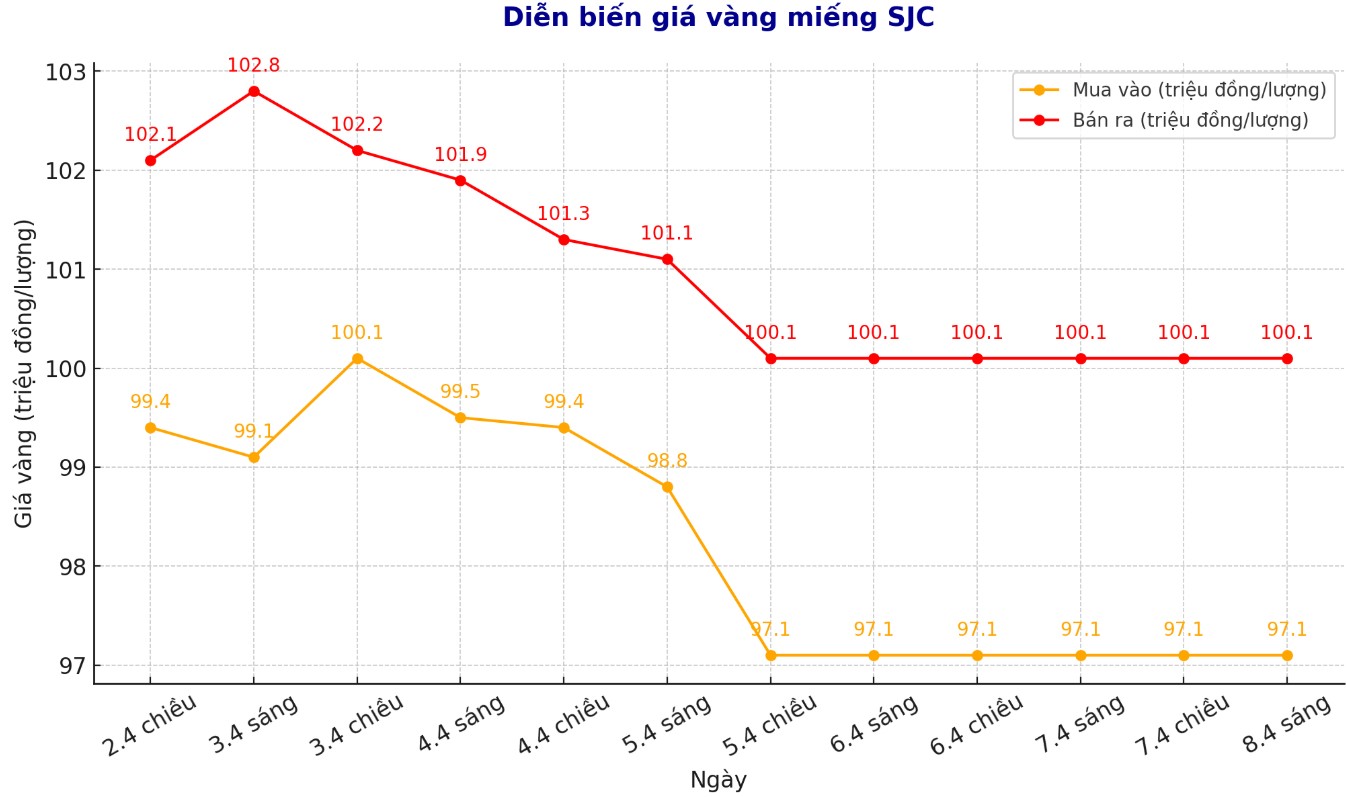

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 97.1-100.1 million VND/tael (buy in - sell out), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 97.1-100.1 million VND/tael (buy in - sell out), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 97.3-100.1 million VND/tael (buy - sell), an increase of 100,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2.8 million VND/tael.

