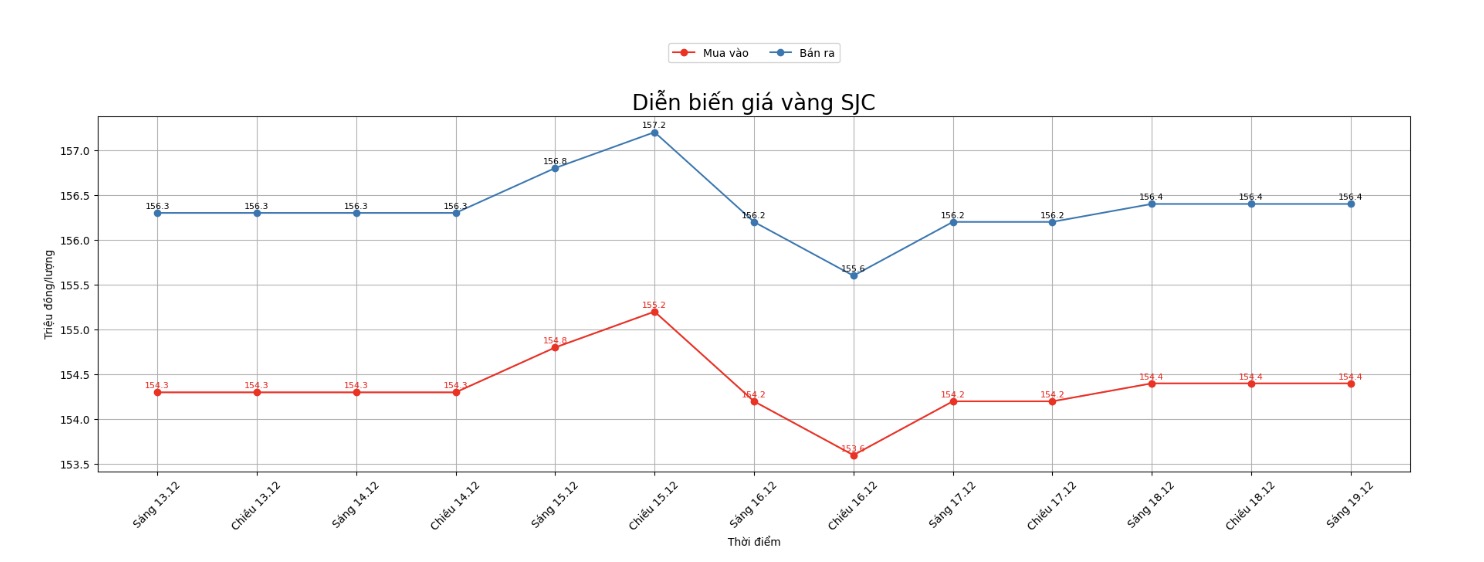

Updated SJC gold price

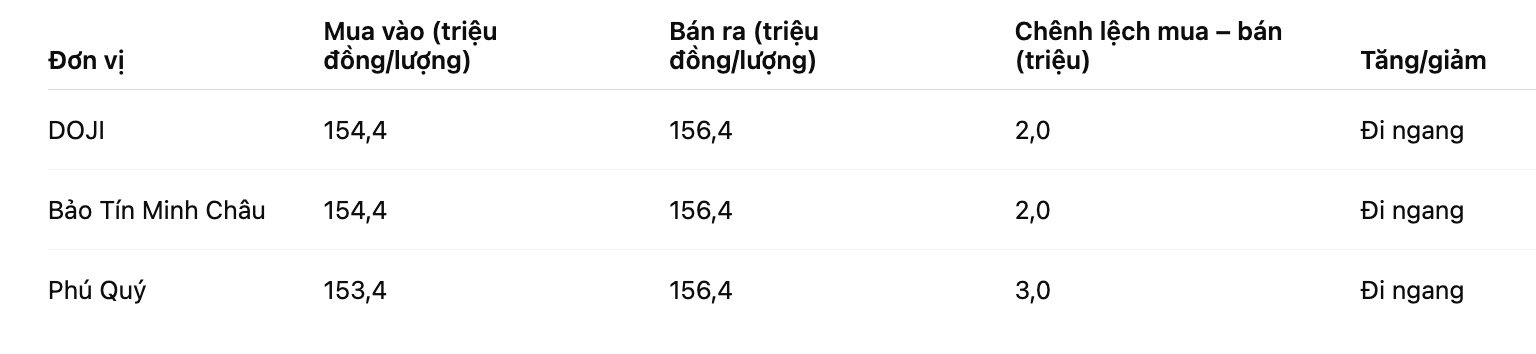

As of 9:10 a.m., DOJI Group listed the price of SJC gold bars at VND154.4-156.4 million/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 154.4-156.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 153.4-156.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

