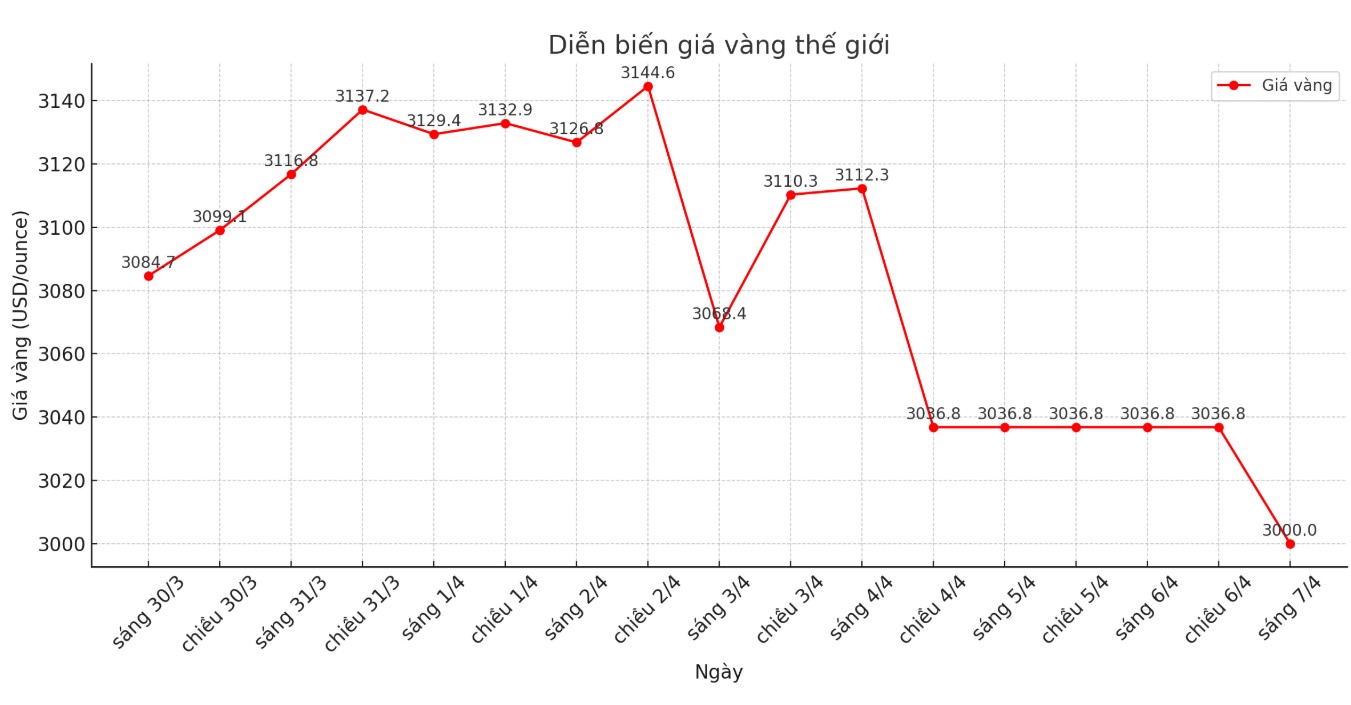

As predicted by many experts, gold prices at the beginning of the trading session continued to decline. After falling $47.9/ounce last week, gold prices fell sharply this morning by $46.1/ounce.

As of 8:10 a.m. on April 7 (Vietnam time), the world gold price listed on Kitco was at 2,990.7 USD/ounce.

The global market plummeted due to the new US tariff strategy. Financial markets around the world continued to fall sharply after US President Donald Trump announced a new tariff strategy last Wednesday.

This unprecedented sell-off has seriously affected the stock, commodity and precious metals markets, raising concerns about the stability of the global economy.

The S&P 500 index recorded a record decline in two days after the US announced tariffs, recording the capitalization of aviation companies of more than 4,000 billion USD, surpassing the 3,300 billion USD lost in March 2020.

In another development, China has announced an additional 34% tax rate on imports from the US, causing investors to worry that a global trade war has really begun.

Federal Reserve Chairman Jerome Powell said at a conference in Virginia that the current economic outlook is extremely uncertain. Mr. Powell said the Fed will be cautious and wait until there is a clearer view before changing monetary policy. He affirmed that it is too early to give a specific direction.

Economic experts also expressed concern. Mohamed El-Erian, a senior economic adviser to the Allianz, warned that the market is underestimating the impact of tariffs on inflation. He said the US would hardly see a one-time rate cut this year and the risk of an economic recession had become alarming.

Kevin Grady - Chairman of Phoenix Futures and Options said the market is currently very chaotic, including with gold. He said many investors are selling profitable investments, such as gold, to collect cash to add funds for investments in stocks. When gold increased sharply, speculators who were impatient or low in capital jumped in to buy, and now they are also forced to sell.

Marc Chandler - CEO at Bannockburn Global Forex commented that gold is gradually losing its role as a safe haven asset in the eyes of individual investors when it is sold off in parallel with stocks, although the USD and bond yields are decreasing.