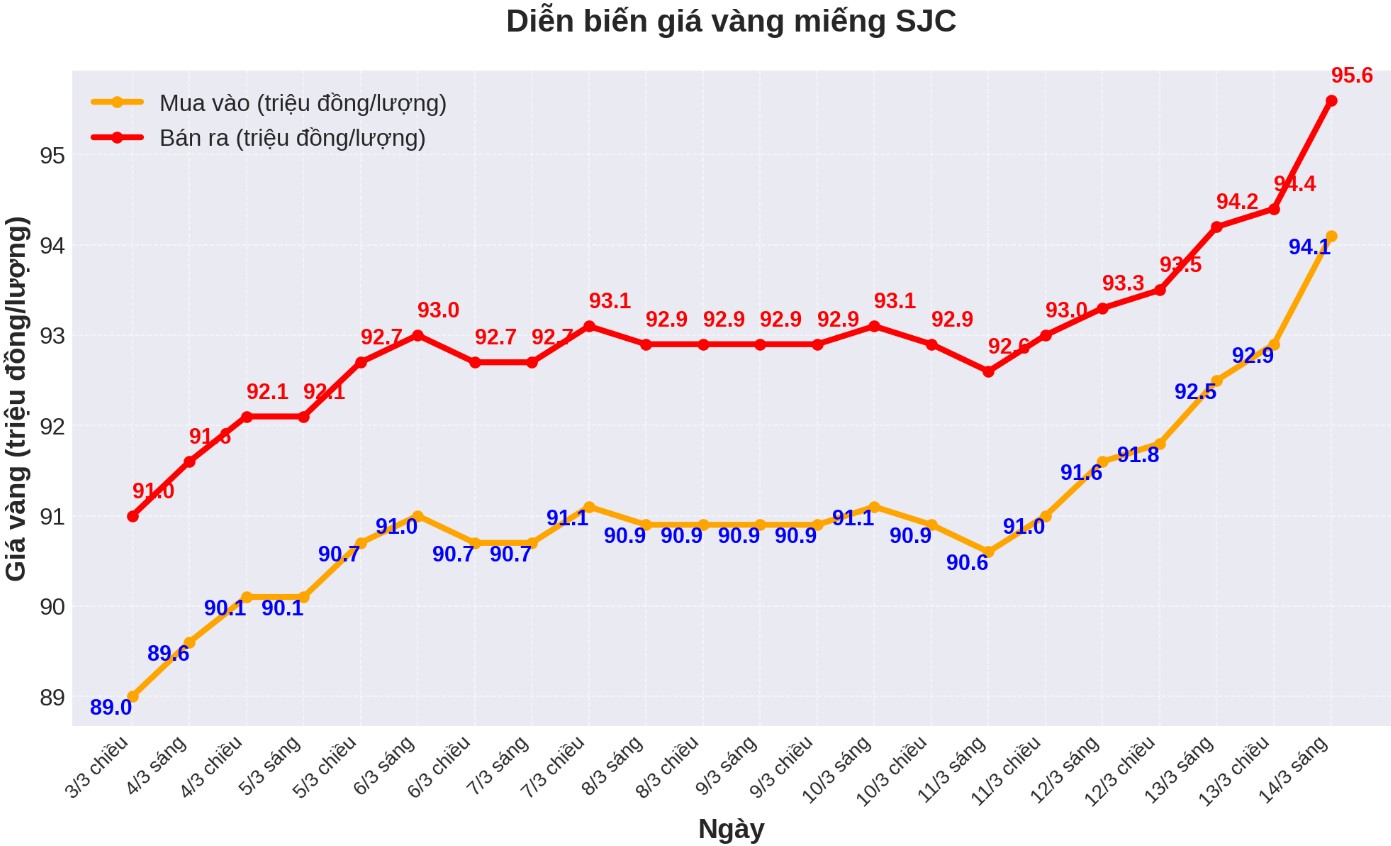

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at VND94.1-95.6 million/tael (buy - sell), an increase of VND1.6 million/tael for buying and VND1.4 million/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at VND94.1-95.6 million/tael (buy - sell), an increase of VND1.6 million/tael for buying and an increase of VND1.4 million/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND93-94.4 million/tael (buy - sell), an increase of VND500,000/tael for buying and an increase of VND200,000/tael for selling. The difference between buying and selling prices is at 1.4 million VND/tael.

