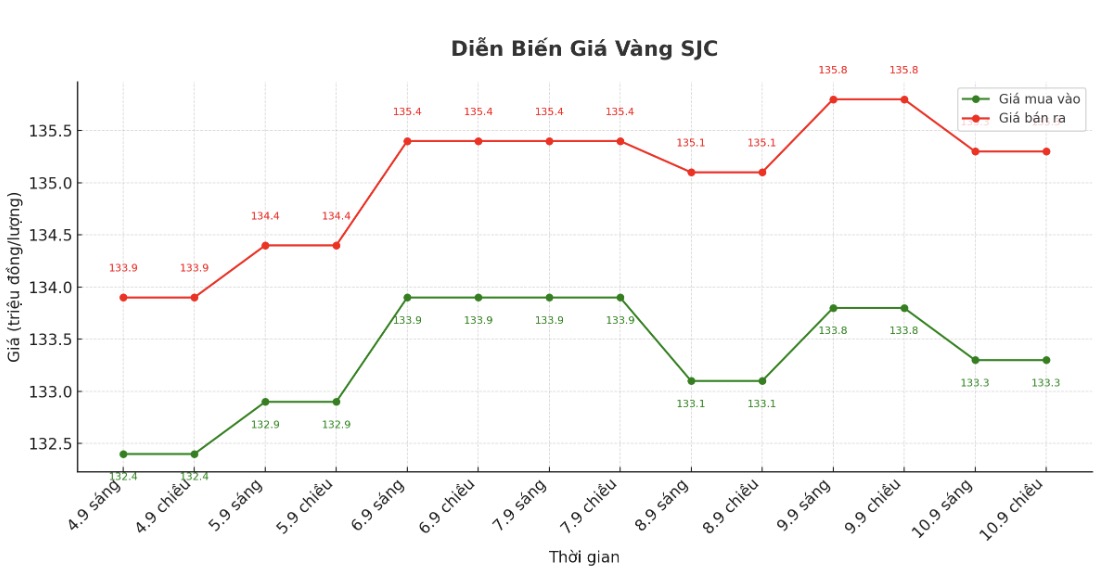

SJC gold bar price

As of 7:00 p.m., DOJI Group listed the price of SJC gold bars at 133.3-135.3 million VND/tael (buy - sell), down 500,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 133.3-135.3 million VND/tael (buy - sell), down 500,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 132.5-135.3 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.8 million VND/tael.

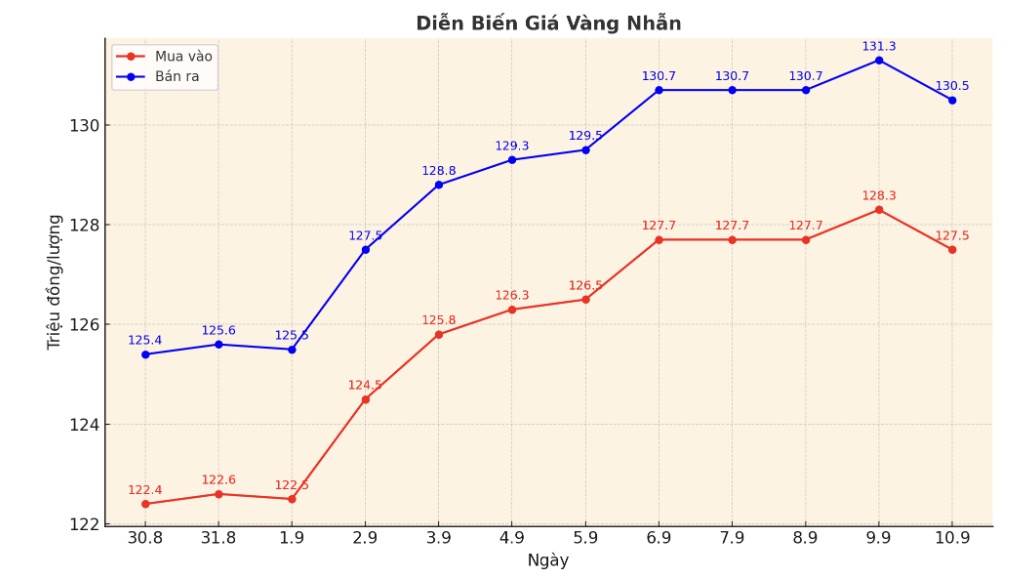

9999 gold ring price

As of 7:00 p.m., DOJI Group listed the price of gold rings at 127.5-130.5 million VND/tael (buy in - sell out), down 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 128.2-131.2 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 127.7-130.7 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

