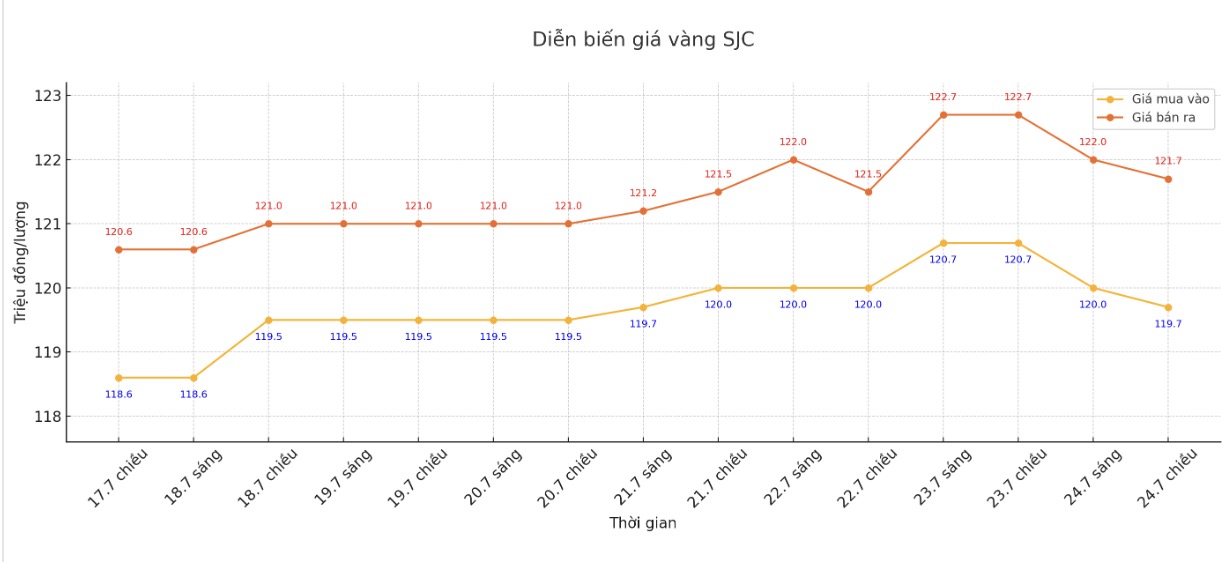

SJC gold bar price

As of 6:00 a.m. on July 25, the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.7-121.7 million/tael (buy in - sell out); down VND 1 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 119.7-121.7 million VND/tael (buy - sell); down 1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.7-121.7 million VND/tael (buy - sell); down 1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 119.2-121.7 million/tael (buy in - sell out); down VND 1 million/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

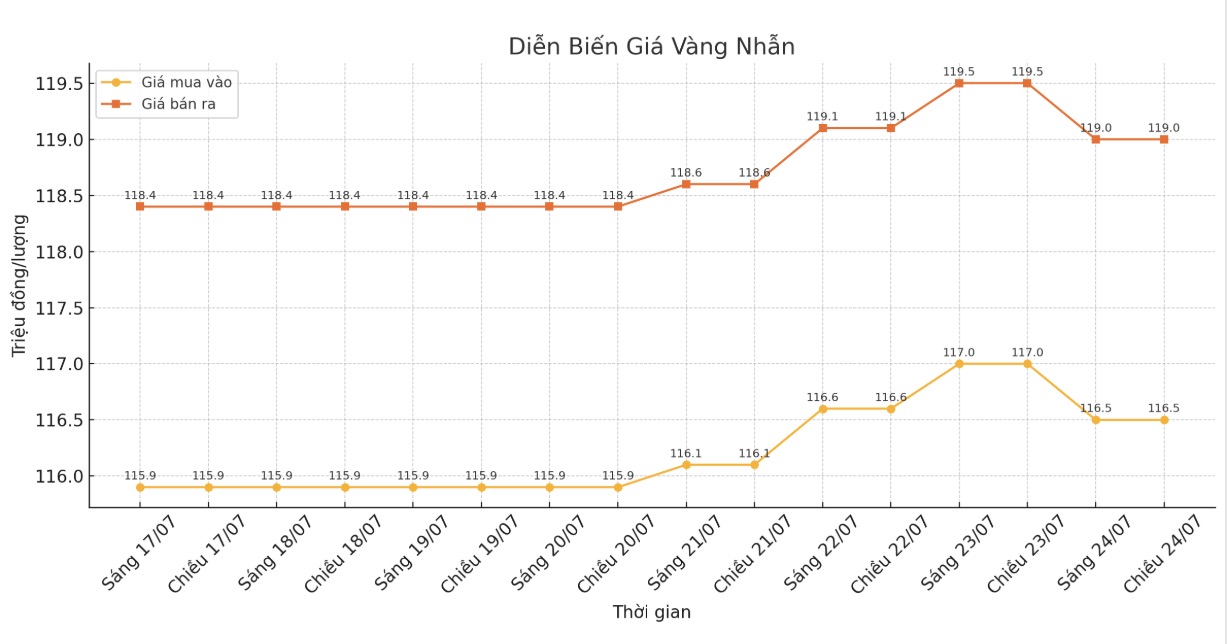

9999 gold ring price

As of 6:00 a.m. on July 25, DOJI Group listed the price of gold rings at VND 116.5-119 million/tael (buy in - sell out), down VND 500,000/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.7-119 7.5 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.7-118.7 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

