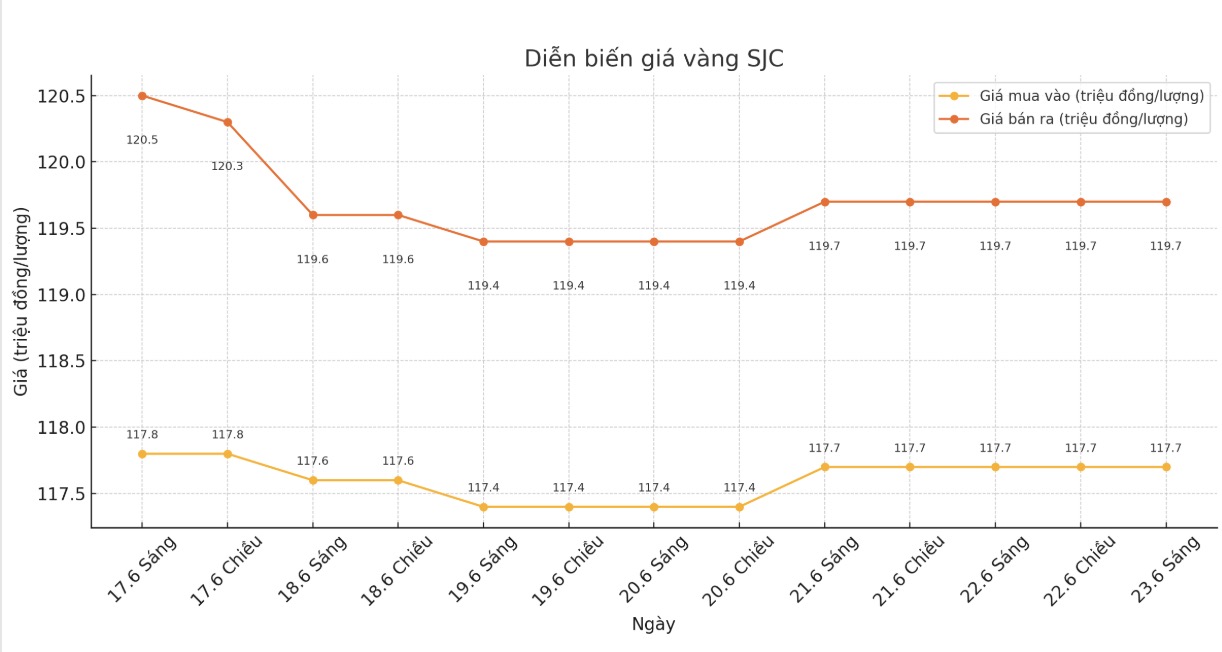

Updated SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.7 crore VND1.7 million/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.7-119 seven million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117-119 7.7 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

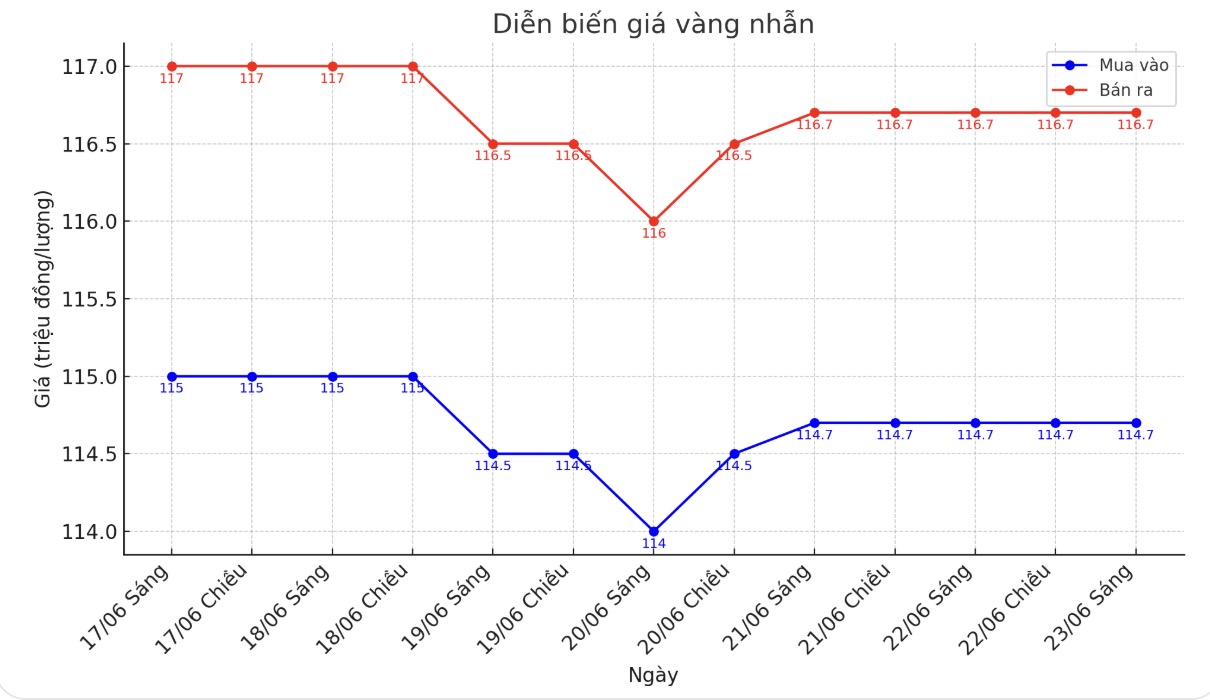

9999 round gold ring price

As of 9:30 a.m., Bao Tin Minh Chau listed the price of gold rings at 114.6-117.6 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.6-116.6 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

