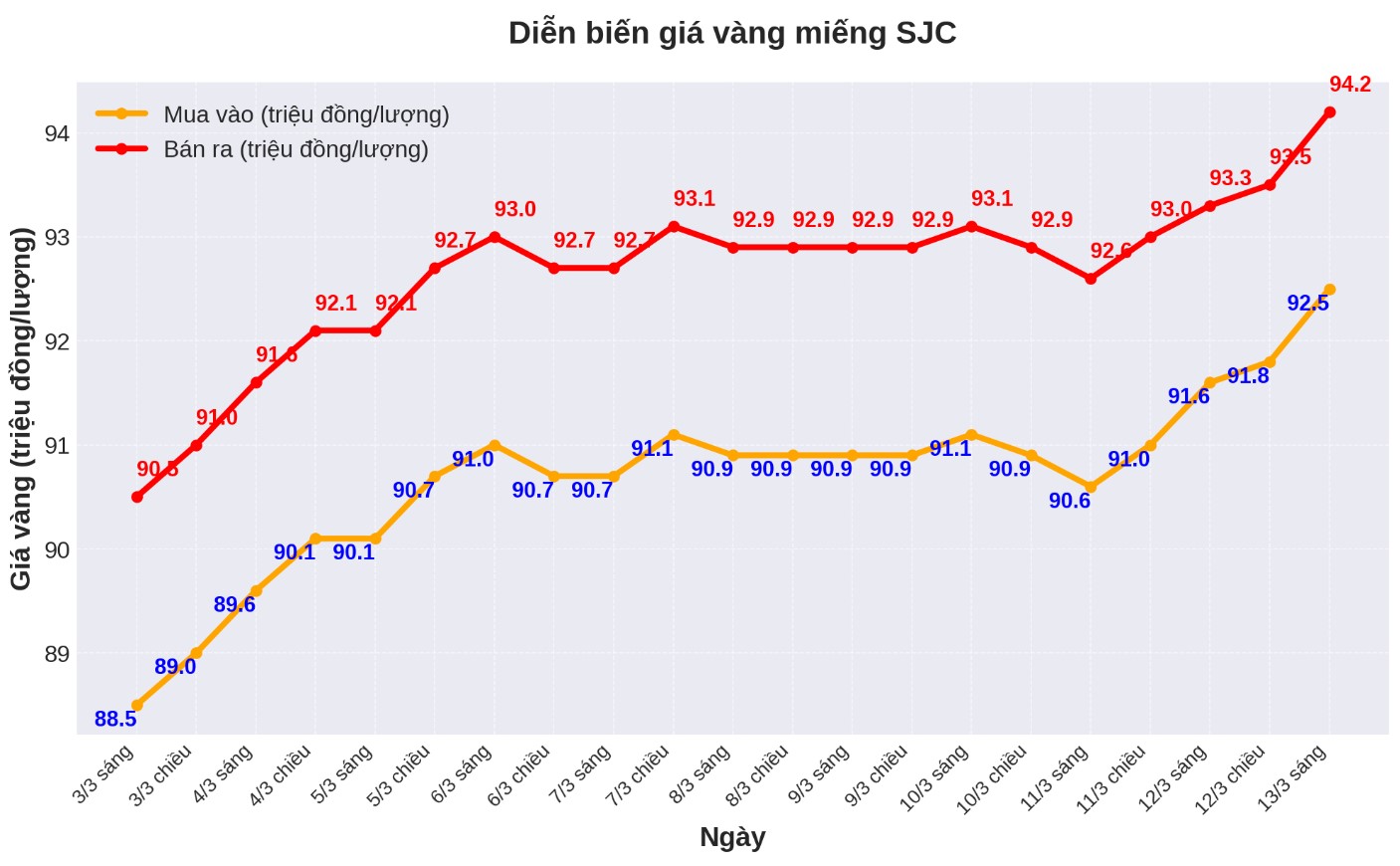

Updated SJC gold price

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at VND92.5-94.2 million/tael (buy - sell), an increase of VND900,000/tael for both buying and selling. The difference between buying and selling prices is at 1.7 million VND/tael.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at VND92.5-94.2 million/tael (buy in - sell out), an increase of VND900,000/tael for both buying and selling. The difference between buying and selling prices is at 1.7 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND92.5-94.2 million/tael (buy - sell), an increase of VND900,000/tael for both buying and selling. The difference between buying and selling prices is at 1.7 million VND/tael.

