at the beginning of the year pushed gold into a state of overbought. According to him, the possibility of gold prices returning to the 4,000 USD/ounce test zone is still present, especially if the global financial market stabilizes again and risk appetite improves.

Recent US economic data, including the jobs report showing that the labor market is cooling down, continue to be closely watched by investors. Although this information may strengthen expectations that the Fed will ease monetary policy in the second half of the year, the supportive impact on gold prices is assessed as not strong enough to completely eliminate the current adjustment pressure.

Gold price data is compared to the previous day.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.

See more news related to gold prices HERE...