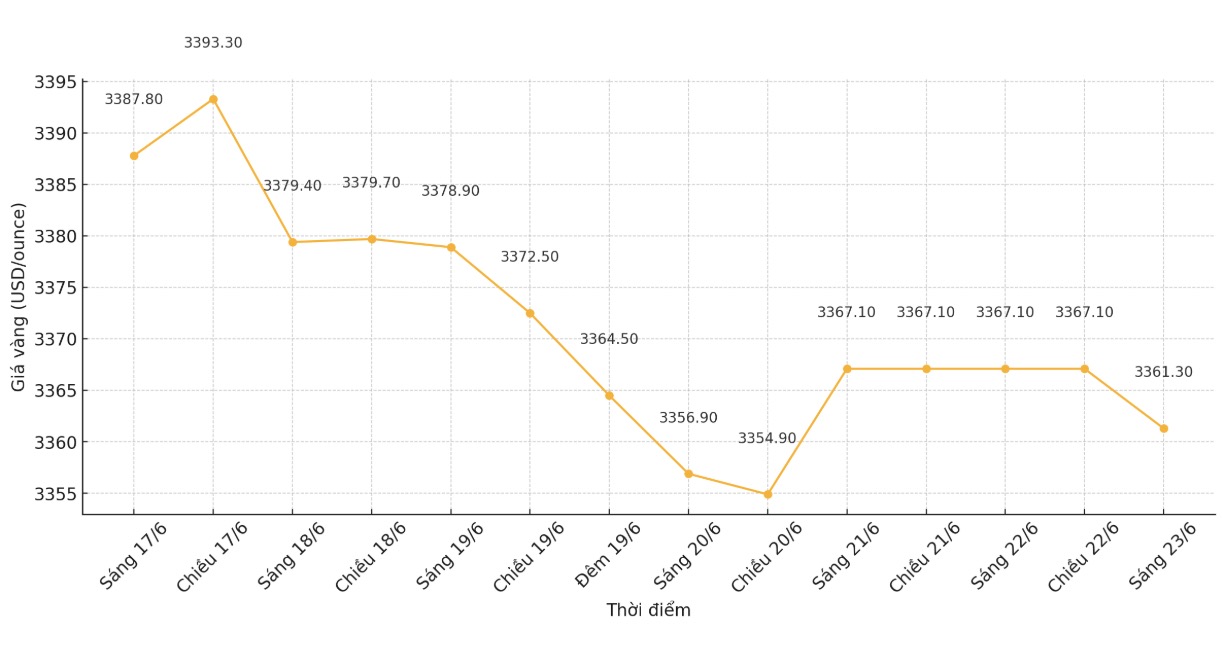

World gold price

At 9:25, the world gold price was listed around 3,361.3 USD/ounce, down 5.8 USD compared to 1 day ago.

Gold price forecast

World gold prices have had an unsuccessful trading week as the market is under pressure from the US Federal Reserve's "hawl" stance and geopolitical tensions in the Middle East are not large enough to stimulate a strong buying wave.

According to analysts, selling pressure appears when the market notices that high interest rates will continue, causing the cost of holding gold to increase. However, many opinions still maintain that gold still has the potential to recover thanks to the global risk of not cooling down.

Rich Checkan, chairman of an asset management company, believes gold could rebound: Mid-East tensions are escalating, while golds correction has gone too far. I believe the uptrend is not over yet.

Darin Newsom - market analyst - still rates gold as a long-term safe haven: "Despite short-term selling, global economic and political instability will continue to keep gold as a safe haven".

On the contrary, Adrian Day - Chairman of a fund management company - said that China's buying momentum is slowing down: "Western demand has increased but not strong enough to make gold prices break out. If there are no unexpected events, gold will move sideways or decrease slightly.

Adam Button - a currency strategist - commented: "Gold is currently reacting to the risk of war in Iran. If I knew the exact situation of the war, I would immediately know the direction of gold prices. Even if gold failed to surpass the April peak, the current price is still quite positive.

Marc Chandler, director of a foreign exchange analytics firm, warned of gold's ability to test medium-term bottlenecks: Despite the war, gold still fell more than 2% last week, the strongest decline in 5 weeks. If it breaks through the $3,265/ounce zone, the correction could extend and bring prices back to $3,200.

Sean Lusk - co-director of commercial risk prevention - assessed the gold outlook as un bright: FED maintains the view of not cutting interest rates early, the USD strengthens. hedge funds are still defensive, but in the medium term, the risk of price reduction is real.

Mr. Lusk also noted that some cash flow has shifted to other markets: " Metals such as platinum, palladium or silver are attracting capital thanks to industrial and jewelry demand, while gold is caught between high interest rates and a strong USD".

Alex Kuptsikevich - market analyst - warned that gold is being overbought: "Gold has increased for 6 consecutive months, the longest increase streak in 20 years. Meanwhile, investors are starting to turn to silver and platinum because supply is scarce and demand is stable. Gold could fall back to $3,100-$3,400 an ounce to accumulate.

Meanwhile, Colin Cieszynski - chief strategist of SIA Wealth Management - maintained a neutral attitude: "Gold prices fluctuated strongly as the conflict developed. Depending on the situation, prices can increase or decrease sharply. I think we cannot predict yet so we should keep the waiting attitude".

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...