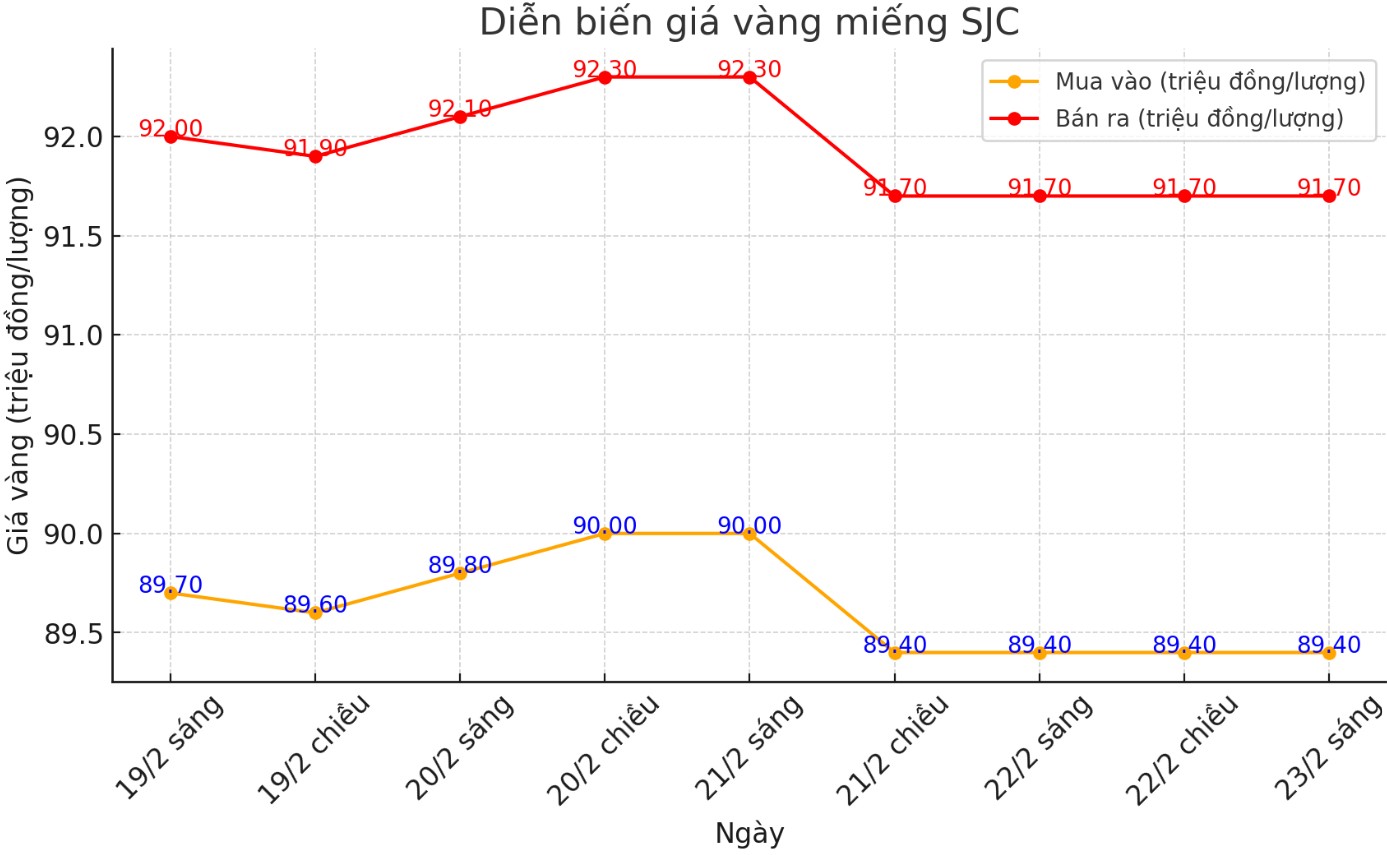

SJC gold bar price

At the end of the trading session of the week, DOJI Group listed the price of SJC gold at VND89.4-91.7 million/tael (buy in - sell out).

Compared to the closing price of last week's trading session (February 16, 2025), the price of SJC gold bars at DOJI increased by 2.1 million VND/tael for buying and increased by 1.4 million VND/tael for selling.

The difference between the buying and selling prices of SJC gold at DOJI Group is at 2.3 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at VND89.4-91.7 million/tael (buy in - sell out).

Compared to the closing price of the previous trading session (February 16, 2025), the price of SJC gold bars at DOJI increased by 2.1 million VND/tael for buying and increased by 1.4 million VND/tael for selling.

The difference between the buying and selling prices of SJC gold at DOJI Group is at 2.3 million VND/tael.

If buying SJC gold at DOJI Group and Saigon Jewelry Company SJC in the session of February 16 and selling it in today's session (February 23), gold buyers at DOJI Group and Saigon Jewelry Company SJC will both lose 900,000 VND/tael.

