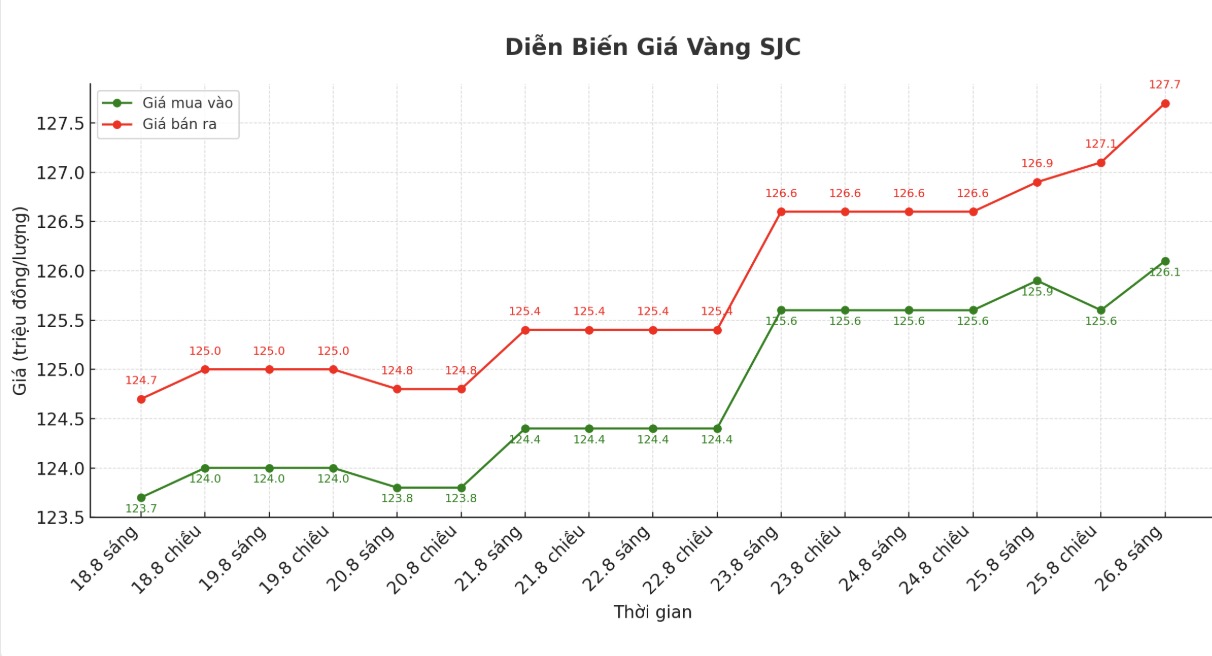

Updated SJC gold price

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at 126.1-127.7 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and an increase of 800,000 VND/tael for selling. The difference between buying and selling prices is at 1.6 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 125.6-127.1 million VND/tael (buy - sell), down 300,000 VND/tael for buying and up 200,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 125.1-127.7 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and an increase of 800,000 VND/tael for selling. The difference between buying and selling prices is at 2.6 million VND/tael.

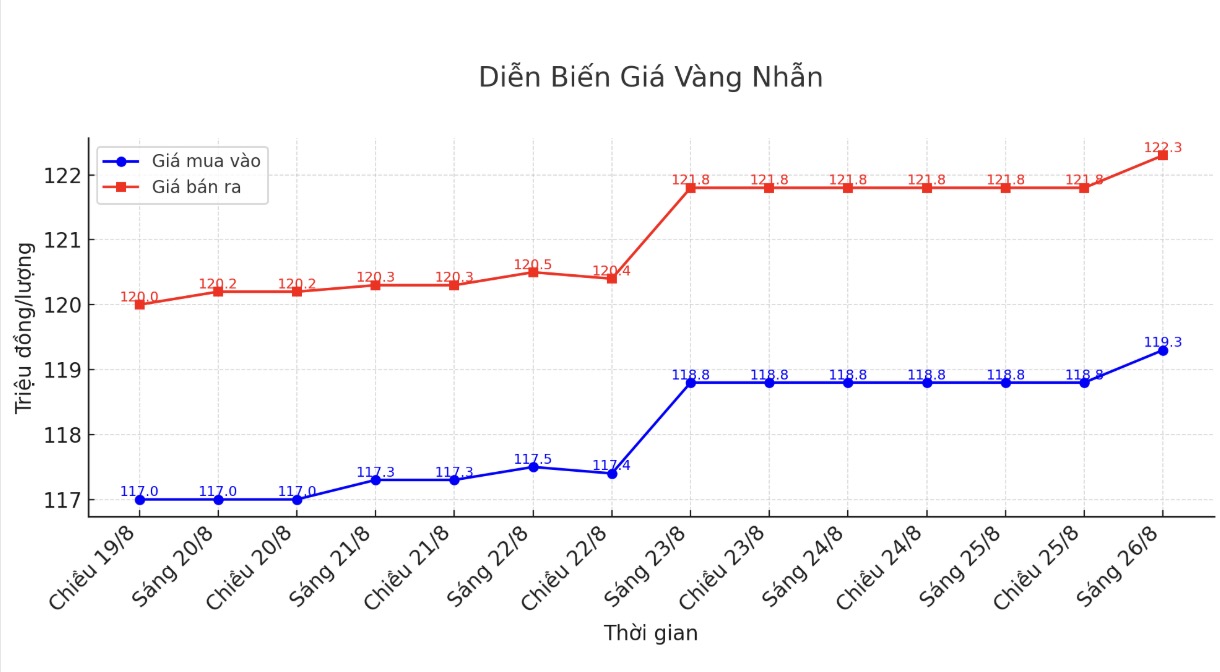

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 119.3-122.3 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 119.2-122.2 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 119.2-122.2 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

