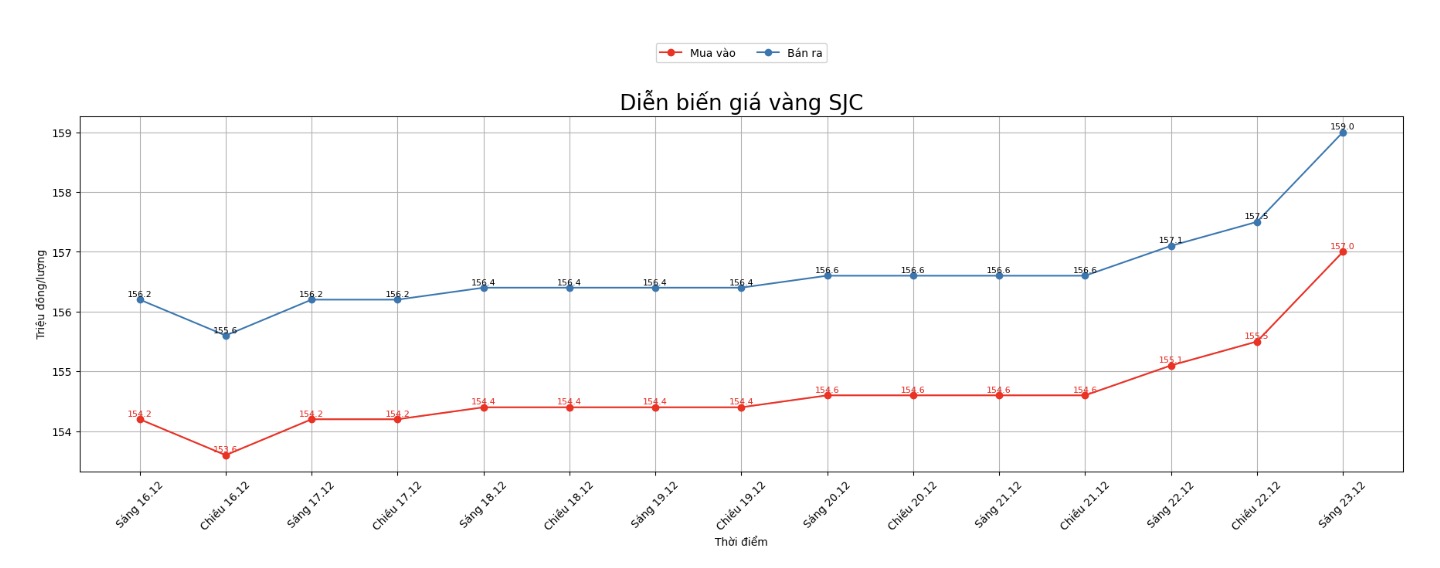

Updated SJC gold price

As of 9:25, the price of SJC gold bars was listed by DOJI Group at 157-159 million VND/tael (buy - sell), an increase of 1.9 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 156-159 million VND/tael (buy - sell), an increase of 1.9 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 157-159 million VND/tael (buy - sell), an increase of 1.9 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

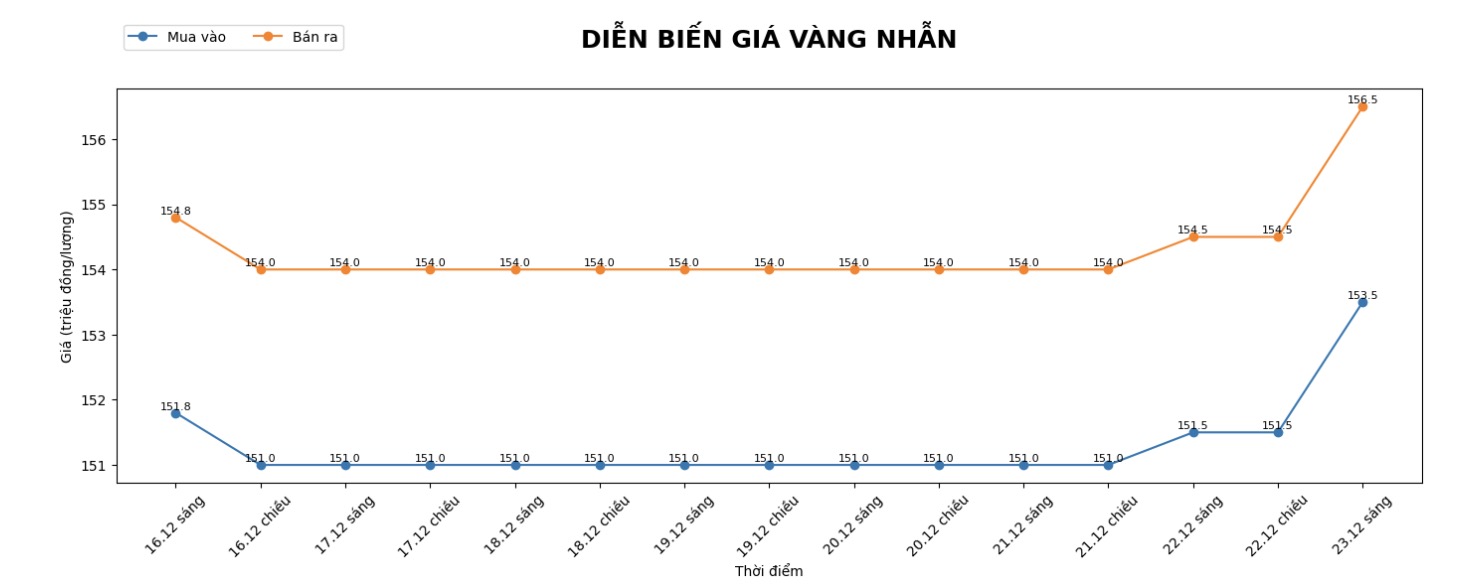

9999 round gold ring price

As of 9:20 a.m., DOJI Group listed the price of gold rings at 153.5-156.5 million VND/tael (buy - sell), an increase of 2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 154.5-157.5 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 153.8-156.8 million VND/tael (buy - sell), an increase of 1.6 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