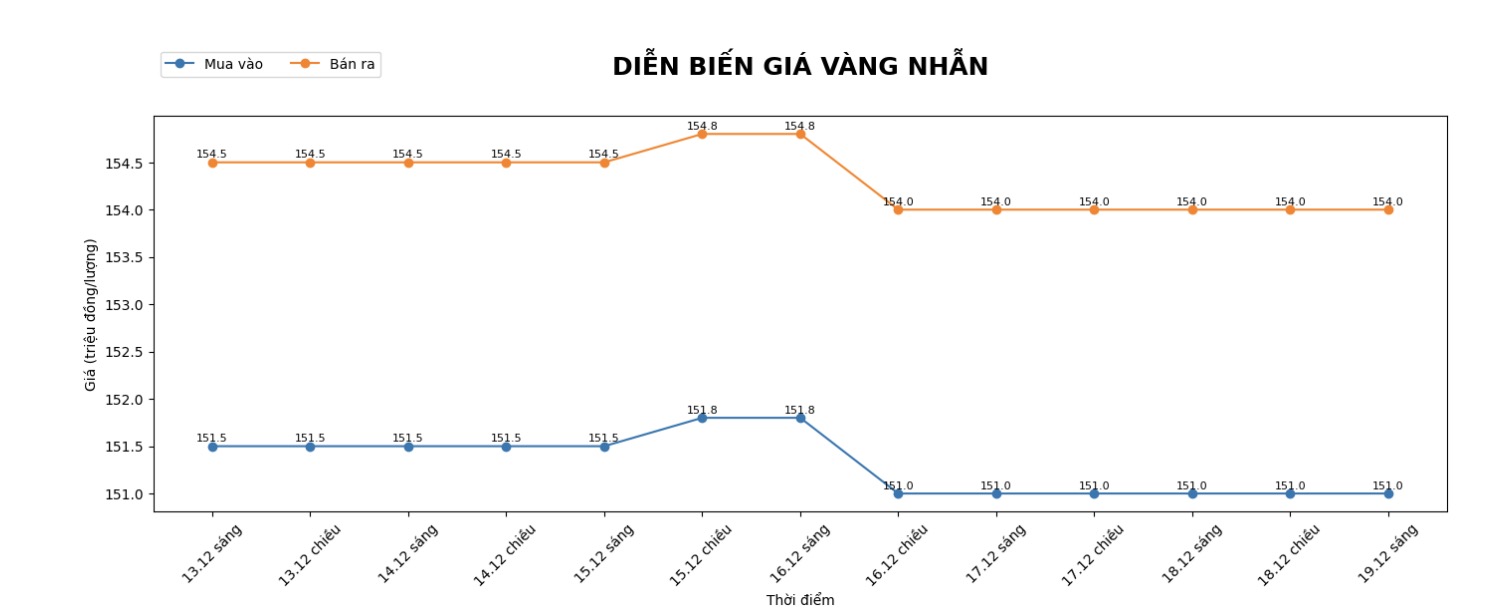

9999 round gold ring price

As of 9:10 a.m., DOJI Group listed the price of gold rings at 151-154 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.2-155.2 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.4-154.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

