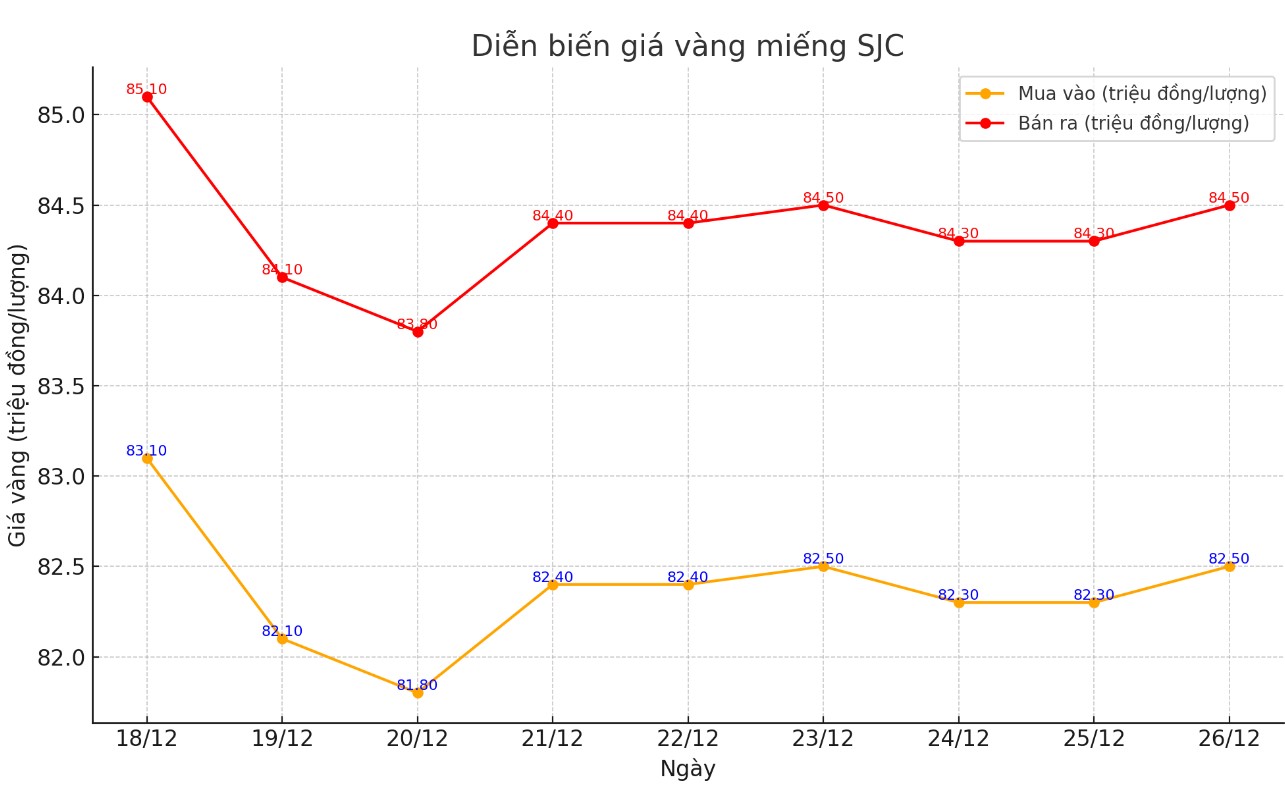

Update SJC gold price

As of 7:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND82.5-84.5 million/tael (buy - sell), an increase of VND200,000/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 82.5-84.5 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.5-84.5 million VND/tael (buy - sell), up 200,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

