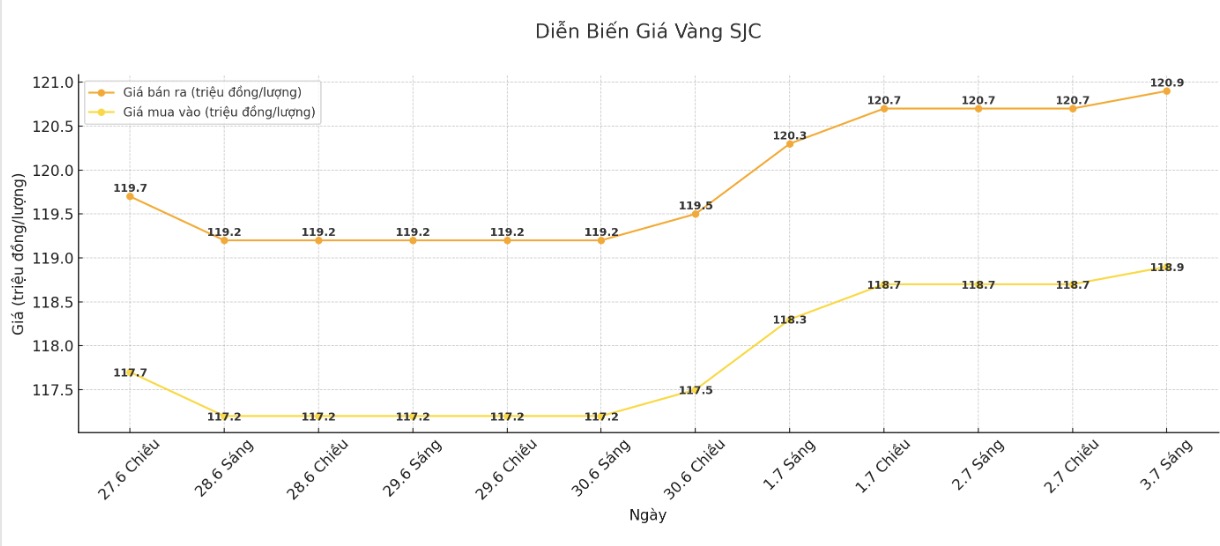

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.9-120.9 million/tael (buy in - sell out), an increase of VND 200,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed the price of SJC gold bars at 118.9-120.9 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.9-120.9 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 118.3-120.9 million/tael (buy in - sell out), an increase of VND 200,000/tael in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

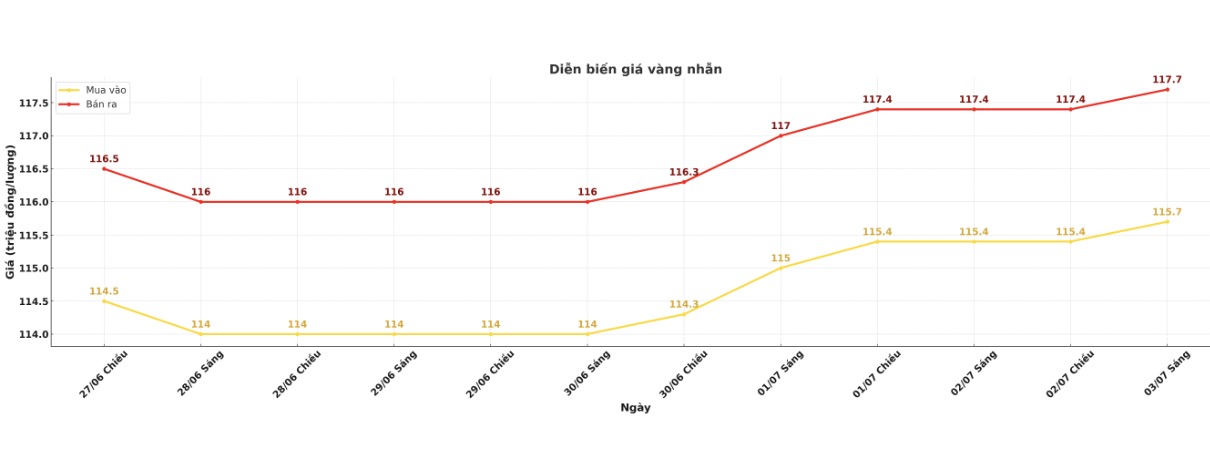

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 115.7/17.7 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.8-118.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.2-117.2 million VND/tael (buy in - sell out), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

