Update SJC gold price

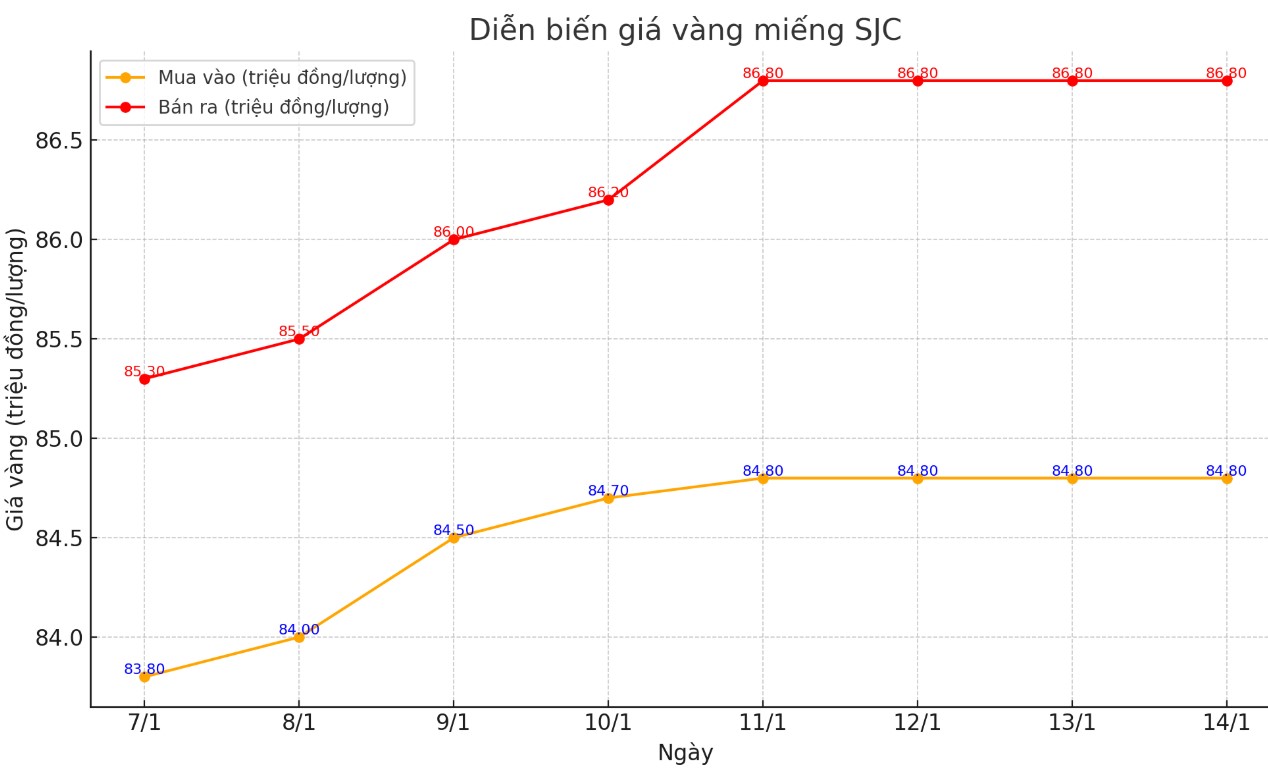

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 84.8-86.8 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84.8-86.8 million VND/tael (buy - sell); unchanged.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.8-86.8 million VND/tael (buy - sell); unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Price of round gold ring 9999