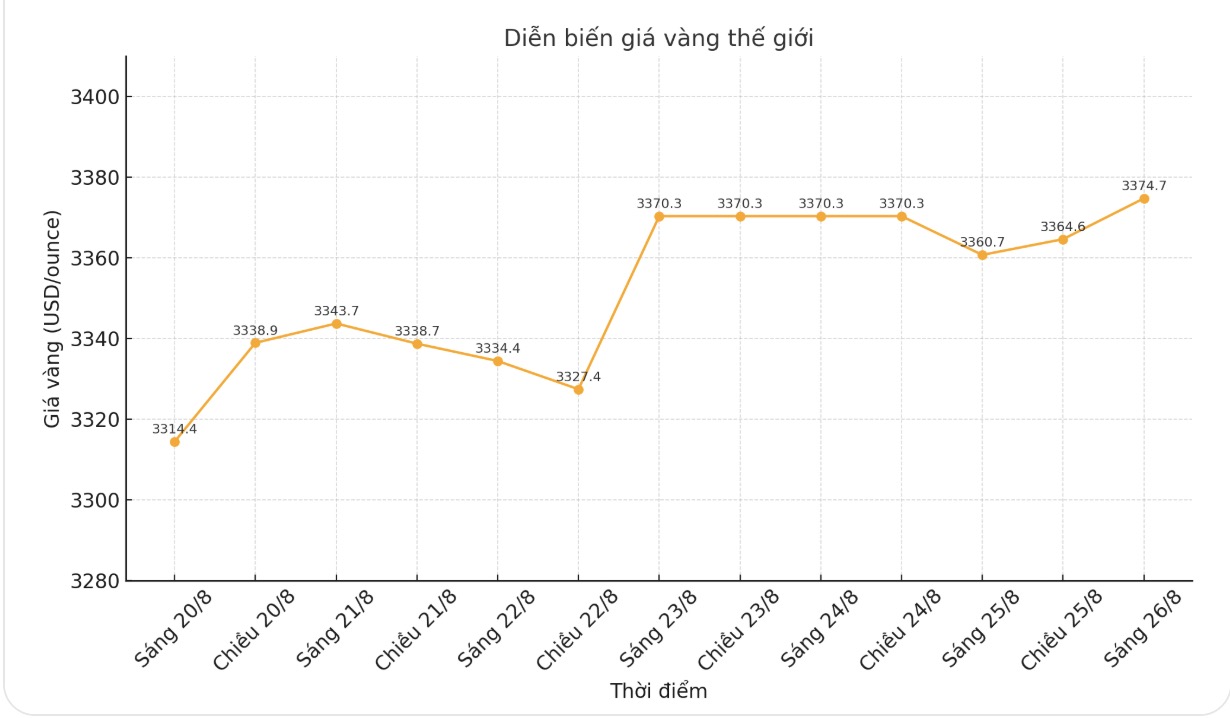

World gold price

At 9:00 a.m., the world gold price was listed around 3,374.7 USD/ounce, up 14 USD compared to a day ago.

Gold price forecast

Precious metals analysts at Heraeus said that confidence in the possibility of the US Federal Reserve (FED) cutting interest rates has added momentum for gold, but the weakening of the USD and political risks could be a major dominating factor in the coming time.

According to Company Generale Bank (France), the precious metal still maintains its support despite the declining global instability and shifting trading flows.

The bank said short-term risks are emerging as uncertainty levels gradually return to normal. However, experts emphasize that the risk of price reduction is still quite limited.

ETF capital flows remain stable, while the moderate sale of managed money funds even creates a more solid foundation, because this is the most vulnerable component to dominate prices, the banks report stated.

society Generale has maintained its bullish outlook for gold this year. In June, the bank said it would not sell any holdings until prices exceeded $4,000 an ounce - a level it was expected to reach in the second quarter of 2025. However, profit-taking is holding prices within a certain range.

Technically, December gold delivered the short-term upward advantage. The next target for buyers is to surpass the solid resistance level of 3,500 USD/ounce. Meanwhile, the sellers want to pull prices below the strong support level at the bottom of July at 3,319.2 USD/ounce.

The immediate resistance level was at the peak last week at 3,423.4 USD, then up to 3,450 USD. The most recent support was $3,400/ounce, followed by last week's low of $3,353.4/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...