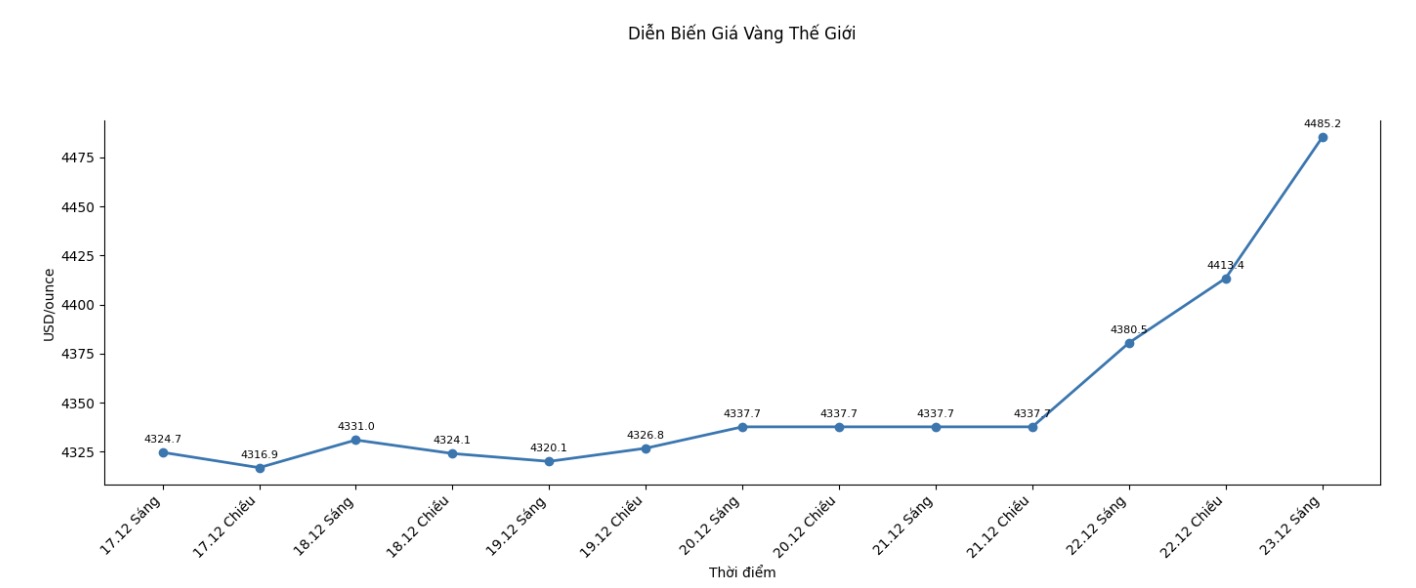

World gold price

At 9:30 a.m., the world gold price was listed around 4,485.2 USD/ounce, up sharply by 104.7 USD compared to a day ago.

Gold price forecast

Silver and gold prices increased sharply as safe-haven purchases dominated, in the context of rising geopolitical tensions.

Tensions in the energy market increased as the US implemented control measures against an oil tanker operating near Venezuela.

In another development, a senior Russian general was killed after a bomb exploded on a car in Moscow, according to the investigation agency. Lieutenant General Fanil Sarvarov, head of the combat training department under the Russian General Staff, died from injuries after a car-based explosive device exploded early Monday morning, the Investigation Committee said in a Telegram announcement, according to Bloomberg.

Notably, China continued to buy a record amount of gold worth 961 million USD in November from Russia, this is the second consecutive month that gold exports from Russia to China have exceeded 900 million USD. Gold buying rates also seemed to increase sharply at the end of the year.

In October, France's Societe Generale estimated, based on the difference between imported bullion, domestically produced gold and official reserves, that the actual amount of gold that Beijing may have purchased had increased 10 times compared to the figure of the People's Bank of China (PBOC) - an increase of 250 tons instead of 25 tons.

This analysis is based on UK gold exports, one of the most reliable indicators of physical gold flows. This index shows that China has added more than 1,080 tons of gold to its reserves since mid-2022.

According to J.P. Morgan (one of the world's largest financial - banking corporations, headquartered in the US), after a year of unprecedentedly strong price increases, the global gold market is expected to continue to maintain an upward trend in 2026.

According to the latest report from J.P. Morgan Global Research believes gold could average $5,055 an ounce by the fourth quarter of 2026, driven by persistent demand from investors and central banks, along with the emergence of new demand sources.

In 2025, gold prices have hit new peaks many times and surpassed the $4,000/ounce mark for the first time. The main driving force comes from strong cash flow into gold ETFs, central bank buying demand and investor asset diversification in the context of declining US interest rates and weakening the USD.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...