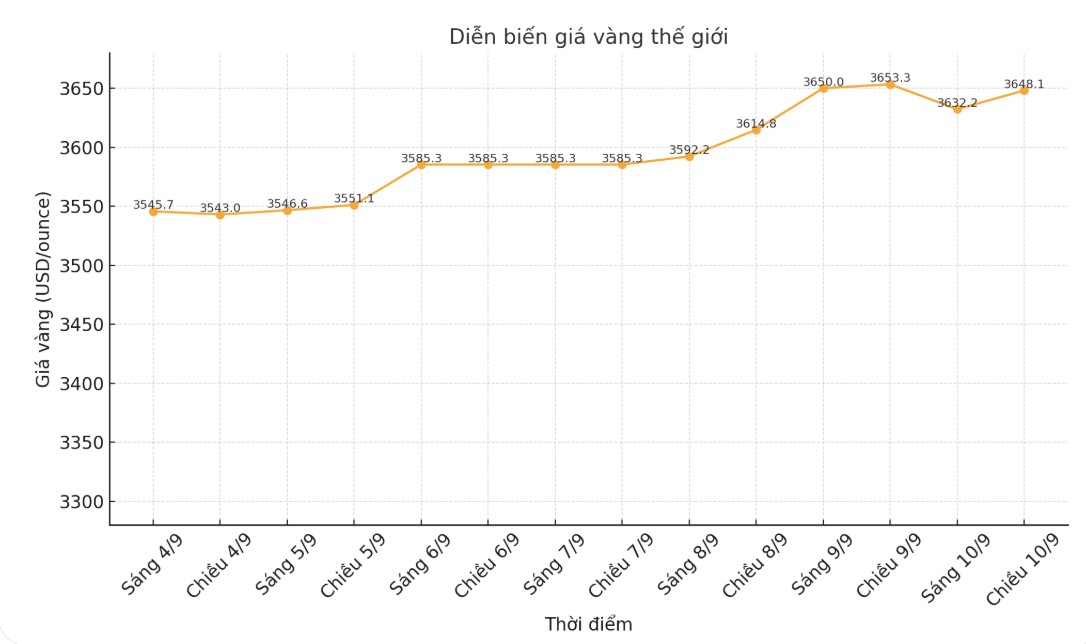

World gold price

The world gold price was listed at 7:00 p.m. at 3,648.1 USD/ounce, down 5.2 USD.

Gold price forecast

Spot gold prices hit a record high of $3,673.95 an ounce on Tuesday. Since the beginning of the year, this precious metal has increased by 38%, driven by a weakening USD, strong central bank buying, loose monetary policies and increased global instability.

According to Mr. Paul Wong - Market Strategist at Sprott Asset Management, the direct driving force for the recent breakthrough is said to be the macro funds buying gold and selling long-term bonds at the same time. That is the factor that pushes gold above $3,500/ounce.

According to Wong, this long-term accumulation model is very technical. Usually, when an asset has had a strong increase without being sold off, it is a signal of hidden strength and the process of hoarding. When this model breaks out, it will often create a price increase gap. He said the upcoming technical target is around $3,900/ounce.

Mr. Wong said that the developed world is entering a period of prolonged currency inflation, and the gold market has "evaporated" that. Gold is very complicated, it involves currency, bonds, credit, economy, stocks, geopolitics. But at the same time, it is simple, because it has existed for thousands of years and everyone knows its value".

Since April, gold has mainly accumulated in a four-month upward model - showing no signs of selling strongly, central banks are not selling, investment funds have not bought more but are certainly not selling off" - he said.

