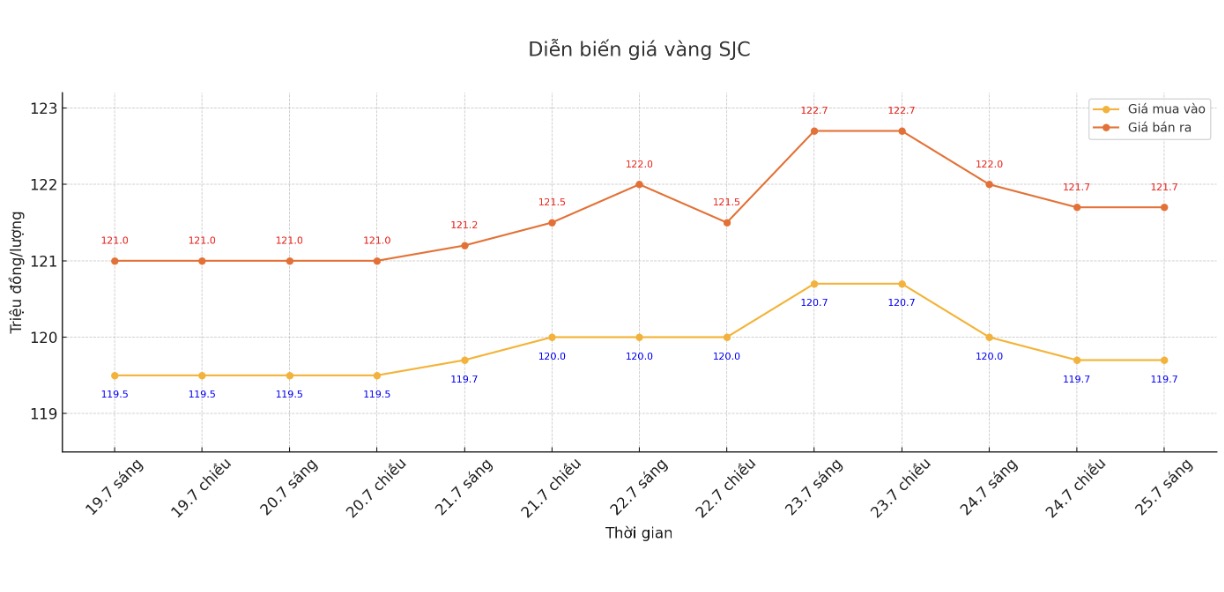

Updated SJC gold price

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at VND 119.7-121.7 million/tael (buy in - sell out), down VND 300,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.7-121.7 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 119.2-121.7 million/tael (buy in - sell out), down VND 300,000/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

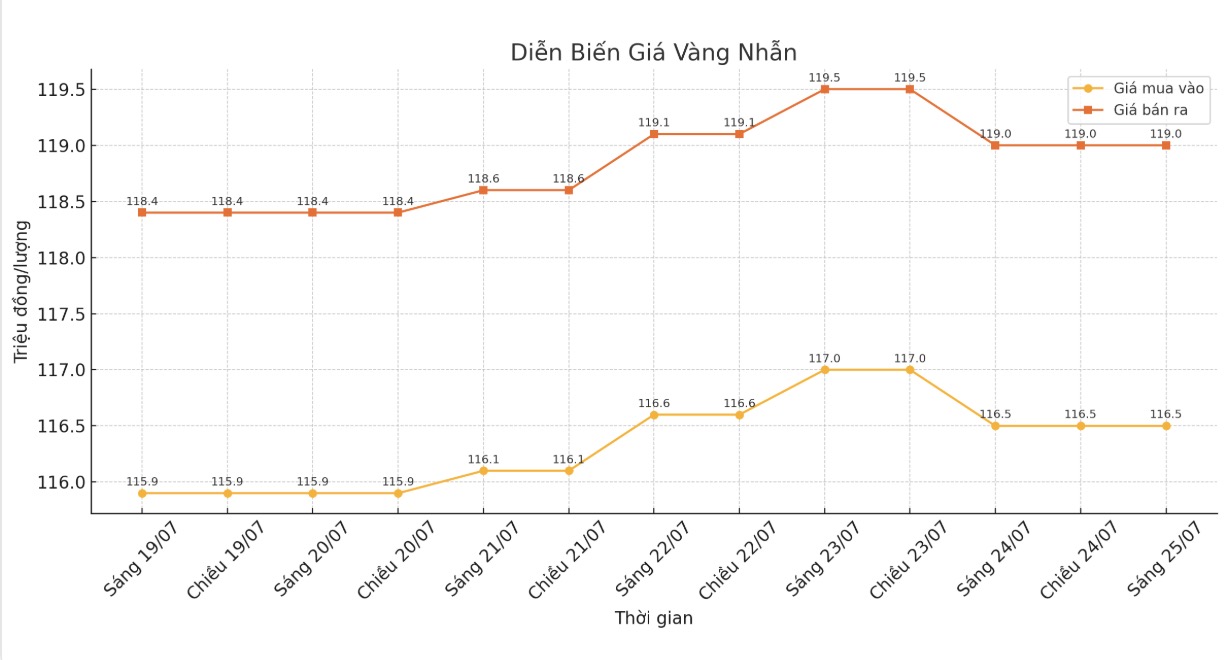

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 116.5-119 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.7-119 7.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.5-118.5 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

