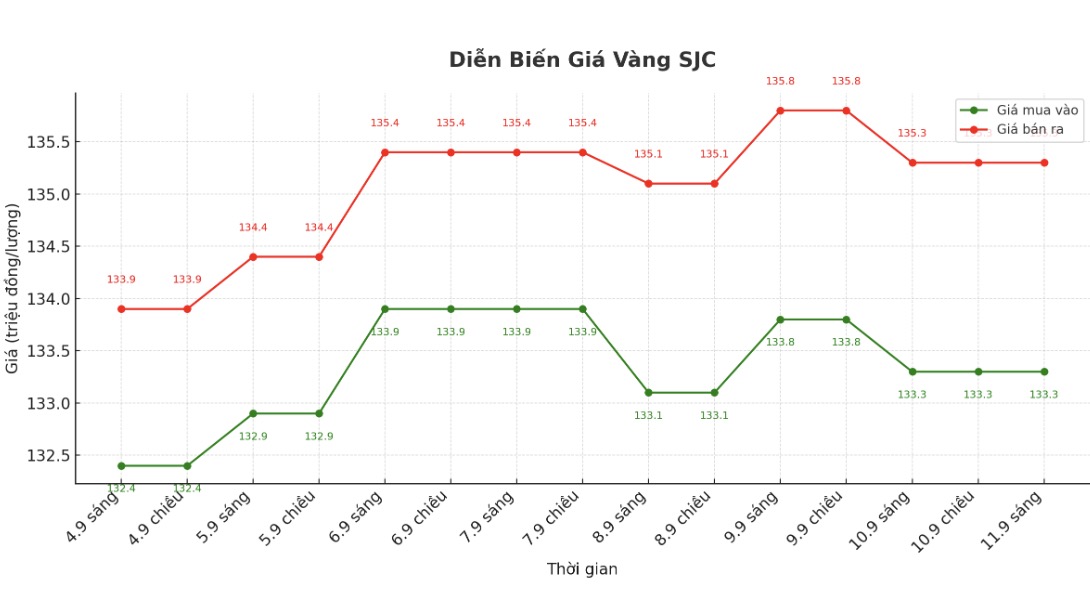

Updated SJC gold price

As of 9:20 a.m., DOJI Group listed the price of SJC gold bars at VND133.3-135.3 million/tael (buy in - sell out), unchanged in both buying and selling directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 133.3-135.3 million VND/tael (buy in - sell out), unchanged in both buying and selling directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 132.5-135.3 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2.8 million VND/tael.

9999 round gold ring price

As of 9:20 a.m., DOJI Group listed the price of gold rings at 127.5-130.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 127.7-130.7 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 127.5-130.5 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

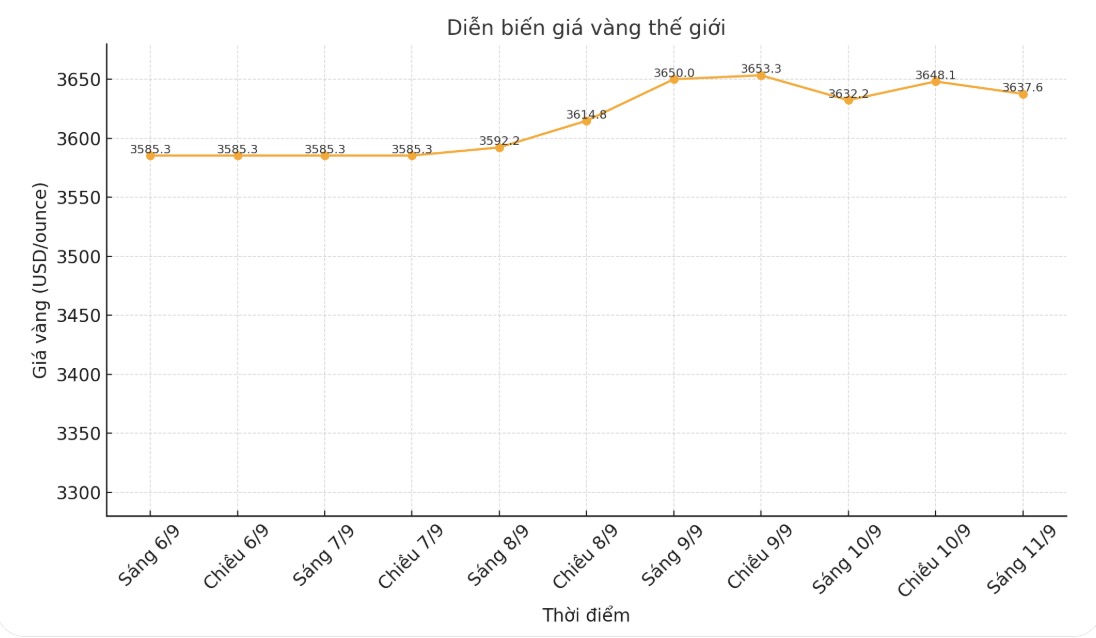

World gold price

At 9:20 a.m., the world gold price was listed around 3,637.6 USD/ounce, up 5.4 USD compared to a day ago.

Gold price forecast

The gold market is fluctuating after the latest data showed that US production prices eased pressure last month.

The PPPI fell 0.1% in August, after a 0.9% (unadjusted) gain in July, the US Department of Labor announced on Wednesday. The new inflation data was cooler than expected, with economists forecasting a 0.3% increase.

Over the past 12 months, wholesale retail inflation has increased by 2.6%, significantly lower than the forecast and 3.3% (unadjusted) in July.

The core PPI, which excludes volatile food and energy, fell 0.1% in August, down from a consensus forecast of 0.3% and after July's 0.9% increase. For the year, core PPI reached 2.8%, while the expectation was 3.5%, and the revised July rate was 3.4%.

PPI is often seen as an early indicator of inflation as high input costs are shifted by manufacturers to customers. Market analysts said that the decrease in production prices along with the cooling of CPI inflation will give the Federal Reserve (FED) a basis to accelerate the interest rate cut roadmap, thereby creating support for gold prices.

In geopolitics, tensions returned, supporting gold and silver prices as safe havens. Poland shot down Russian drones that entered the territory in the latest major airstrike on Ukraine.

Polish Prime Minister Donald Tusk told the Polish National Assembly on September 10 that NATO's Early Warning and Air Control System (AWACS) has been put in a state of alert after reports of a major attack by Russian missiles and drones on Ukraine on the night of September 9.

Polish Prime Minister Donald Tusk said that there were 19 airstrikes in Poland overnight, many of which were drones entering from Belarus.

The shooting down of these drones, which pose a security threat, has changed the political situation. Therefore, the consultations of the allies have been conducted in the form of a requirement to officially activate Article 4 of the NATO Treaty, said Mr. Tusk.

Meanwhile, Israel carried out an attack to assassinate the Hamas leader in Doha. The explosions were recorded in the Qatari capital.

eyewitnesses saw smoke rising from Katara district in Doha. Israeli sources said the targets of the attack were senior Hamas leaders, including Khalil Al-Hayya.

Technically, investors buying December gold futures are holding a clear advantage in the short term. The next target for buyers is to close above the strong resistance level of 3,750 USD/ounce. In contrast, the short-term target for the bears is to pull prices below the solid support level of $3,550/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...