In a rather quiet holiday trading session, the gold market struggled before the minutes of the December monetary policy meeting of the US Federal Reserve (Fed). The content of the minutes showed that the US central bank was not in a hurry to cut interest rates in 2026.

In early December, the Fed cut interest rates by 0.25%, marking the third consecutive quarter of loosening monetary policy. This move is generally in line with market expectations. However, the Fed still maintains its view of only implementing two interest rate cuts next year.

Minutes of the meeting show that US monetary policymakers are still concerned about inflation, in the context of uncertain economic prospects.

The minutes stated: "Regarding the level and timing of further adjustments to the target range of the Federal Reserve interest rate, some members believe that, according to their economic scenario, keeping the target range unchanged for a period of time after the interest rate has been lowered at this meeting is appropriate.

Some opinions believe that this approach will help policymakers better assess the delayed impacts of recent moves on the labor market and economic activity, and at the same time have more time to strengthen the belief that inflation will return to 2%.

The minutes also emphasized that members agreed on the need to carefully balance risks and value maintaining long-term inflation expectations to achieve the Fed's double goal.

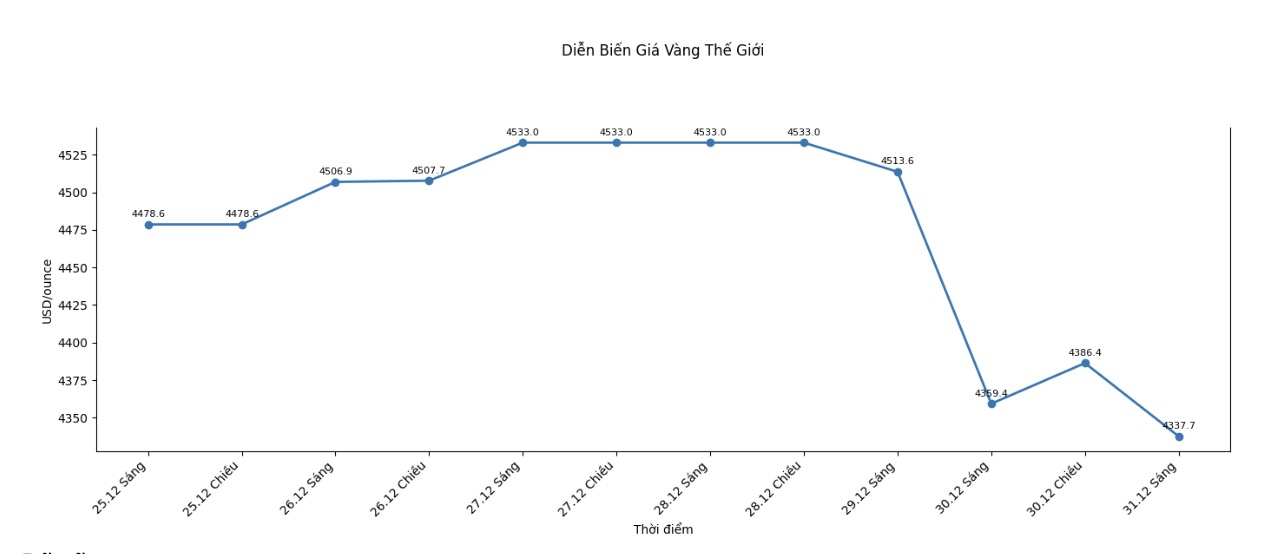

The gold market continues to react quite cautiously to this information. The world spot gold price was listed at 5:12 AM on December 31 (Vietnam time) at the threshold of 4,337.7 USD/ounce, up 7.4 USD/ounce.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...