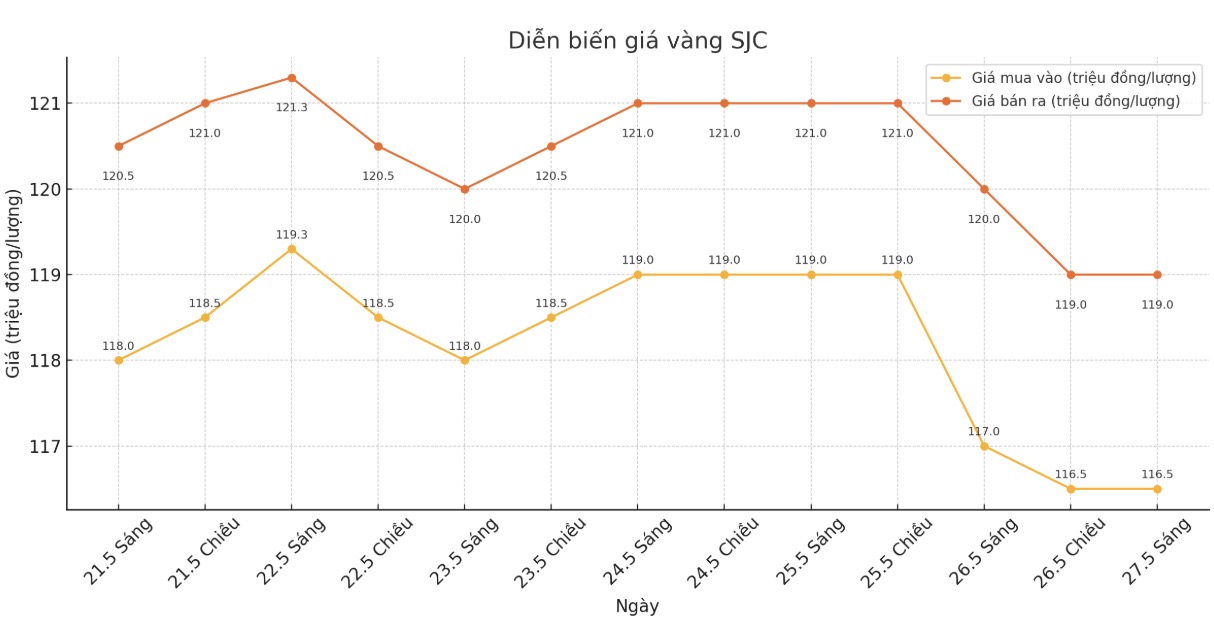

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND116.5-119 million/tael (buy - sell), down VND500,000/tael for buying and down VND1 million/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 116.5-119 million VND/tael (buy - sell), down 500,000 VND/tael for buying and down 1 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 116.5-119 million VND/tael (buy - sell), down 500,000 VND/tael for buying and down 1 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 116-119 million VND/tael (buy - sell), down 500,000 VND/tael for buying and down 1 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

