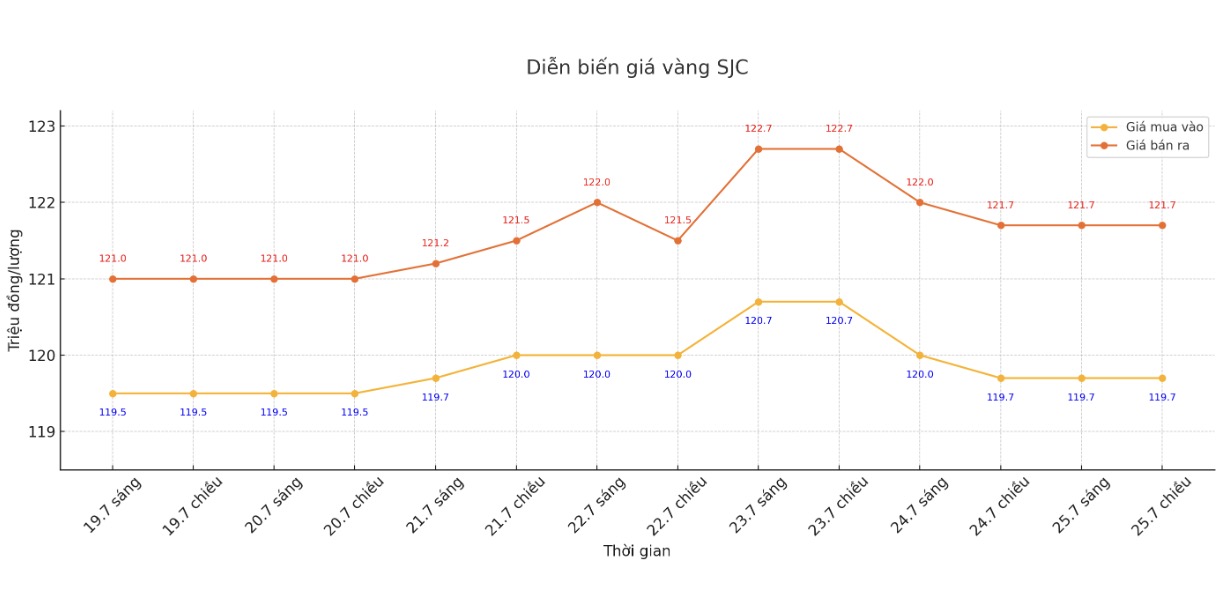

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.7-121.7 million/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 119.7-121.7 million VND/tael (buy - sell); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.7-121.7 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 119.2-121.7 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2.5 million VND/tael.

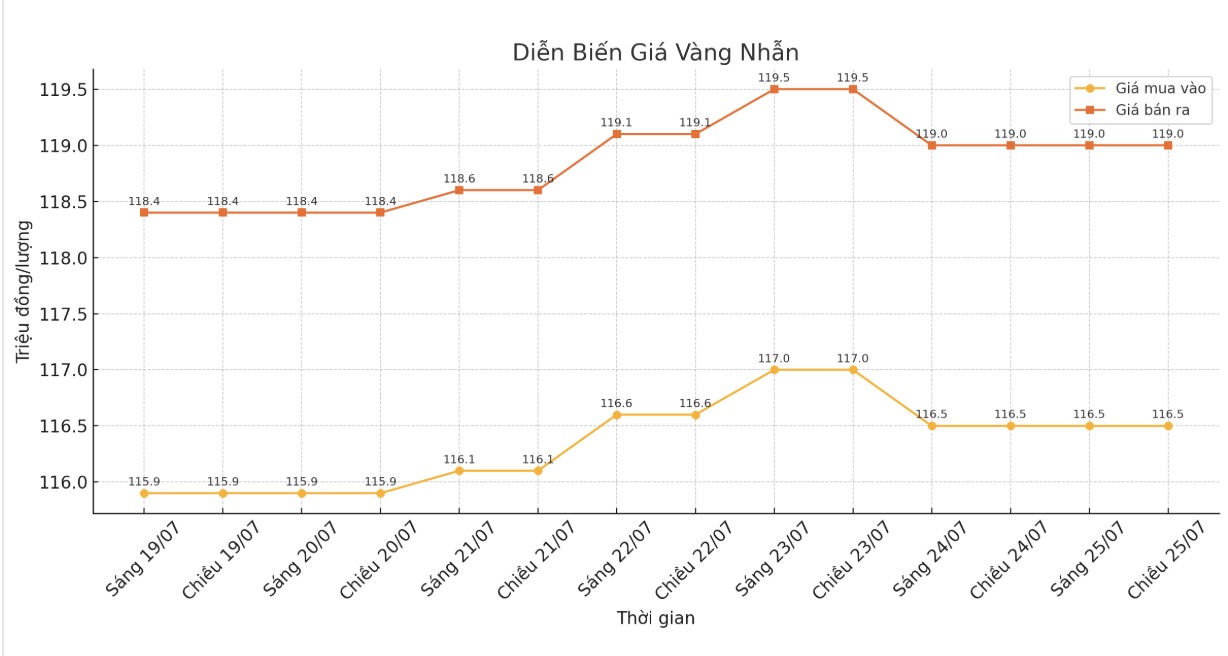

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 116.5-119 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.7-119 7.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.5-118.5 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