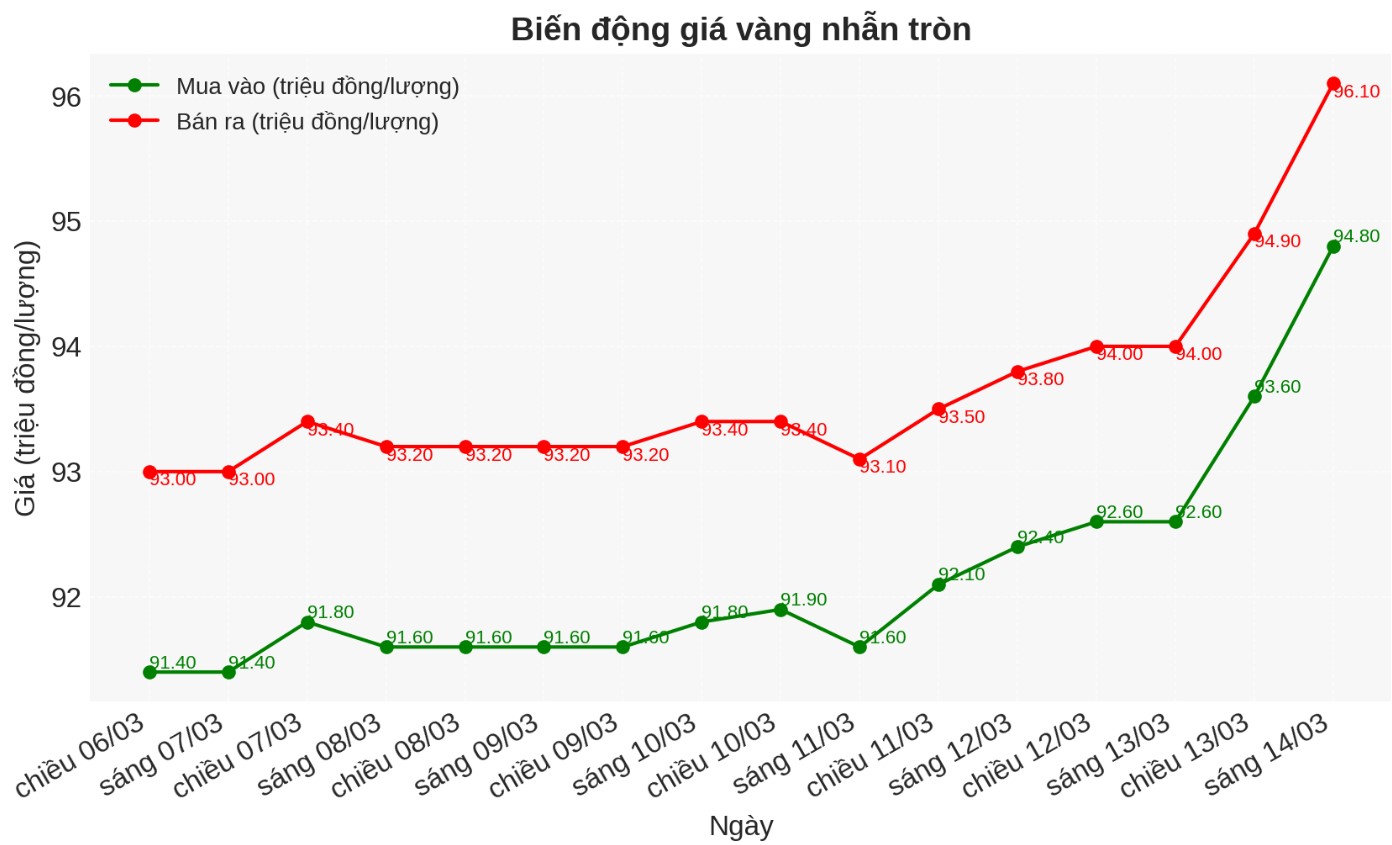

9999 round gold ring price

As of 9:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND94.8-96.1 million/tael (buy - sell); an increase of VND1.8 million/tael for buying and an increase of VND1.6 million/tael for selling. The difference between buying and selling is listed at 1.3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 93.4-95 million VND/tael (buy - sell); increased by 300,000 VND/tael for both buying and selling. The difference between buying and selling is 1.6 million VND/tael.