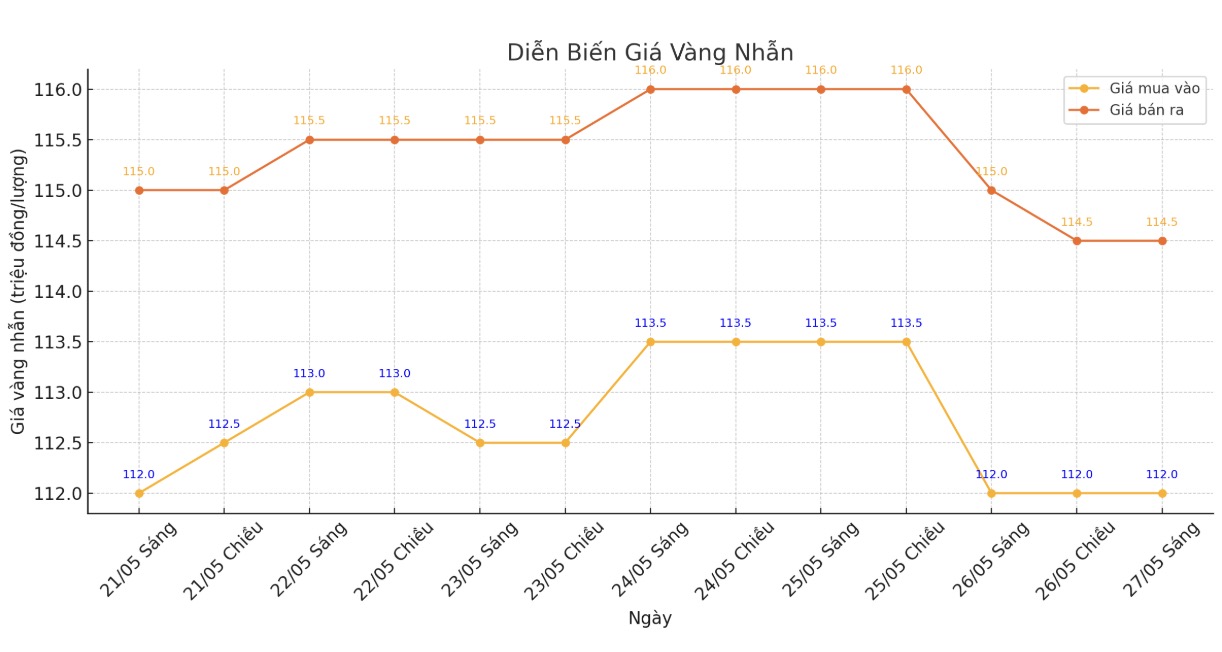

9999 round gold ring price

As of 9:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112-14.5 million VND/tael (buy - sell), unchanged for buying and down 500,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 112-115 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

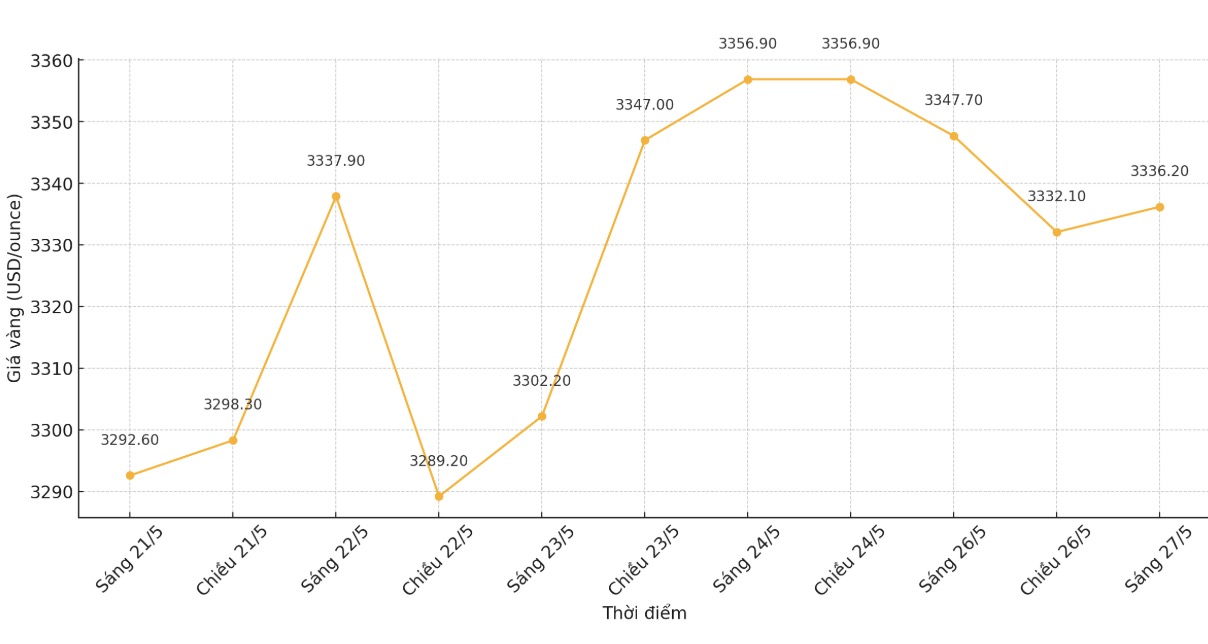

World gold price

At 9:07 a.m., the world gold price listed on Kitco was around 3,336.2 USD/ounce, down 11.5 USD/ounce.

Gold price forecast

Due to the US market's long holiday closures and quiet trading, gold still maintains a support level of over 3,300 USD/ounce. Precious metals are under pressure as safe-haven demand eases.

Gold prices increased sharply last week after President Donald Trump threatened to impose a 50% tax on all imports from the European Union, but then postponed the plan until July 9 after a call with European Commission President Ursula von der Leyen.

Although the threat of a global trade war has eased, uncertainty is still affecting investor sentiment, expected to continue supporting gold prices. Mr. James Hyerczyk - senior analyst at FXEmpire.com - commented that despite the slight decrease in prices, the technical and fundamental context is still leaning towards an uptrend, with a price target of 3,500 USD/ounce from Citi Bank and UBS Bank.

The market is above $3,310/ounce, safe-haven demand is solid, traders are advised to prioritize uptrends and pay attention to important news to get into the market.

Despite the easing of trade tensions, financial experts at Brown Brothers Harriman, a prestigious US financial services firm, warned that the tax escalation targeting Europe cannot be underestimated. They predict the European Union will react quickly.

The US, the European Union and China account for 60% of global domestic product, so this trade dispute could negatively affect the world economy.

Brown Brothers Harriman (one of the longest-standing and prestigious US investment banks and asset management companies) is also optimistic about the USD as the USD index fluctuates near 99. The USD index is affected by financial concerns, unpredictable tariffs and weak US economic data, expected to last this week.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...