The gold market is still stuck in a solid accumulation pattern. Despite taking a partial profit, an investment firm still expects the precious metal to be well supported through the end of the year.

In a recent interview, Mr. Tom Bruce - macro investment strategist at Tanglewood Total Wealth Management (an American asset management and investment consulting company), said that he took advantage of the sideways move of gold prices to reduce the holding ratio, from 12% to 10%.

However, he added that the sale was only to rebalance the portfolio, and the current 10% holdings were the company's maximum. In the first half of this year, Tanglewood held gold at a higher level due to the price of this precious metal increasing by nearly 30%.

I think gold could continue to move sideways for a while, but we are still optimistic in the long term, he said.

Bruce explained that taking profits is reasonable as geopolitical tensions cool down, allowing gold prices to fluctuate within a narrow range. Recent trade deals signed by the US with Europe and Japan have eased market concerns.

Trade deals, while not excellent, will provide some clarity for investors. This clarity is a disadvantage for gold, he said.

According to the agreements, tariffs on imports from Europe and Japan will increase by 15%. Although there is some clarity in trade, Bruce said there are still questions about how higher prices due to tariffs will affect inflation expectations and economic activity.

While tariffs could push up inflation, Bruce said this would not stop the Fed from cutting interest rates in September. However, he warned those who expect strong cuts this year to adjust their expectations.

Economic data this week shows that inflation remains high. The core CPI (excluding food and energy) increased by 3.1% in the 12 months to July.

Meanwhile, the total producer price index (PPI) increased by 3.3%, the largest 12-month increase since February.

Bruce predicted that the weak housing sector will reduce housing prices and rents - factors that have contributed greatly to inflation in recent months.

Housing costs may reduce the general inflation rate, even if commodity prices increase slightly. But there are limits. I think a total of 1% interest rate cut can be achieved in a short time without causing a big problem. But if it falls further, there will be risks," he said.

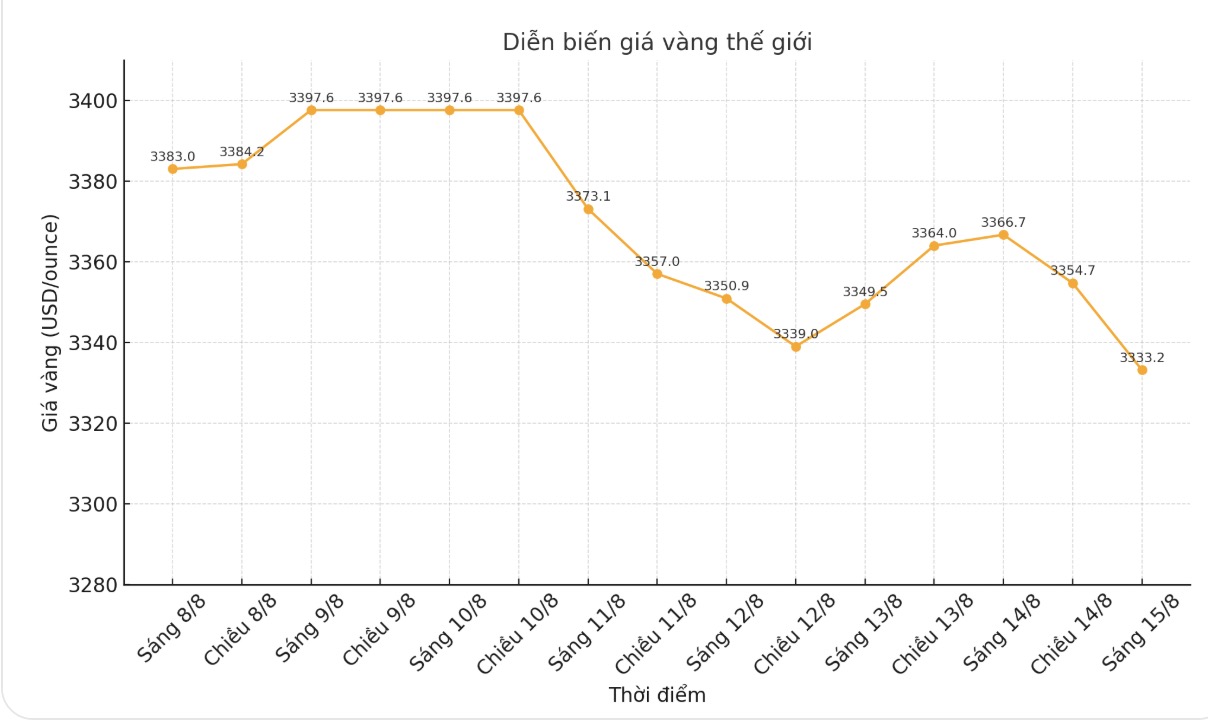

Although the new easing cycle will continue to support gold prices above $3,300/ounce, Bruce said there is another factor that makes him optimistic. That is, the US government continues to have spending problems when the budget deficit is unsustainable. At the same time, global confidence in the US dollar as a reserve currency is declining, reducing the greenback's purchasing power.

The competitor were seeing for the US dollar is gold. I am still optimistic about gold, but it may only fluctuate within the price range. Looking ahead, the main driver will probably be a weakening USD, the expert said.

See more news related to gold prices HERE...