Updated SJC gold price

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at VND 119.6-121.1 million/tael (buy - sell), down VND 100,000/tael for buying and down VND 600,000/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.6-121.1 million VND/tael (buy - sell), down 100,000 VND/tael for buying and down 600,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.8-121.1 million VND/tael (buy - sell), down 400,000 VND/tael for buying and down 600,000 VND/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

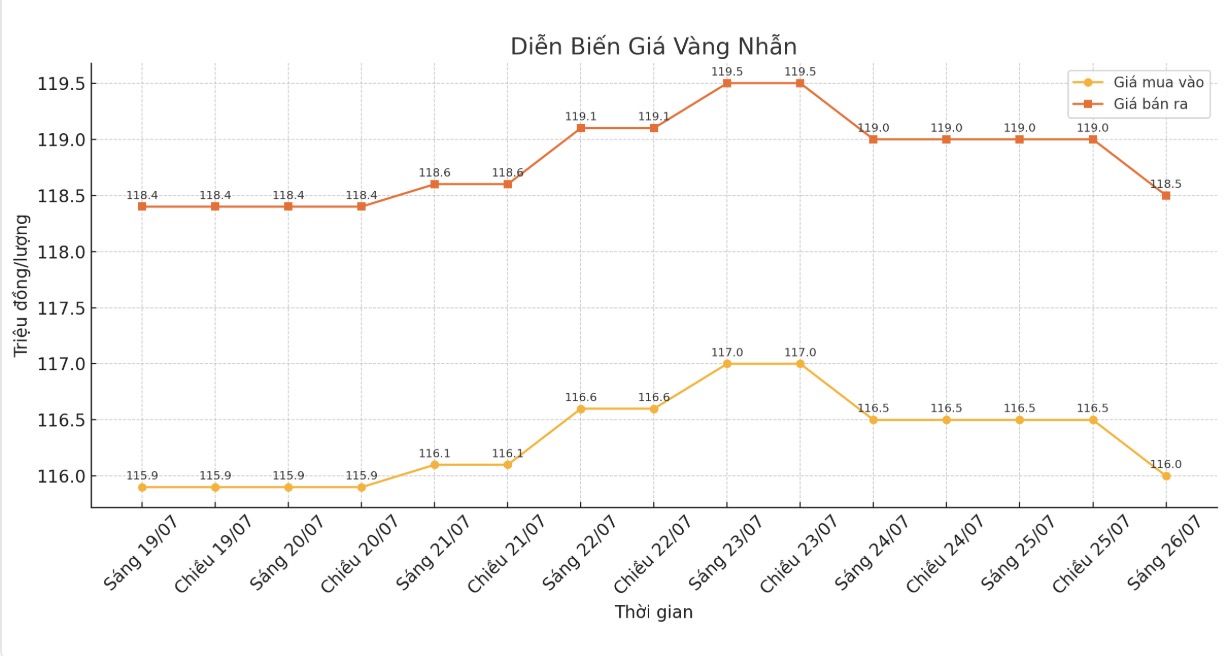

9999 round gold ring price

As of 9:10 a.m., DOJI Group listed the price of gold rings at 116-118.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.2-119.2 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.1-118.1 million VND/tael (buy in - sell out), down 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