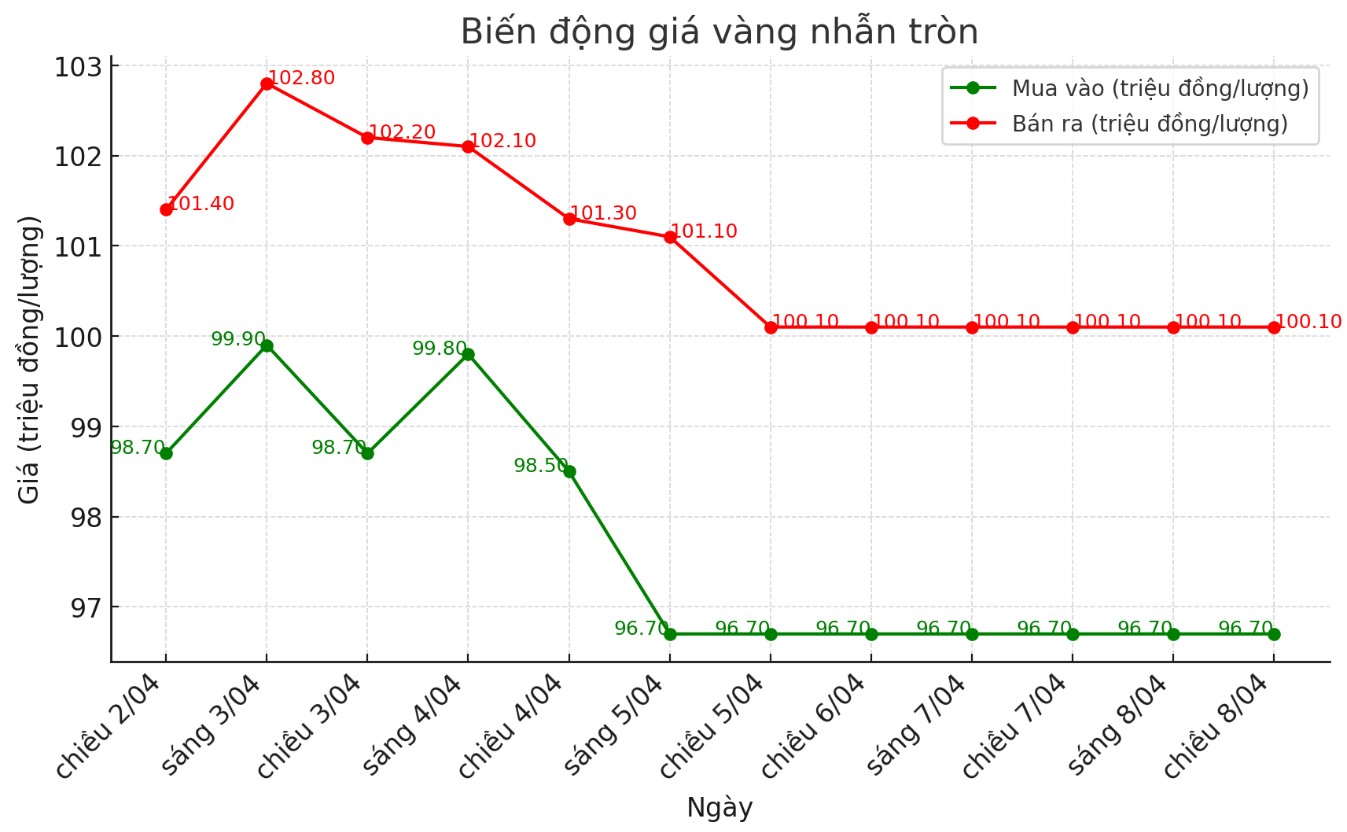

9999 round gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 96.7-100.1 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is at 3.4 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 97.6-100.3 million VND/tael (buy - sell), down 100,000 VND/tael for buying and down 200,000 VND/tael for selling. The difference between buying and selling is 2.7 million VND/tael.

As world gold prices fluctuate strongly, the gap between domestic and domestic prices is widening, showing very clear risks. If gold prices turn down, buyers will face a huge loss. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