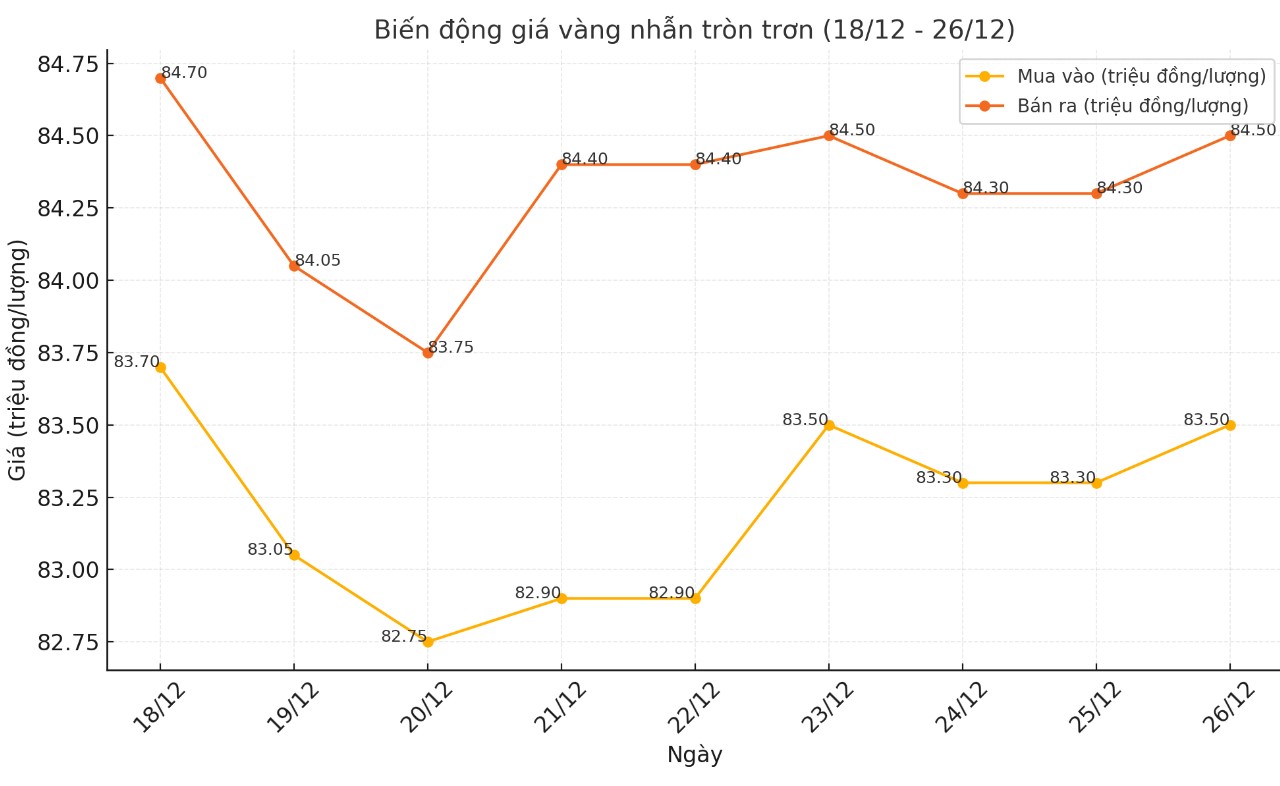

Price of round gold ring 9999

As of 6:15 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.5-84.5 million VND/tael (buy - sell); an increase of 200,000 VND/tael for both buying and selling compared to the closing price of yesterday's trading session.

Bao Tin Minh Chau listed the price of gold rings at 82.7-84.5 million VND/tael (buy - sell), an increase of 200,000 VND/tael for both buying and selling compared to the close of yesterday's trading session.

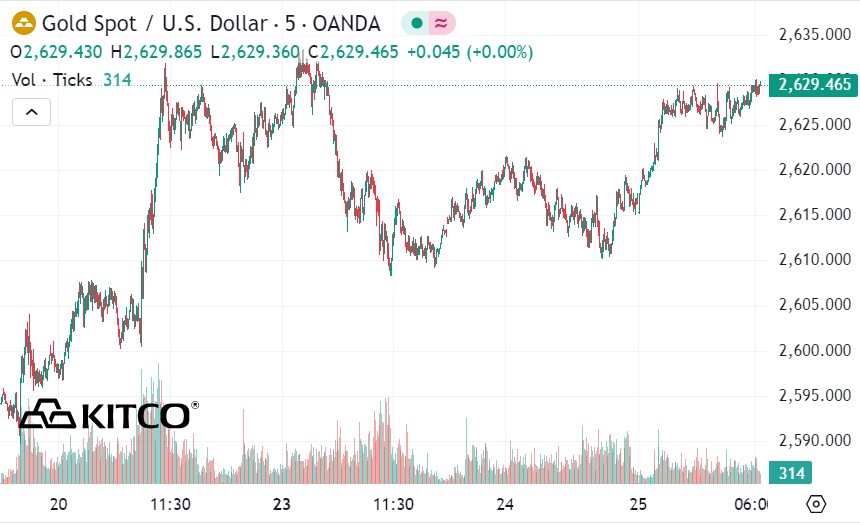

World gold price

As of 6:30 p.m., the world gold price listed on Kitco was at 2,629.4 USD/ounce, up 12.6 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices increased as the USD index decreased. Recorded at 6:30 p.m. on December 26, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.950 points (down 0.07%).

Geopolitical tensions pushed gold prices up in Asia on the afternoon of December 26, as investors watched the US Federal Reserve's 2025 interest rate strategy and President-elect Donald Trump's tax policies, factors that could have a major impact on the precious metal next year.

The stability of the US dollar and US government bond yields in this session helped gold prices recover after the decline from the recent Fed meeting. In addition, the usual upward trend in the last week of December is also supporting the recovery of gold.

Geopolitically, the conflict between Hamas and Israel continues to be deadlocked in reaching a ceasefire agreement, despite positive signs from negotiations. Brian Lan - CEO of GoldSilver Central in Singapore - said that if the instability in the Middle East escalates, gold prices could continue to rise.

Traders are now awaiting US jobless claims data on December 26 and preparing for policy changes when Mr Trump takes office in January 2025.

According to the World Gold Council (WGC), central bank demand for gold has reached its highest level in more than ten years, a clear testament to gold’s strong position as a safe-haven asset, especially as the global geopolitical and economic situation continues to be uncertain. At the same time, loose monetary policies and slower rate hikes from central banks have also contributed to the positive momentum for gold prices.

Zain Vawda, an analyst at OANDA, said that in the absence of major geopolitical shocks, gold prices in 2025 could remain stable around $2,800/ounce.

Meanwhile, George Milling-Stanley - strategist of State Street Global Advisors - predicts that gold prices have a 50% chance of fluctuating between 2,600-2,900 USD/ounce, and a 30% chance of surpassing the threshold of 3,100 USD/ounce.

See more news related to gold prices HERE...