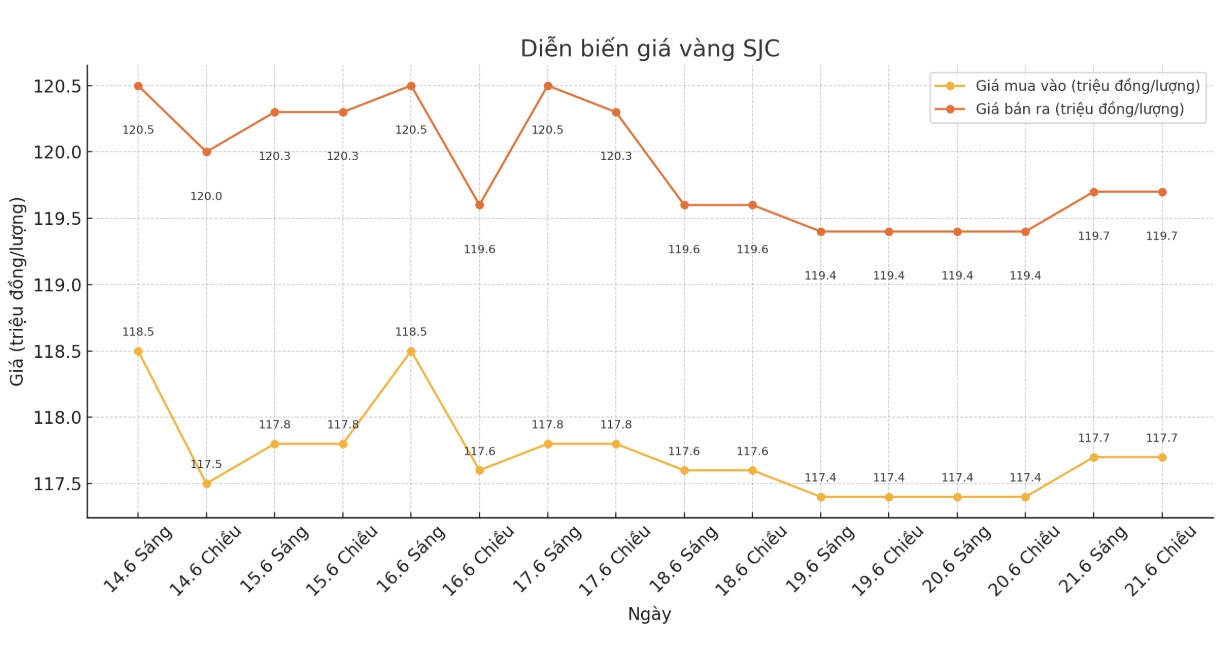

SJC gold bar price

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 117.7 hyd 19.7 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session (June 15, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC decreased by VND100,000/tael for buying and VND600,000/tael for selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.7-119 seven million VND/tael (buy in - sell out). Compared to a week ago, Bao Tin Minh Chau adjusted the price of SJC gold bars down 100,000 VND/tael for buying and down 600,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

If buying SJC gold at Bao Tin Minh Chau and Saigon Jewelry Company SJC on June 15 and selling it today (6, 22), buyers will lose VND 2.6 million/tael.

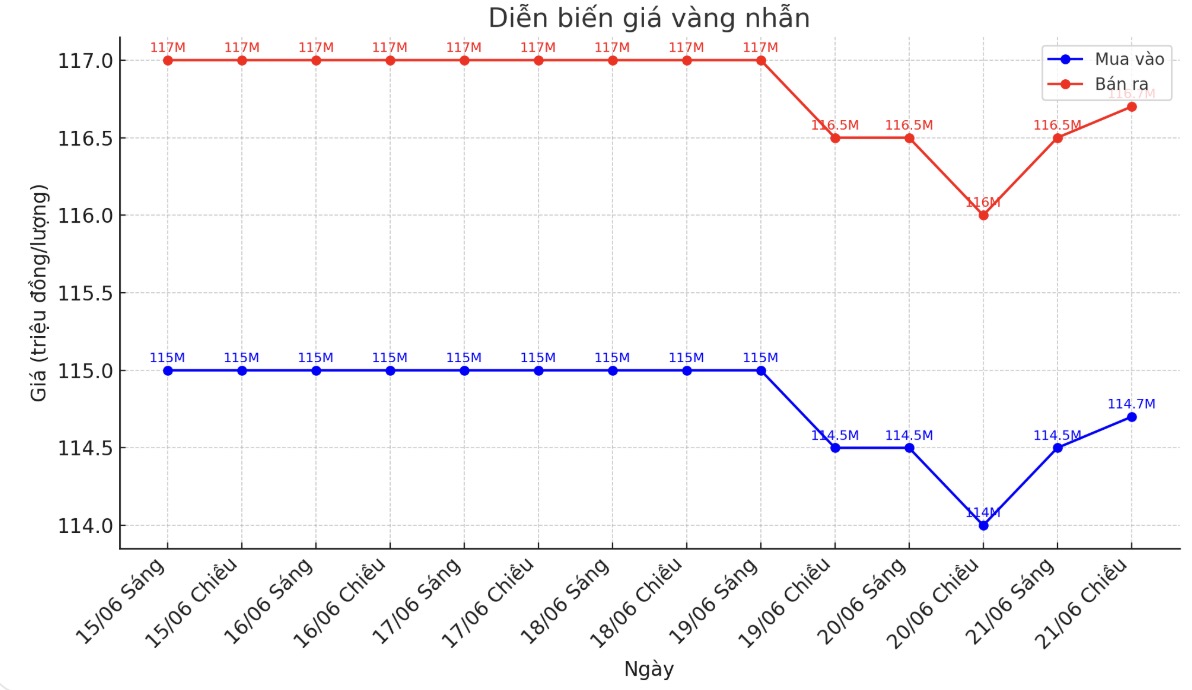

9999 gold ring price

This afternoon, Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy - sell); down 1.5 million VND/tael in both directions compared to a week ago. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.5-116.5 million VND/tael (buy - sell), down 500,000 VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of June 15 and selling in today's session (6, 22), buyers at Bao Tin Minh Chau will lose 4.5 million VND/tael, while buyers at Phu Quy will lose 3.5 million VND/tael.