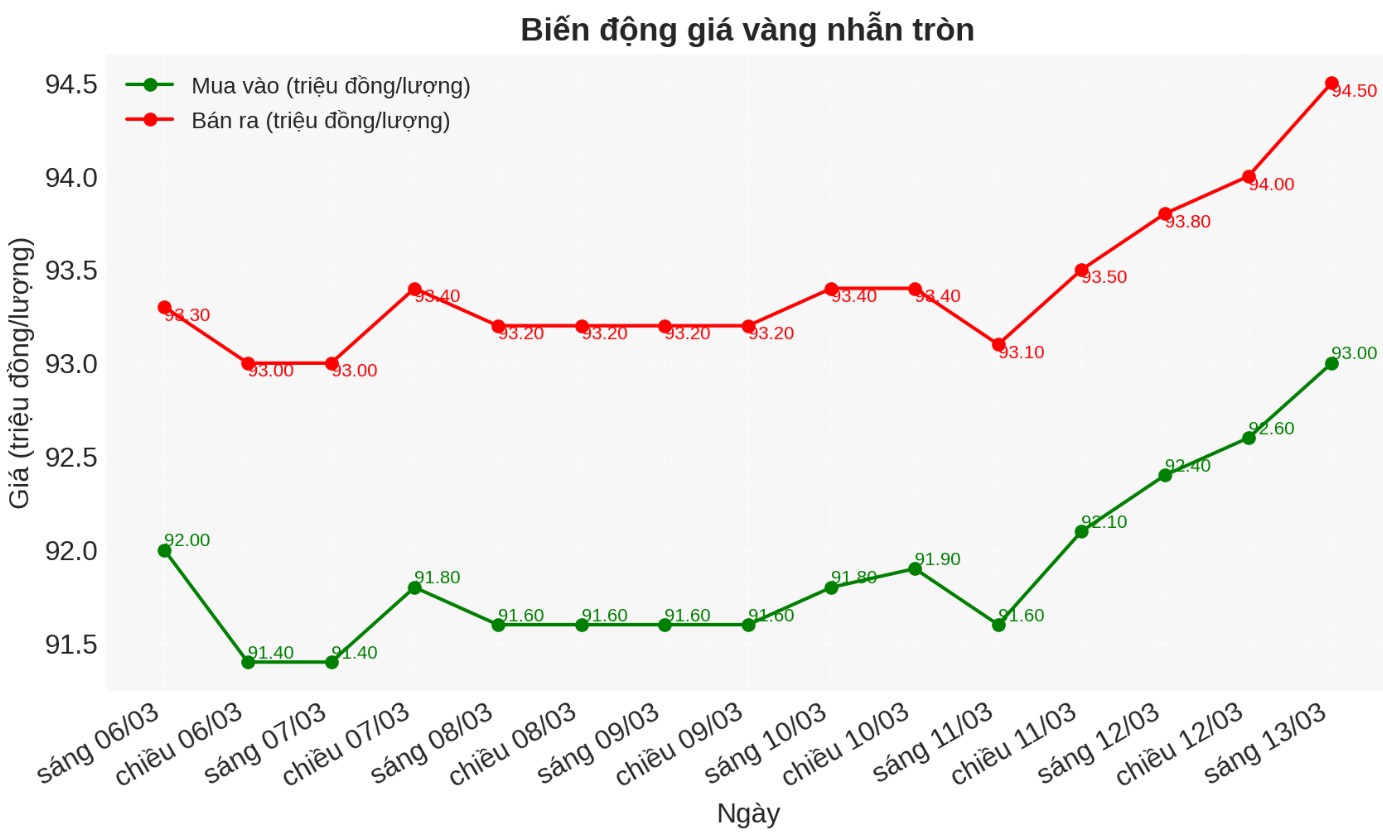

9999 round gold ring price

As of 9:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND93-94.5 million/tael (buy - sell); increased by VND600,000/tael for buying and increased by VND700,000/tael for selling. The difference between buying and selling is listed at 1.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 93.1-94.7 million VND/tael (buy - sell); increased by 700,000 VND/tael for buying and increased by 800,000 VND/tael for selling. The difference between buying and selling is 1.6 million VND/tael.