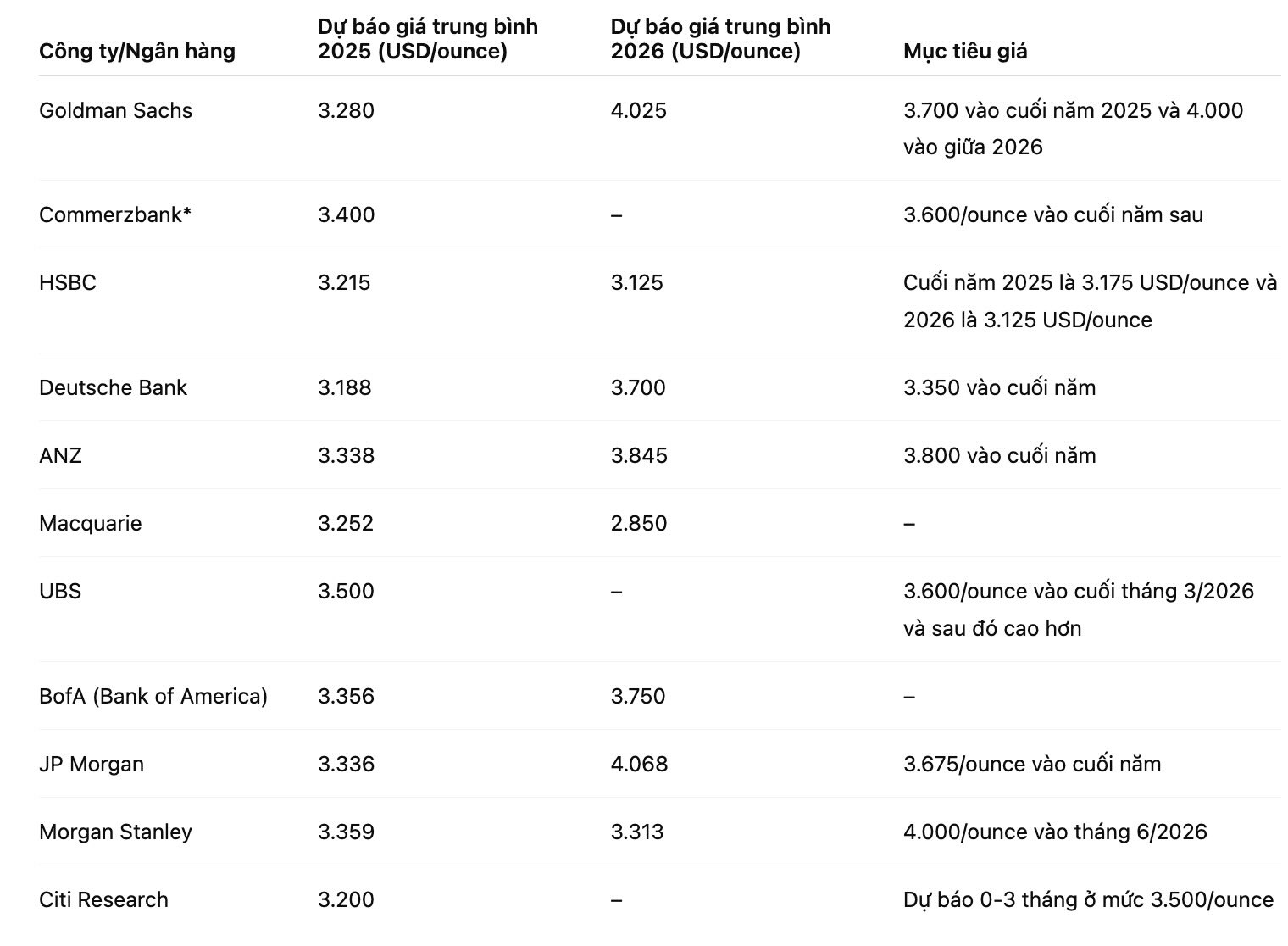

In another development, ANZ Bank on Wednesday raised its year-end gold price forecast to $3,800/ounce and said prices could peak nearly $4,000 in June next year, thanks to strong investment demand for precious metals.

Here is a list of the latest forecasts for gold prices in 2025 and 2026 (in USD/ounce):

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...