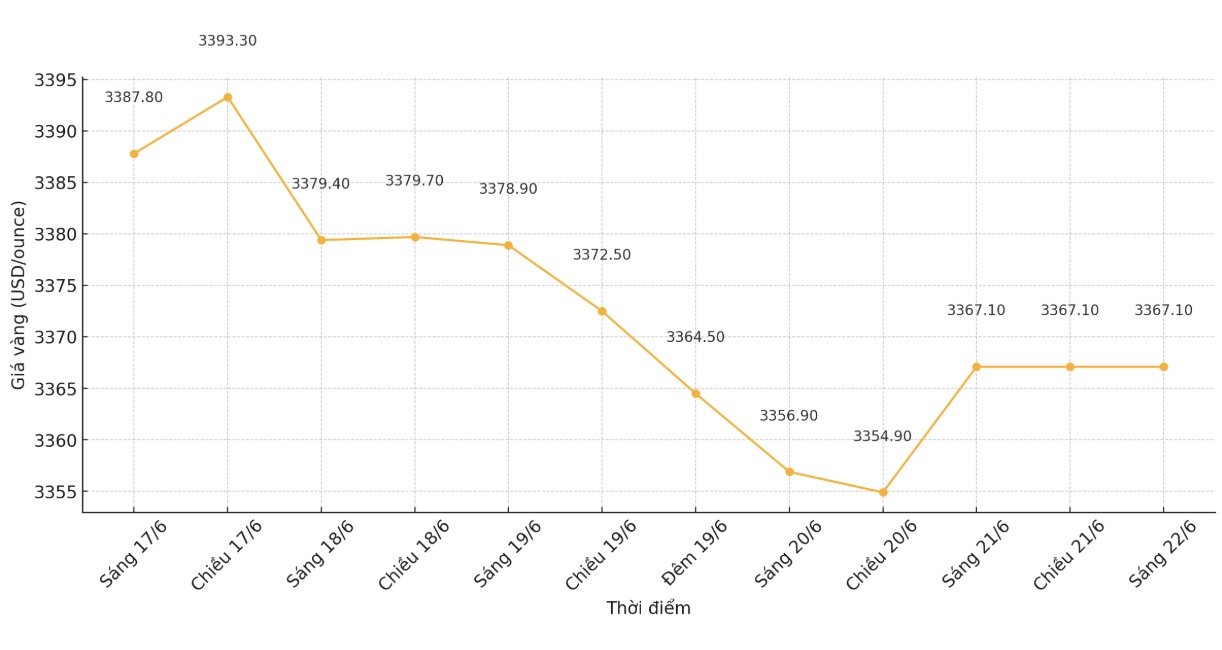

World gold price

At the end of the trading session of the week, the world gold price listed on Kitco was at 3,367.1 USD/ounce, down sharply by 63.4 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

A survey from a news agency that focuses on monitoring the gold market shows that industry experts are still not in agreement on the short-term gold price trend. Some see gold prices rising next week, while some see prices falling, while others see little volatility. On the other hand, individual investors still maintain a moderately optimistic view.

Of the 16 experts surveyed, 38% believe gold prices will increase, 31% predict a decrease and the rest believe that prices will go sideways. Meanwhile, more than 250 individual investors participating in the survey also showed that nearly half were leaning towards the possibility of gold prices continuing to increase next week, the rest divided equally for a downward or sideways scenario.

Mr. Adam Button - Head of currency strategy at Forexlive, commented that the fluctuations in the precious metals market reflect the ups and downs of geopolitical risks. In the current context, Mr. Button is cautious and hesitant to make predictions about the gold price trend.

"Gold is currently trading around the Middle East," Button said. Gold buyers are now worried about a war in Iran.

According to Philip Streible - Chief Market Strategist of Blue Line Futures, many people are currently pouring capital into gold, however, in the context of instability, holding a safe asset like gold is still a smart choice to prevent risks. He recommends that investors should maintain a share of gold in their portfolios before the weekend.

Christopher Vecchio - Head of futures and exchange rates at Tastylive.com - said that gold continues to play an important monetary asset role in the world market and the long-term trend is still positive. However, he noted that current strong speculative activities could create short-term pressures.

Gold is converging many supporting factors but has not yet reached a new peak, this is a signal that investors need to pay attention to. The fact that many people buy gold and sell fake USDs is unintentionally creating a certain obstacle - Vecchio commented.

Economic data to watch next week

Monday: S&P Preliminary PMI.

Tuesday: US consumer confidence; Chairman of the US Federal Reserve (FED) auctioned before the House Financial Services Committee.

Wednesday: New home sales; FED Chairman holds a hearing before the Senate Banking, Housing and Urban Committee.

Thursday: Weekly jobless claims, long-term US orders, final Q1/2025 GDP, Waiting for sale house transactions.

Friday: US PCE core inflation.

See more news related to gold prices HERE...