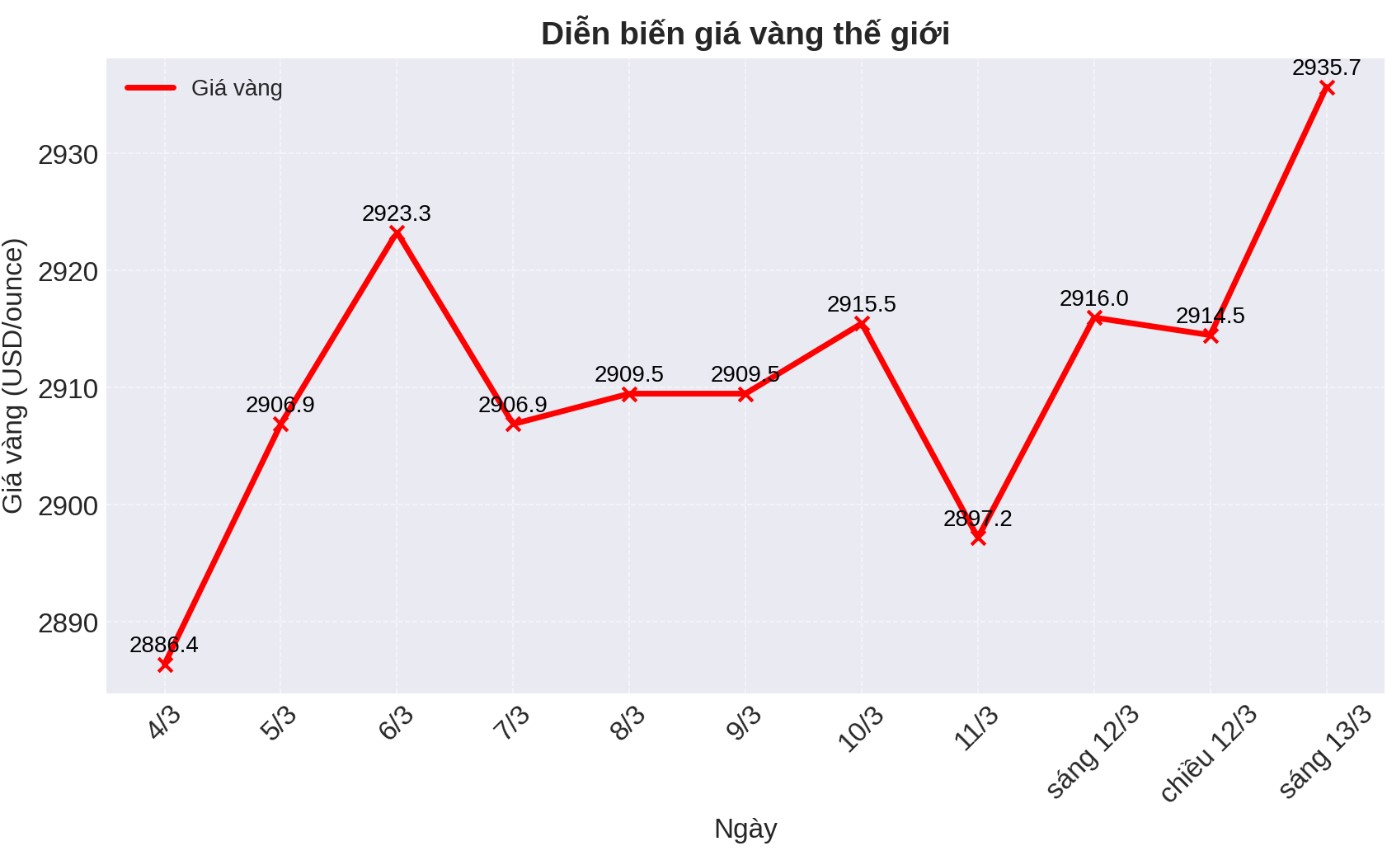

World gold price

As of 9:00 a.m. on March 13, the world gold price listed on Kitco was at 2,938.7 USD/ounce, up 22.7 USD/ounce compared to the same time in the previous session.

Gold price forecast

World gold prices increased in the context of the USD decreasing. Recorded at 9:00 a.m. on March 13, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.535 points (down 0.05%).

Gold prices hit a two-week high, the reason being that the US inflation report showed the consumer price index (CPI) was lower than expected. The need for safe havens for these two precious metals remains strong as global trade tensions could slow the world's economic growth rate.

The US February CPI report - one of the important economic data this week - showed the consumer price index increased by 2.8% over the same period last year. Previously, the market predicted a 2.9% increase in CPI over the same period, lower than the 3.0% in the January report.

The Producer Price Index (PPI) report will be released on Thursday, expected to increase by 0.3% monthly, down from January's 0.4% increase. After the CPI data was released, the USD index decreased largely the increase achieved in the previous session.

According to Ross Norman - CEO of Metals Daily, the sharp increase in gold prices may be due to a mysterious buyer hoarding large quantities of gold without paying attention to the price.

Norman gives three theorists. One is that gold is no longer tied to other assets as before, but this possibility is unlikely because correlations are all logically well-founded, even if sometimes interrupted.

The second possibility is that the gold market is gradually being dominated by Asia, as the region plays an increasingly important role in the gold valuation process.

Norman said that China, as the world's largest gold producer and consumer, is increasingly influencing the global gold market.

However, the third possibility is receiving the most support: a large and mysterious entity is behind this price increase. Norman said that market data does not provide any clue about the identity of buyers, as there is no clear information about import and export activities or treasury data.

Important economic data for the week

Thursday: US Producer Price Index (PPI), weekly jobless claims.

Friday: University of Michigan Preliminary Consumer Confidence Index.

See more news related to gold prices HERE...