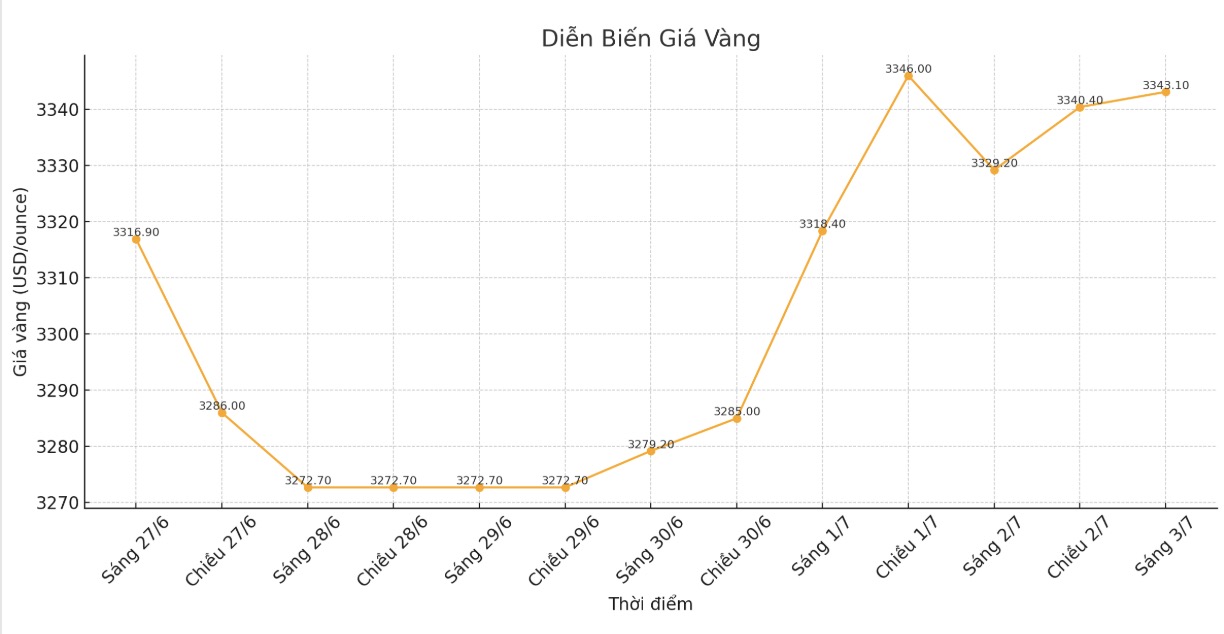

World gold price

At 8:56, the world gold price was listed around 3,343.1 USD/ounce, up to 13.9 USD/ounce compared to 1 day ago.

Gold price forecast

Mr. Robert Minter - ETF Strategy Director at abrdn (a UK-based global asset management company), gold prices remained above $3,300/ounce thanks to strong increases in US and global public debt. He said gold above $3,000/ounce is reasonable and unlikely to fall much. Although short-term risks may arise when pessimism reverses, any correction is a buying opportunity. Minter predicts the Fed will be forced to cut interest rates, which could trigger a new price increase, bringing gold to nearly $3,700/ounce by the end of the year.

Mr. Ryan McIntyre - Senior Executive partner at Sprott commented that gold prices may fluctuate around 3,300 USD/ounce in the summer as investors adjust their expectations for the new price level. However, he also warned that increasing public debt is still a big risk for the stock market.

People say gold is overpriced and the market is too crowded with participants. But I don't see it as crowded as the S&P 500. There are still many investors who can participate in the precious metals market compared to stocks and some of them will be attracted by the value opportunity in silver - he shared.

In another development, central banks have increased global gold reserves in May 2025.

Ms. Marissa Salim - Head of the World Gold Council (WGC) Asia - Pacific Senior Research Group said that in May 2025, global central banks net bought 20 tons of gold, nearly equal to the 12-month average of 27 tons.

The National Bank of Kazakhstan bought the most with 7 tons, bringing its reserves to 299 tons, a total increase of 15 tons since the beginning of the year. The Central Bank of Turkey and the National Bank of Poland both bought an additional 6 tons, of which Poland holds the position of largest net buyer bank in 2025 with a total of 67 tons.

China and the Czech Republic added 2 tons of gold each side, while Kyrgyzstan, Cambodia, the Philippines and Ghana each added 1 ton. April data showed the central bank of Qatar was buying 2 tonnes of gold.

On the other hand, the Singapore Monetary Authority sold the most in May with 5 tons, followed by the Central Bank of Uzbekistan and the German Central Bank each selling 1 ton. Since the beginning of the year, Uzbekistan has been the largest net seller (27 tons), Singapore has been second with 10 tons.

The WGC survey shows that 95% of central banks believe gold reserves will continue to increase in the next 12 months, up from 81% last year.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...