The gold market is fluctuating after the latest data showed that US production prices eased pressure last month.

The PPPI fell 0.1% in August, after a 0.9% (unadjusted) gain in July, the US Department of Labor announced on Wednesday. The new inflation data was cooler than expected, with economists forecasting a 0.3% increase.

Over the past 12 months, wholesale retail inflation has increased by 2.6%, significantly lower than the forecast and 3.3% (unadjusted) in July.

The core PPI, which excludes volatile food and energy, fell 0.1% in August, down from a consensus forecast of 0.3% and after July's 0.9% increase. For the year, core PPI reached 2.8%, while the expectation was 3.5%, and the revised July rate was 3.4%.

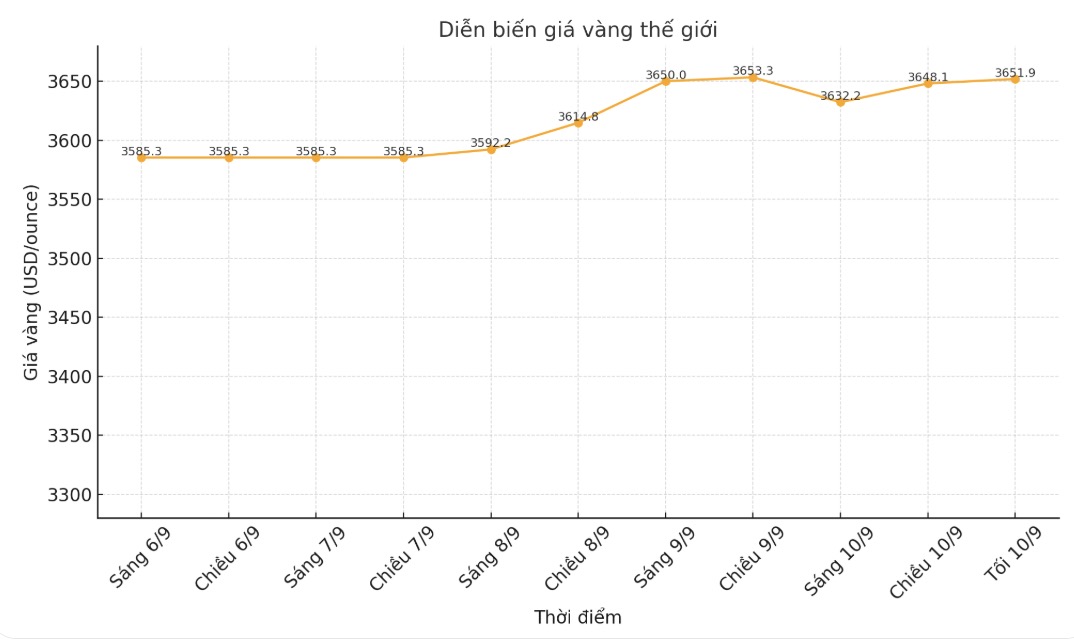

Immediately after the data was released at 8:30 am (EDT), gold prices rebounded strongly but quickly adjusted again. The most recent spot gold price was at 3,650.78 USD/ounce, up 0.65% on the day.

PPI is often seen as an early indicator of inflation as high input costs are shifted by manufacturers to customers. Market analysts said that the decrease in production prices along with the cooling of CPI inflation will give the Federal Reserve (FED) a basis to accelerate the interest rate cut roadmap, thereby creating support for gold prices.

Technically, investors buying December gold futures are holding a clear advantage in the short term. The next target for buyers is to close above the strong resistance level of 3,750 USD/ounce. In contrast, the short-term target for the bears is to pull prices below the solid support level of $3,550/ounce.

The first resistance level seen at this week's highest level was 3,715.20 USD, then 3,750 USD/ounce. First support was at an overnight low of $3,651.40 an ounce, followed by a weekly low of $3,621.70 an ounce.

See more news related to gold prices HERE...