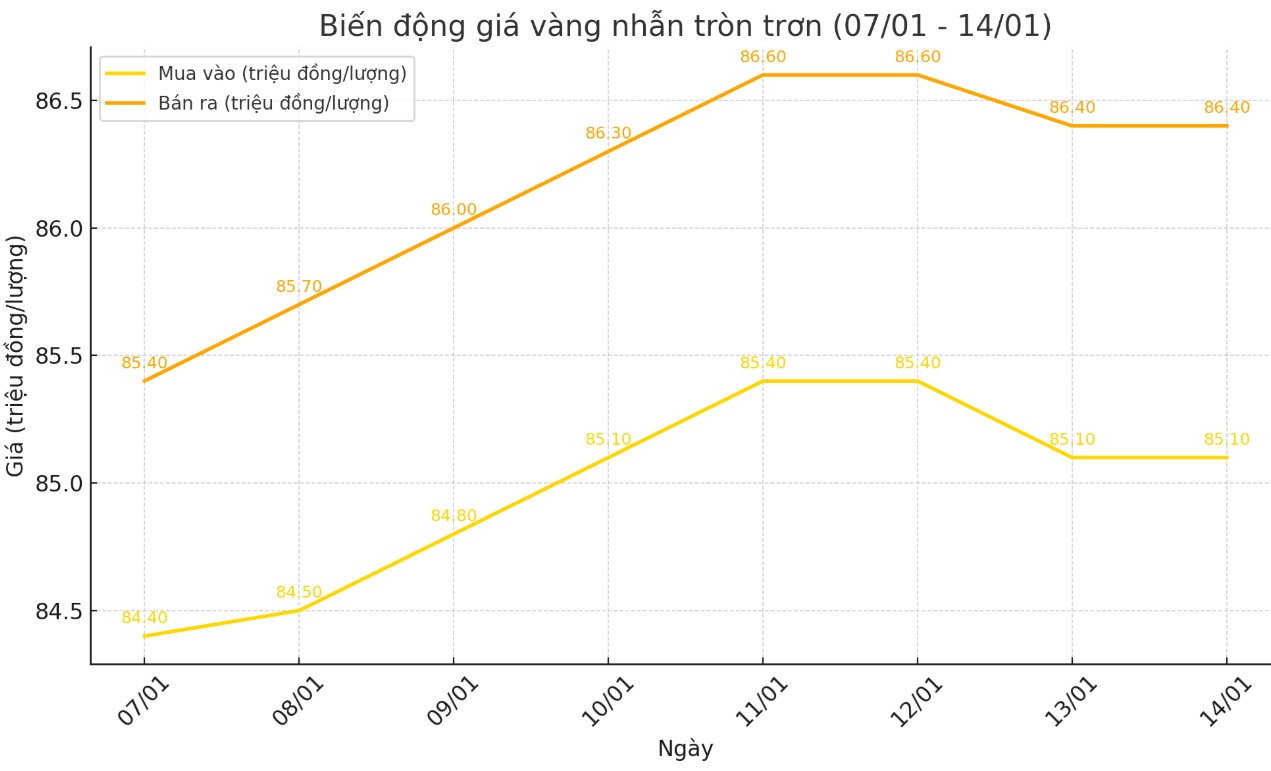

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 85.1-86.4 million VND/tael (buy - sell); down 300,000 VND/tael for buying and down 200,000 VND/tael for selling compared to the beginning of yesterday's trading session.

Bao Tin Minh Chau listed the price of gold rings at 85.2-86.6 million VND/tael (buy - sell), down 300,000 VND/tael for both buying and selling compared to the beginning of yesterday's trading session.

World gold price

As of 1:00 a.m. on January 14 (Vietnam time), the world gold price listed on Kitco was at 2,660.2 USD/ounce, down 29.1 USD/ounce.

Gold Price Forecast

World gold prices plummeted amid the rising USD. Recorded at 1:00 a.m. on January 14, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 109.680 points (up 0.18%).

According to Kitco, gold prices fell mainly due to short-term corrections and profit-taking by futures traders after recent good gains.

Besides, the recovery of the USD index to its highest level in more than two years and the increase in US Treasury bond yields were also external factors that negatively affected the market in the new trading week.

The US economic headline this week is the US consumer price index (CPI) for December (due out on Wednesday) which is the most notable economic data this week. The CPI is expected to increase 2.9% year-on-year, compared to the 2.7% increase in the November report. Excluding food and energy prices, the "core" CPI is forecast to increase 0.2%, down from four consecutive monthly increases of 0.3%, according to a Bloomberg survey. The core CPI is expected to increase 3.3% year-on-year, unchanged from the previous three months. The US producer price index (PPI) will be released on Tuesday.

The main outside markets today saw Nymex crude oil futures surge to a six-month high and trade around $79.00 a barrel. New Western sanctions on Russian oil exports are believed to be partly responsible for the recent price increase. The yield on the 10-year US Treasury note is currently at 4.782%. This yield was at 3.65% when the US Federal Reserve (FED) began cutting interest rates in September.

Technically, February gold futures bulls have the overall near-term technical advantage. The bulls’ next upside price objective is a close above the strong resistance at the December high of $2,761.30 an ounce. Meanwhile, the bears’ immediate downside price objective is a break below the December low of $2,596.70 an ounce.

See more news related to gold prices HERE...