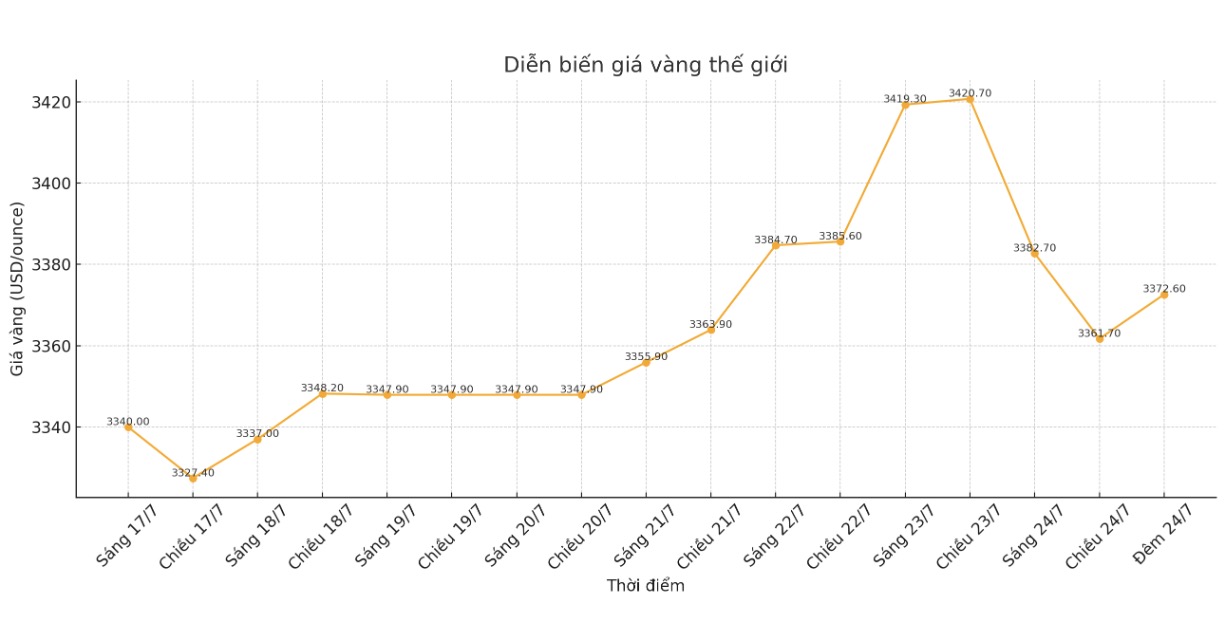

World gold price

The world gold price was listed at 10:45 p.m. on July 24 at 3,372.6 USD/ounce, down 38.8 USD compared to 1 day ago.

Gold price forecast

Gold prices fell sharply due to profit-taking activities from short-term futures traders and the phenomenon of weak buying positions being sold off (teders who have just established buying positions but quickly suffered losses).

August gold contract decreased by 30.6 USD, to 3,366.9 USD. September silver contract decreased by 0.143 USD, to 39.35 USD.

Asian and European stock markets mostly increased overnight. US stock indexes are expected to open ranging from neutral to positive in New York today.

On Wednesday evening (local time), US President Donald Trump said he would not cut the tax to below 15% before the deadline for the trade deal on August 1, showing that the import tax floor is being raised: "We will apply a simple, direct tax rate, ranging from 15% to 50%".

The UK FTSE 100 and Japan's TOPIX both set records on Thursday, after the US-Japan trade deal was announced earlier this week, along with hopes that the US and the European Union could reach an agreement before the deadline set by the US on August 1. Some reports show that the US and EU are moving towards a tariff deal at 15%.

On Thursday, the European Central Bank (ECB) held a monetary policy meeting and is likely to keep interest rates unchanged - for the first time in more than a year. This comes as the ECB awaits more clearly the impact of US tariffs on the EU economy. Deposit interest rate is expected to remain at 2%. However, many analysts predict the ECB will cut another 0.25% in September.

Technically, August gold buyers are still holding a clear advantage in the short term. The next bullish target is to close above the strong resistance level at the June peak of 3,476.3 USD/ounce.

The next downside target for the bears is to push prices below the key technical support level at $3,300/ounce. The first resistance level was 3,400 USD/ounce, followed by 3,425 USD/ounce. The first support was $3,350/ounce, then $3,314.3/ounce.

The main outside markets today recorded a slight increase in the USD index. Nymex crude oil prices also increased slightly, trading around 75.75 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.392%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...