Rich Checkan - Chairman and COO of Asset Strategies International - commented that the situation of Israel's attack on Iran has pushed global tensions to an alarming level and there is no doubt about the next direction of gold: "Tensions are spreading, gold will definitely continue to increase in price this week".

Daniel Pavilonis - senior commodity broker at RJO Futures - gave a perspective on analyzing the price movements of oil and gold in previous escalations in the Middle East.

Both oil and gold are defenses against inflation and are directly affected by yield fluctuations. Last night, oil surged to $77 at the same time as gold peaked, then fell sharply as Iran responded weakly. This development shows that if the situation does not continue to deteriorate, gold prices will hardly break through the peak in April, said the expert.

Pavilonis stressed that geopolitical factors have become the main driver of gold in recent times, but the waves of gains are often due to short-term conflicts: The same thing happened last April, when gold and oil both surged and sold off immediately.

Trade risks to China remain, but inflation has cooled significantly, other major reversals have slowed down. This time too, if it does not escalate, gold could create a double peak and make a slight adjustment".

He warned investors to be cautious about profit-taking pressure: If you miss the opportunity to sell around $3,509/ounce, now is the time to consider lowering your position. When gold is at its peak, cash flow will flow to other metals such as silver, platinum or palladium.

In fact, if we compare positively, the current silver price should have reached $50/ounce. Many people are looking at this gap to seek investment opportunities in silver.

Marc Chandler - CEO of Bannockburn Global Forex - acknowledged that the geopolitical context has strongly reaffirmed gold's safe-haven position: "Compared to USD, Treasury bonds or digital currencies, gold is still the most prominent. After a recent correction, gold will soon return to the uptrend and challenge the peak in April, around $3,500/ounce. The risk of instability will continue, it will be difficult to calm down this week".

Chandler added another factor from monetary policy: This week, the Fed, BOE and BOJ will hold a policy meeting. There are no major changes expected, but the Swiss National Bank is likely to cut deposit interest rates to 0%, while Switzerland's 2-year bond yields have been negative. This is also a factor supporting gold prices".

Adrian Day - Chairman of Adrian Day Asset Management - clearly analyzed the long-term drivers of gold prices: I always emphasize three main drivers: Central banks buying strongly to reduce their dependence on the USD; Chinese investors worry about the yuan depreciating and being limited to buying real estate and coins; and finally, the global super-rich are worried about the huge mountain of public debt. These factors have not changed and will continue to last.

Alex Kuptsikevich - senior expert at FxPro - added an perspective on central banks' record gold demand: The share of gold in global foreign exchange reserves has increased to 20%, surpassing the 16% of the euro and only 46% behind the USD. From 2022 to 2024 alone, banks have added more than 1,000 tons per year, bringing their total gold reserves to 36,000 tons, approaching the record of 38,000 tons in 1965.

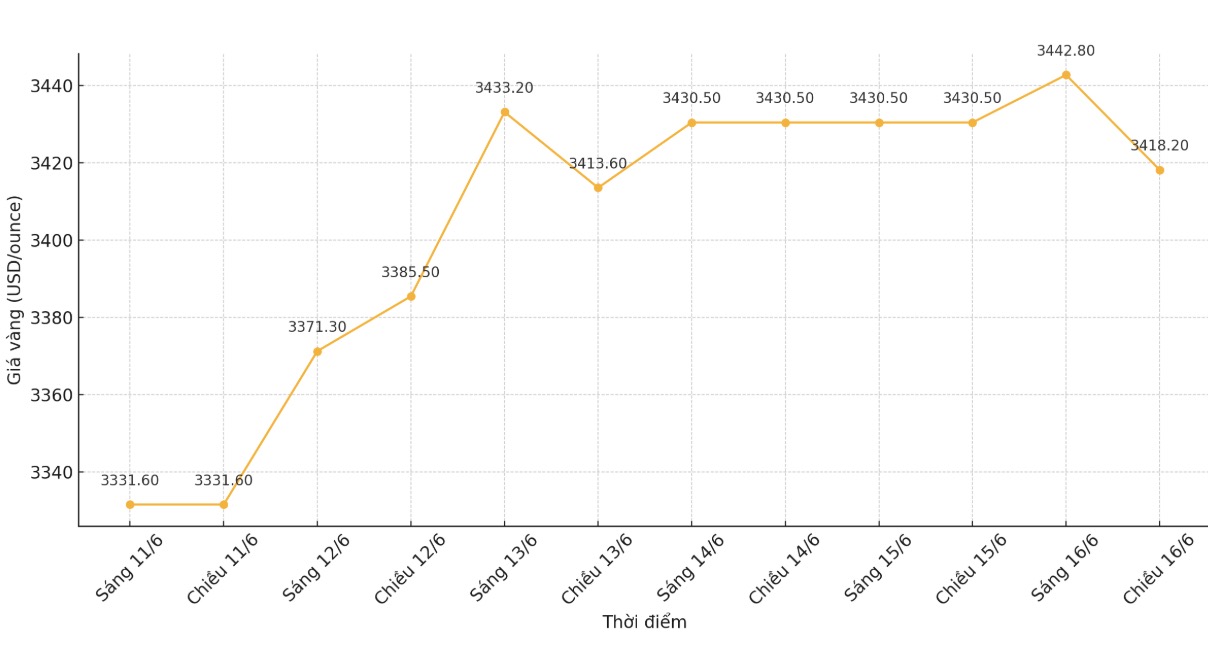

Kuptsikevich noted: The USD is weak, bond yields are falling, US inflation has not risen again, while the economy is stagnant. All increase the likelihood that the US Federal Reserve (FED) will return to policy easing as early as September. In addition, the risk of escalating in the Middle East makes gold more attractive. The $3,400/ounce mark will be an important threshold to test the strength of the increase.

CPM Group experts have also recently issued a gold buy recommendation, raising the short-term target to $3,500/ounce next week and could reach $3,600/ounce before September if the uncertainty continues.

According to this group, the risk of gold falling below $3,200/ounce, even $3,000, in the next few months is very low: We maintain the view that gold prices will continue to benefit from safe-haven investment cash flow. Political and economic fluctuations are still very large, so the recommended buying time frame is shortened to one week instead of two weeks as usual".

Jim Wyckoff - senior expert at Kitco - briefly concluded: " Optimistic technical trends and risk-off psychology will keep safe-haven demand strong this week".