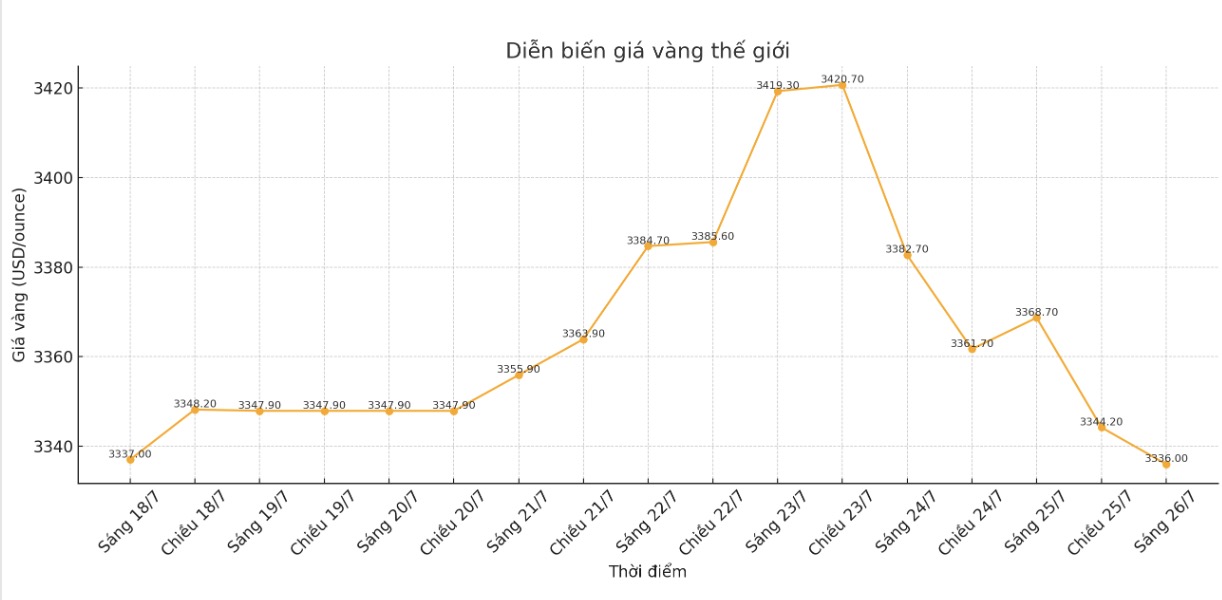

World gold price

The world gold price was listed at 6:25 at 3,336 USD/ounce, down 36.6 USD compared to 1 day ago.

Gold price forecast

Gold prices fell as short-term investors took profits. The risk-off mentality was not too strong at the weekend, but there were no signs of increasing risk acceptance. August gold price decreased by 32.7 USD to 3,340.8 USD/ounce.

Asian and European stocks mostly fell in the night session. US stock indexes are expected to open slightly up today in New York.

On Thursday afternoon, US President Donald Trump visited the US Federal Reserve and the agency's headquarters renovation project. Mr. Trump and FED Chairman Jerome Powell have publicly argued about the cost of reform. Regarding monetary policy, Mr. Trump said: "I just want to see a simple thing happen: Interest rates have to come down." However, he also hinted that he did not want to sack Powell, saying: I think he will do the right thing. Everyone knows what is right.

In another development, China's budget deficit has hit a new record in the first half of 2025, reflecting the government's efforts to stimulate domestic demand amid Trump's tariffs reducing exports to the US. The total fiscal deficit reached 5.25 trillion yuan (equivalent to 733 billion USD) in the first 6 months of the year, according to Bloomberg based on data from the Chinese Ministry of Finance, released on Friday. This deficit has increased by 45% over the same period last year.

The European Union (EU) and China summit in Beijing this week is expected to be low and the reality is true. This is the first direct meeting between EU and Chinese leaders since 2003, but has not achieved many specific commitments.

Technical analysis shows that bulls are still holding a short-term advantage over August gold contracts, but are weakening. The next target for buyers is to close above the strong resistance level at the peak of this week at 3,451.7 USD/ounce. On the contrary, the seller will aim to push the price below the technical support level of 3,300 USD/ounce.

The immediate resistance level is the overnight peak at 3,376.6 USD/ounce, followed by 3,400 USD/ounce. The most recent support was $3,325/ounce and then $3,314.3/ounce.

In the outside market, the USD index increased. WTI crude oil prices are trading around 66.25 USD/barrel. The yield on the 10-year US government bond is at 4.418%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...