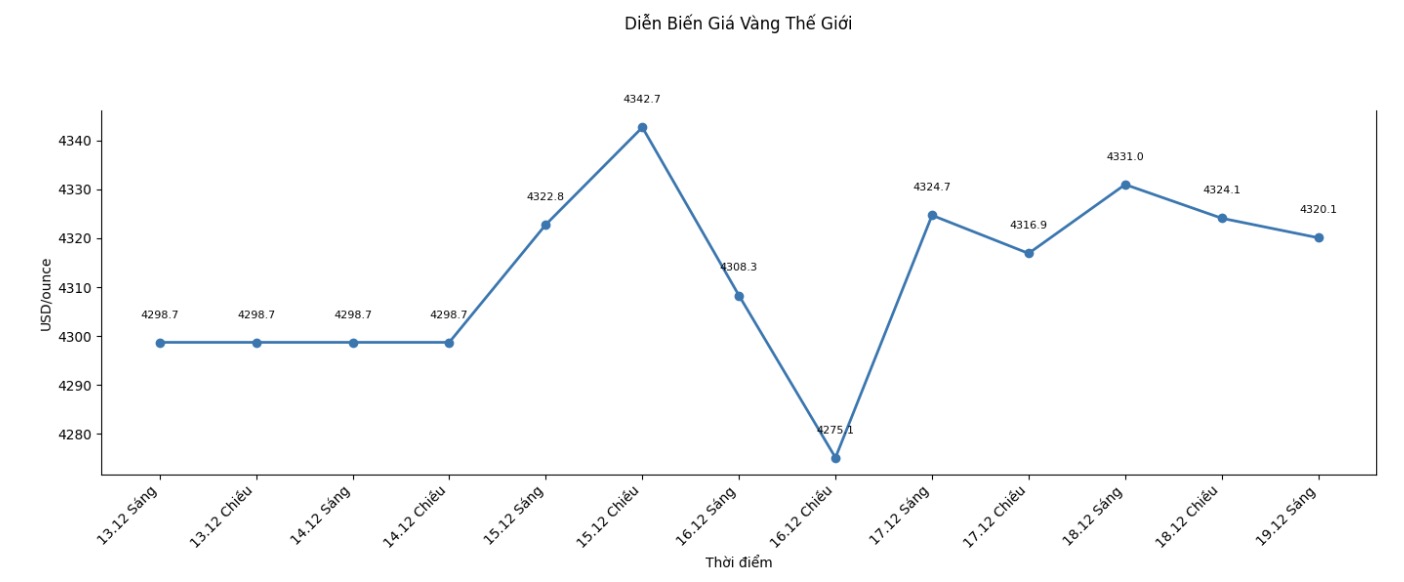

World gold price

At 9:00 a.m., the world gold price was listed around 4,320.1 USD/ounce, down 10.9 USD compared to a day ago.

Gold price forecast

Gold prices turned down after setting a record high of $3,400/ounce last night, in the context of the market receiving lower-than-expected US inflation data.

The US Department of Labor said the consumer price index (CPI) in November increased 2.7% year-on-year, significantly lower than the forecast of 3.1%, according to a Reuters survey.

This "lowing" inflation data has initially put pressure on gold prices, as investors adjusted their expectations for the monetary policy of the US Federal Reserve (Fed) in the coming time.

After the strongest acceleration since the oil crisis in 1979, world gold prices are entering a period that many large organizations consider not over.

In 2025, gold recorded its strongest increase in more than four decades. The price increase is driven by persistent demand from central banks and a wave of new investors, from corporate pension management corporations to surprise names in the digital currency sector.

JP Morgan, Bank of America and consulting firm Metals Focus are all in agreement that gold prices could reach the $5,000/ounce mark in 2026.

According to Bank of America strategist Michael Widmer, expectations of continued profits and the need to diversify portfolios are boosting cash flow into gold. Fundamental factors such as the US budget deficit, efforts to narrow the short-term account deficit and weak USD policies continue to create long-term holdings.

In addition, concerns about the independence of the US Federal Reserve, trade tensions and geopolitical instability, including the conflict in Ukraine and relations with Russia and NATO, still make gold an attractive haven, according to Metals Focus.

The big difference of the current cycle is the anchor role of central banks. This is the 5th consecutive year that central banks have stepped up reserve diversification, reducing dependence on USD-denominated assets. According to JP Morgan, this buying power helps gold prices stay at a higher level than before, even when speculative cash flow has at one point withdrawn.

Morgan Stanley forecasts gold prices to hit $4,500 an ounce by mid-2026, while JP Morgan expects an average of above $4,600 in the second quarter and above $5,000 by the end of the year. Metals Focus also set a target of 5,000 USD for the end of 2026.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...