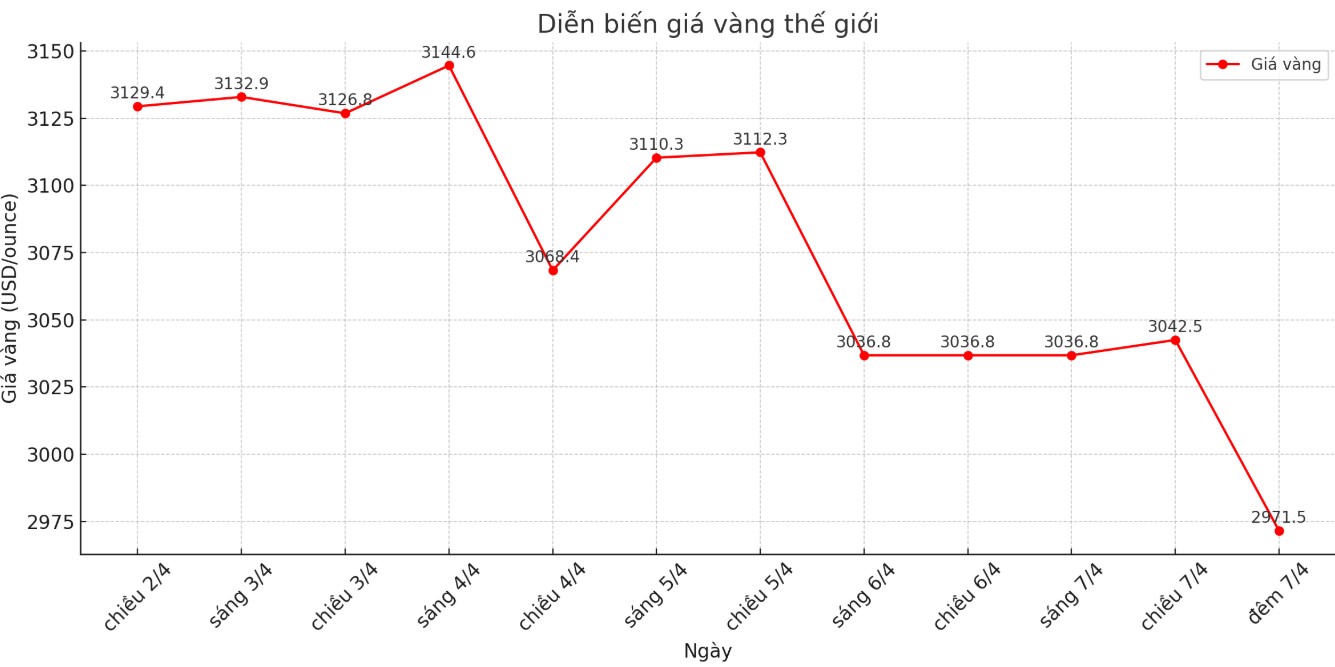

World gold price

As of 23:55 on April 7, the world gold price was listed at 2,971.5 USD/ounce, down 65.3 USD.

Gold price forecast

According to Kitco, gold prices fell sharply last night due to investors taking profits, US bond interest rates increasing, the USD strengthening and oil prices plummeting. Meanwhile, silver prices have risen but have cooled down compared to the beginning of the session, suggesting that silver selling may have weakened.

June gold contract decreased by 38.50 USD, to 2,996.7 USD/ounce. silver prices for May delivery increased by 0.555 USD, to 29.79 USD/ounce.

Gold increased overnight and early in the New York session on Monday, then fell sharply. When false rumors of the US temporarily suspending the 9-day tariffs arose, gold rebounded along with stocks. However, the White House has denied the rumors. President Donald Trump has also said he could impose additional tariffs on Chinese goods. Both gold and stocks fell again shortly after.

Asian and European stock markets also fell sharply overnight. Although US stock indexes are falling, they have escaped their 14-month low. Some major indexes such as the S&P 500 and Nasdaq have or will officially enter the bear zone (down 20% from the 52-week peak).

Fear mentality is everywhere in the global market early this week. Major economies are facing tensions over the tariff war, which risks plunging the US and the world into recession.

Mr. Donald Trump said on Sunday that the US is "taking medicine" to treat the commercial "disease". But the pressure on the Trump administration is growing as the investment and pension accounts of American people have seriously declined. Even strong Trump backers such as Sen. Ted Cruz, Housewives Mitch McConnell and Elon Musk have begun to speak out about concern.

JP Morgan CEO Jamie Dimon warned that tariffs will push up commodity prices and economic growth down, which could lead to inflation with recession.

The market volatility index VIX on Monday surpassed 50 after jumping above 60 overnight. Over the past 20 years, VIX has only exceeded 50, in late 2008 - early 2009 (global financial crisis) and in 2020 (COVID-19 pandemic). On average, VIX has been over the past 10 years at just over 19. The record was 89 in October 2008.

Currently, the market is pricing in the fact that the US Federal Reserve (FED) will cut interest rates 5 times this year, a total of 1.25%. Many investors believe that the FED may cut interest rates urgently before the next policy meeting.

Technically, although the gold price is weakened, the buyer still dominates the technique in the short term. The overnight recovery price shows that the seller may be exhausted. The goal of the buyer is to close on the resistance threshold of 3.201.6 USD/ounce (the climax of the contract). In contrast, the seller wants to push the price below the support threshold of 2,950 USD/ounce.

Key outside markets today saw the USD index increase strongly. Nymex crude oil prices are falling sharply, to a 4-year low and are currently trading around 60.75 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.13%.

See more news related to gold prices HERE...