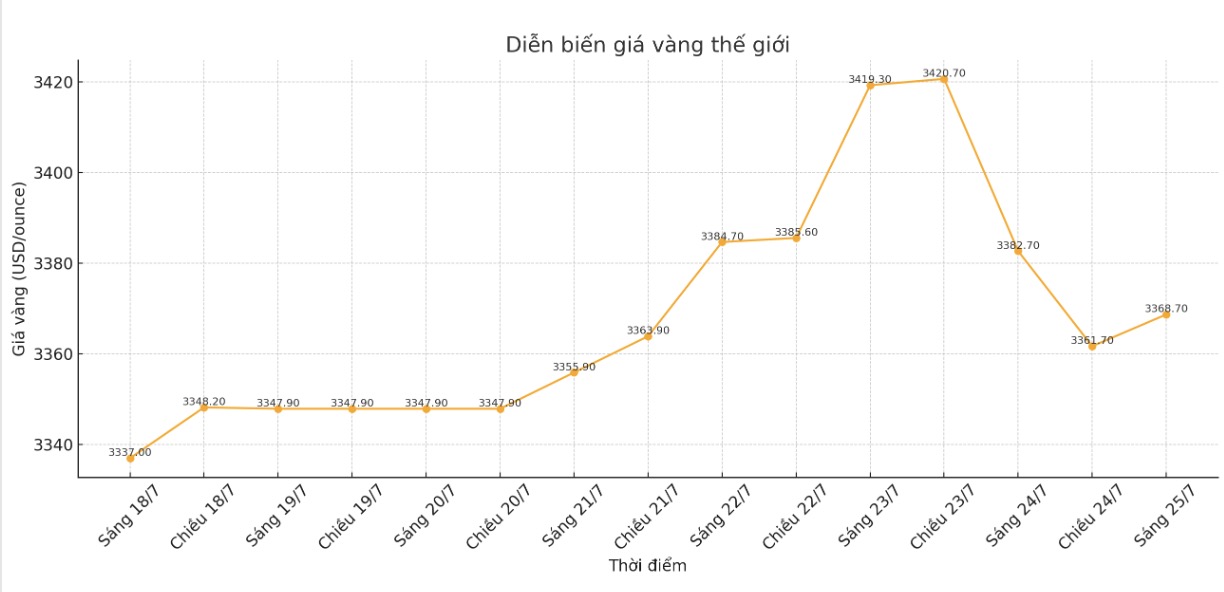

World gold price

At 8:55 a.m., the world gold price was listed around 3,368.7 USD/ounce, down 14 USD/ounce.

Gold price forecast

Gold prices weakened as global trade tensions cooled, causing demand for safe-haven assets such as gold to decline.

Following the trade deal between the US and Japan this week, the two European diplomats said on Wednesday that the European Union (EU) and the US are also getting closer to a new trade deal. The deal could include a basic 15% tax on US goods from the EU, along with some exempted exemptions.

Gold prices fell this morning due to positive news surrounding global trade... This helps reduce risks to global economic growth and strengthen the dominating risk-taking mentality in the financial market, said analyst Carsten Menke of Julius Baer Bank.

Demand for gold from safe-haven seekers has cooled, while central bank purchases remained steady, although not as strong as at the start of the year. We still expect gold prices to increase in the long term, Mr. Menke added.

The next policy meeting of the US Federal Reserve (FED) is scheduled to take place from July 29 to 30. The Fed is expected to keep the current interest rate unchanged, but investors still expect the agency to continue cutting interest rates in September.

Many major financial institutions believe that gold is still in a long-term bullish trend. The reason is that countries are reducing their dependence on the US dollar and actively increasing their gold reserves. At the same time, the USD is expected to continue to weaken in the long term. If the Fed really loosens monetary policy, gold prices could surpass $3,400/ounce and set a new record, even reaching $3,500/ounce.

In another development, the ECB announced to keep interest rates unchanged, including: deposit interest rate at 2%, principal refinancing interest rate at 2.15% and frontier lending interest rate at 2.4%. At the same time, the ECB also did not provide a clear direction on monetary policy in the coming time.

Gold prices are fluctuating in a narrow range, as they have not been able to maintain their increase against the Euro and USD.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...