The gold market may continue to see profit-taking and correction throughout this summer, but price movements on Friday showed that investors still want to hold a stake in gold as an important safe-haven asset ahead of a volatile weekend.

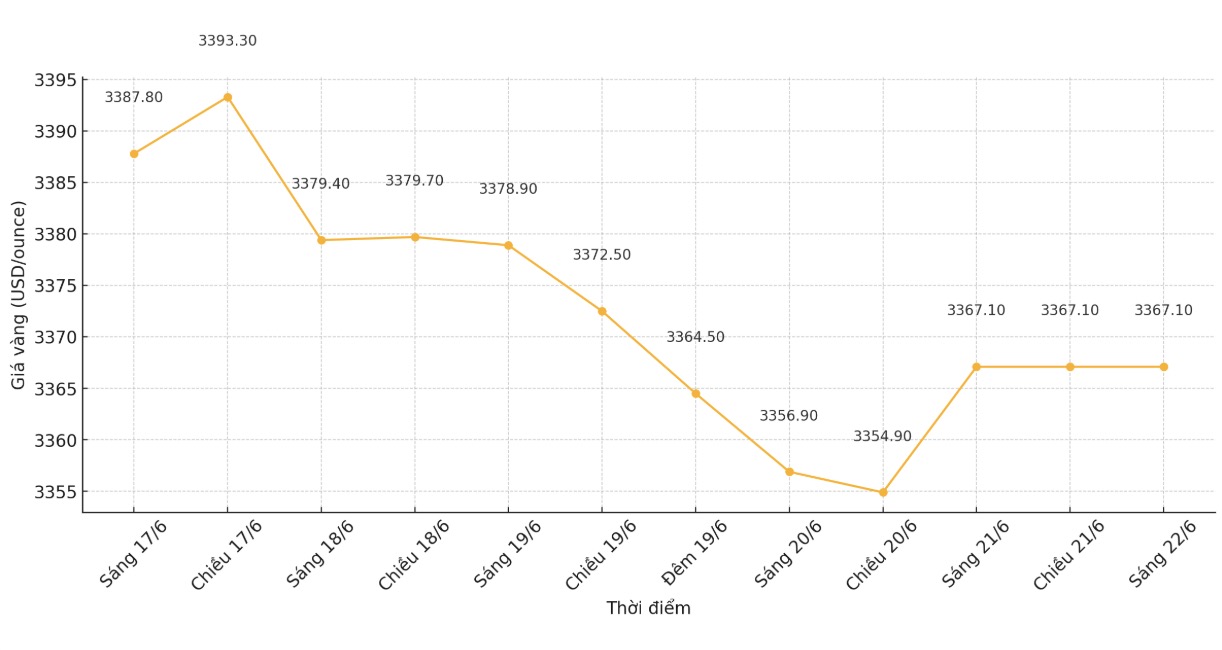

Gold prices ended the week with a sharp decrease. Investors quickly sold when prices could not hold the three-month peak, or 3,400 USD/ounce.

The latest spot gold price was recorded at 3,367.1 USD/ounce, down nearly 2% compared to last week. However, gold received support on Friday, up nearly 1% from its early low thanks to tensions between Israel and Iran increasing demand for safe havens.

Experts say that in the context of chaos and instability in the Middle East, investors are still looking to gold as a hedge against risks.

Philip Streible - Chief Market Strategist at Blue Line Futures - commented: "It is true that many people are currently pouring money into gold, but when it is not clear what the upcoming situation will be, keeping an asset without political risks is still a smart choice. Gold is the simplest way to balance portfolio risks. In my opinion, investors should keep a portion of their gold before the weekend to be more assured.

Although gold and silver still have room to adjust down, Streible believes that geopolitical instability will limit the decline of the precious metal.

Christopher Vecchio - Head of futures and exchange-traded contracts at Tastylive.com - said that gold is still maintaining a long-term uptrend as it continues to be considered an important monetary asset in the global market. However, he warned that current speculative activities suggest that the metal will face some challenges in the short term.

"Currently, gold has all the supporting factors but still cannot set a new peak. This should be a worrying signal for investors. Obviously, many people are buying gold and selling fake USDs, which is putting pressure on gold at the moment, Vecchio said.

Although the short-term outlook is somewhat negative, Vecchio remains optimistic and considers the declines as a buying opportunity.

It would be no surprise if the precious metal weakens until the end of the month as investors restructure their portfolios and take profits. However, this does not reflect the trend in the next three months. If gold holds $3,310, it's fine, if it breaks through this mark, I will reconsider my view at $3,260," he said.

Fawad Razaqzada - Market Analyst at City Index and FOREX.com - also said that although the weak momentum is appearing, this is not the right time to sell fake gold.

It would be a risky forecast to declare an end to the gold rally while Iran and Israel are still tense. The trend is still increasing and important support levels remain strong. Therefore, it is too early to confirm that the uptrend has ended, especially before the end of the week when tensions in the Middle East escalate, he said.

According to Razaqzada, the first support level is around $3,350/ounce. If it breaks through $3,350/ounce, the next target is $3,300/ounce, which is the previous bottom. Further down will be an uptrend line formed from the beginning of the year. In terms of resistance, $3,400/ounce remains a key milestone for tracking, he added.

In addition to the short-term geopolitical factor, experts are still optimistic about gold as the US monetary policy continues to be an important support. The US Federal Reserve (FED) kept interest rates unchanged this week. However, many experts believe that it is only a matter of time before the Fed has to lower interest rates.

Next week, the market will closely follow Fed Chairman Jerome Powell's half-year hearing before the US Congress. Mr. Powell continues to face a lot of criticism from President Donald Trump as the FED has not cut interest rates despite persistent inflationary pressures.