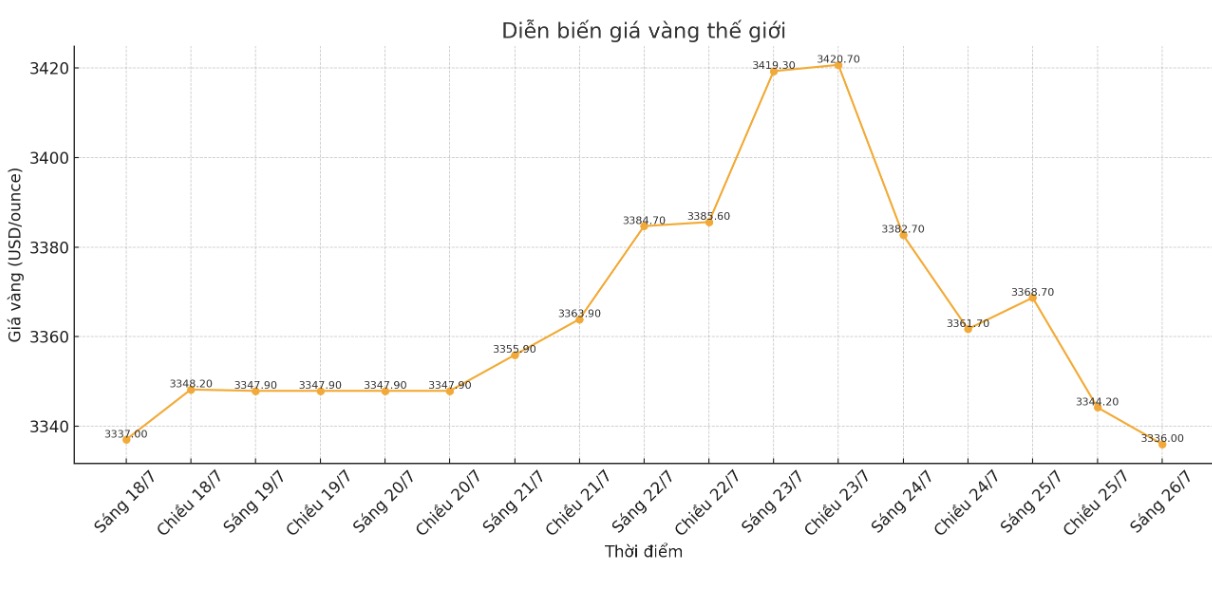

World gold price

At 9:15 a.m., the world gold price was listed around 3,336 USD/ounce, down 32.7 USD/ounce.

Gold price forecast

Gold prices fell as short-term investors took profits. The risk-off mentality was not too strong at the weekend, but there were no signs of increasing risk acceptance.

Gold prices fell partly due to the strengthening of the US dollar and positive developments in tariff negotiations between the US and many countries. At the same time, yesterday, President Donald Trump expressed confidence that the US Federal Reserve (FED) will start cutting interest rates.

Commerzbank analysts say gold prices appear to be finding a direction, as potential trade deals are affecting the precious metal's safe-haven role. They are neutral in the short term, believing that gold prices have reached a temporary peak.

Darin Newsom - senior market analyst at Barchart.com commented that gold prices will move sideways in the short term.

Why? There is currently no reason to believe that gold prices will plummet, although it may decrease slightly when buying pressure shifts to silver and copper. But the core reason for golds strength is its role as a safe haven amid global uncertainty that remains unchanged. No one predicts what will happen next.

There are rumors that China may have been buying more gold than we thought, which is noteworthy. I didnt think this amount of gold would be released to the market soon, Newsom added.

According to the latest data from the China Gold Association (CGA), China's gold consumption in the first half of 2025 decreased by 3.54%.

The CGA said total gold consumption reached 505.21 tons. The most obvious decline was in the jewelry segment, with jewelry sales down 26% compared to the first half of 2024, to only 199.83 tons.

Meanwhile, demand for gold bars and coins skyrocketed by 23.69%, reaching 264.24 tons in the first 6 months of the year.

Gold used for industry and other purposes also increased by 2.59% over the same period last year, reaching 41.14 tons.

In another development, the Executive Board of the European Central Bank (ECB) announced on July 24 to keep interest rates unchanged at 2%, after cutting 8 times over the past year.

The ECB said that inflation has returned to the 2% target and is stable, but warned that the global economic environment remains unstable due to trade tensions.

EU diplomats say the US and EU are aiming for an agreement that would result in a 15% tariff on EU imports into the US. The ECB warned that higher US tariffs will lead to lower growth in the Eurozone...

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...