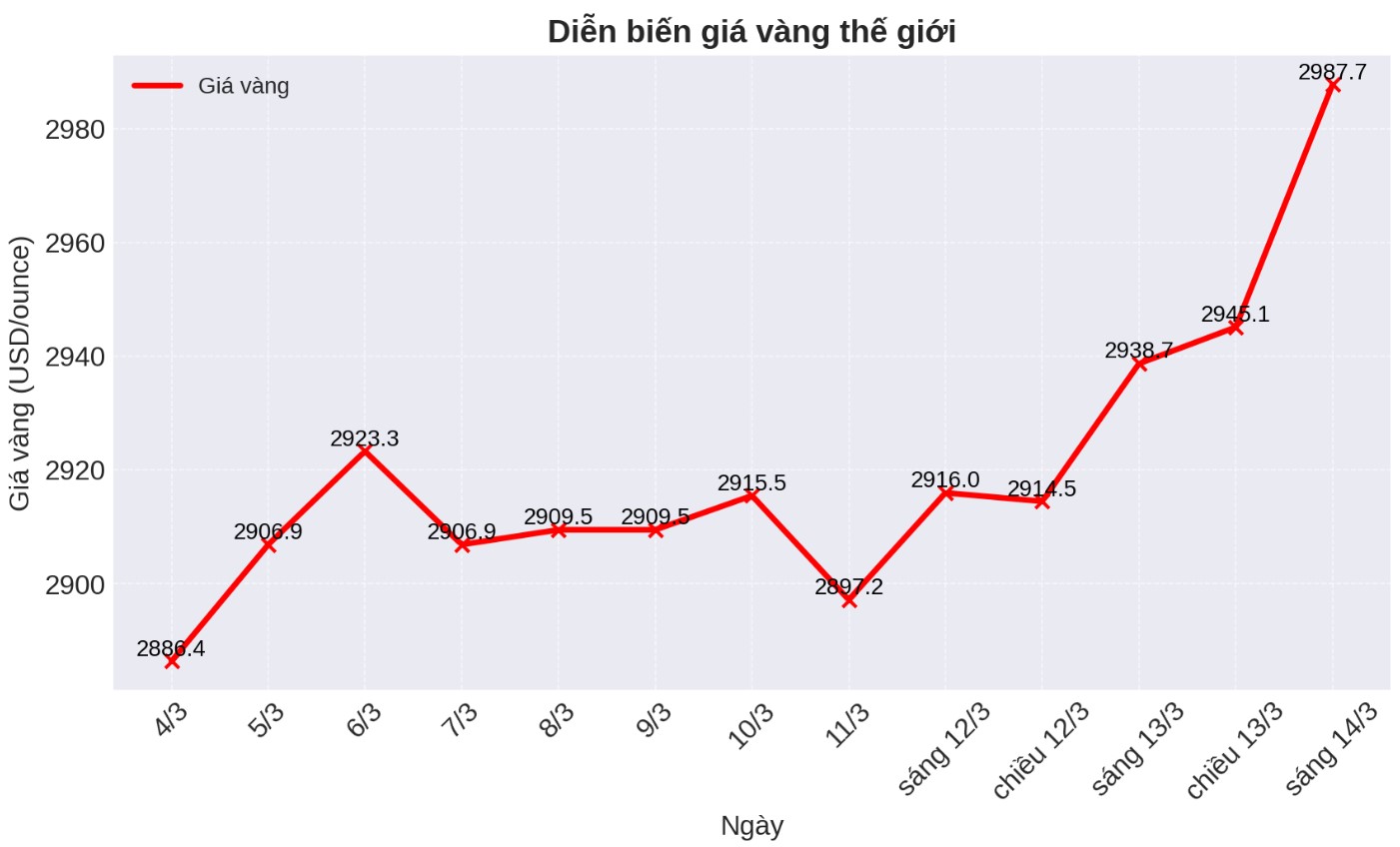

World gold price

As of 9:00 a.m. on March 14, the world gold price listed on Kitco was at 2,987.7 USD/ounce USD/ounce, up 49 USD/ounce compared to the same time in the previous session.

Gold price forecast

World gold prices increased despite the increase of the USD. Recorded at 9:00 a.m. on March 14, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.962 points (up 0.12%).

Gold prices are heading towards $3,000/ounce and maintaining their outstanding asset position in the context of global economic uncertainty and rising geopolitical tensions.

Gold prices fluctuated strongly after the US Bureau of Labor Statistics released the February Producer Price Index (PPI) report.

This wholesale price index increased by 3.2% over the same period last year, lower than the 3.7% of the previous month and lower than Fact Set's forecast of 3.3%.

Core PPI - excluding volatile food and energy prices - fell 0.1% from January, while the previous month increased by 0.5% and was forecast to be 0.3%.

The PPI report shows that the US economy is cooling down, causing traders to bet on the possibility that the US Federal Reserve (FED) will cut interest rates or make cuts earlier than expected.

Today's $3,000 milestone highlights gold's skyrocketing rally over the past year, especially as gold surpassed the long-term trend line on the historical chart in February 2023.

The next meeting of the Federal Open Market Committee (FOMC) will take place on March 18-19. Although recent inflation reports show a stagnant US economy, the Fed is likely to keep interest rates unchanged at its upcoming meeting.

John Ciampaglia, general director of Sprott Asset Management, predicted that uncertainties related to US President Donald Trump's tax policy and changes in global monetary policy are creating both opportunities and risks in the precious metals market.

According to Bart Melek - Head of Commodity Strategy at TD Securities, the imposed tariff policies will cause inflation, causing gold investors to worry. He said lower inflation in the US could create conditions for the Fed to cut interest rates more in the coming time.

Meanwhile, Ryan McIntyre, managing partner at Sprott Inc., said the precious metal is not overvalued, as demand for safe-haven assets is rising sharply.

"I think that new stocks are assets that are overvalued when considering many different indicators. When looking at what's happening in the world and comparing risks with potential profits, gold is still the top choice," McIntyre said.

See more news related to gold prices HERE...