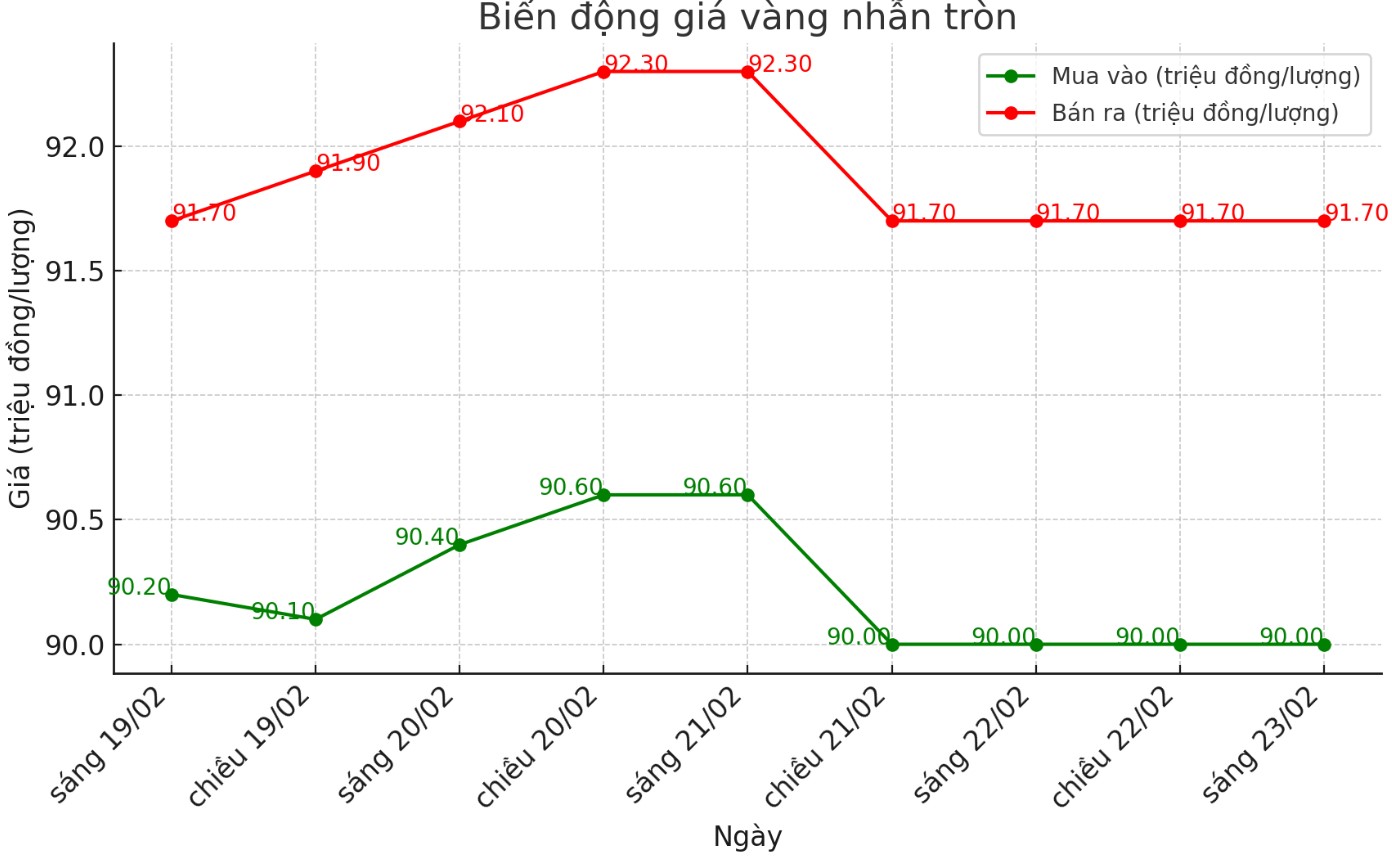

9999 gold ring price

This morning, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 90-91.7 million VND/tael (buy - sell); an increase of 1.7 million VND/tael for buying and an increase of 1.4 million VND/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 1.7 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 90.2-91.8 million VND/tael (buy - sell); an increase of 1.75 million VND/tael for buying and an increase of 1.5 million VND/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 1.6 million VND/tael.

If buying gold rings in the session of February 16 and selling in today's session (February 23), buyers at DOJI will lose 300,000 VND/tael; meanwhile, buyers at Bao Tin Minh Chau will still lose 100,000 VND/tael.

Why are buyers losing money despite rising gold prices?

Currently, the difference between the buying and selling prices of SJC gold at DOJI is up to 2.3 million VND/tael. For 9999 gold rings, the difference at DOJI is 1.7 million VND/tael and at Bao Tin Minh Chau is 1.6 million VND/tael.

This large difference makes it difficult for individual investors to make a profit if they trade in the short term. When buying, investors immediately suffer a loss equal to the difference, and can only make a profit if gold prices increase strongly beyond this threshold.

When investing in gold, investors need to closely monitor market developments and consider carefully before making a decision. One of the important factors is the difference between buying and selling prices. If the margin of difference is too high, investors may face the risk of losses even when gold prices tend to increase. In particular, for SJC gold bars, this difference is often huge, making it difficult to invest in the short term.

Observing the world gold price trend is also very necessary. 9999 gold rings tend to fluctuate according to the international market, while SJC gold bars are often affected by operating policies and domestic supply and demand. Therefore, investors need to consider between types of gold to choose an investment channel that is suitable for their strategy.

In addition, choosing a reasonable time to buy and sell also determines investment efficiency. When gold prices increase sharply but the difference between buying and selling is still high, investors need to patiently wait for adjustments to have better prices, minimizing the risk of losses. Consulting experts and updating information regularly will help investors have a more overview of the market, thereby making accurate decisions.

World gold price

At the end of the trading session of the week, the world gold price listed on Kitco was at 2,936.2 USD/ounce, up 53.8 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

World gold prices were under pressure at the end of the week as the USD index increased. Recorded at 7:00 a.m. on February 23, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.520 points (up 0.24%).

Although the gold market seems to be overvalued, Christopher Vecchio - Head of futures & Forex at Tastylive.com - said that he cannot ignore the strong increase supported by solid fundamentals.

Vecchio believes that the trend of gold going from bottom to top is a matter of time before gold prices reach $3,000/ounce and above.

Similarly, Lukman Otunuga - Director of Market Analysis at FXTM - also emphasized that gold still has a lot of room to increase prices. Due to unstable geopolitics, investment demand for gold ETFs has increased sharply in recent weeks.

See more news related to gold prices HERE...