SJC gold bar price

As of 6:00 a.m. on July 3, the price of SJC gold bars was listed by Saigon Jewelry Company at 118.7/20.7 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 118.7 - 20.7 million VND/tael (buy - sell); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.7-120.7 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.1-120.7 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2.6 million VND/tael.

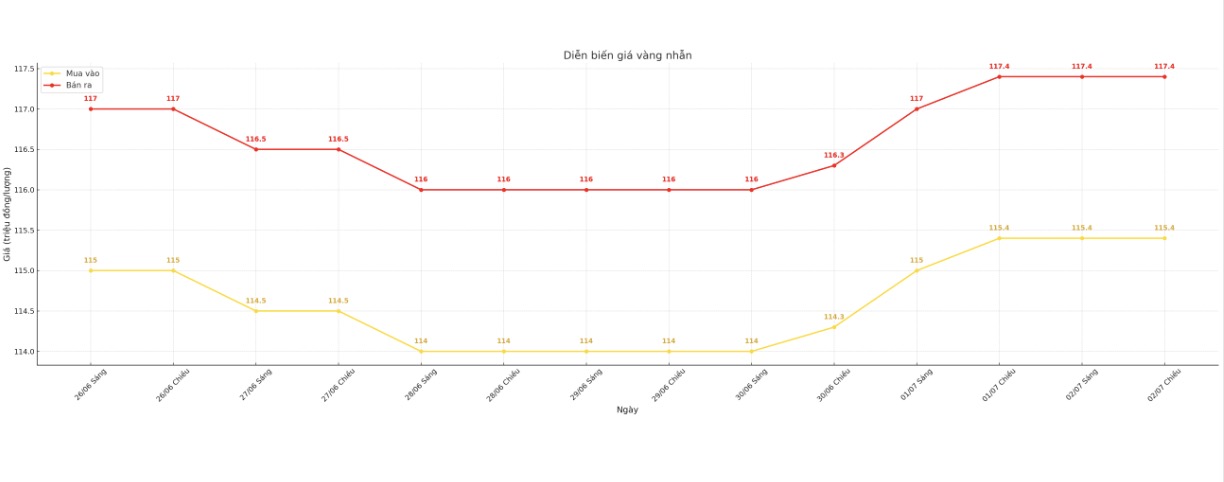

9999 gold ring price

As of 6:00 a.m. on July 3, DOJI Group listed the price of gold rings at VND 115.4-117.4 million/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.5-118.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.1-117.1 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

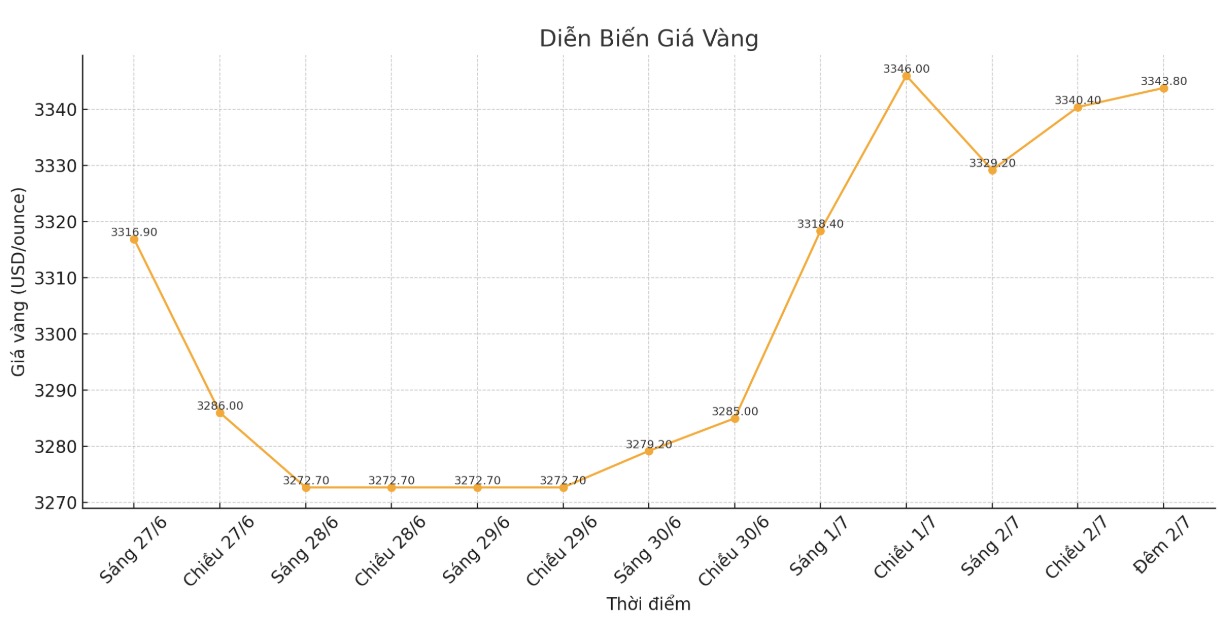

World gold price

Recorded at 11:42 p.m. on July 2, spot gold was listed at $3,343.8/ounce, up $4.5.

Gold price forecast

Gold and silver prices increased in the trading session last night, as these two precious metals temporarily stopped their fluctuations before the important US economic report scheduled to be released on Thursday.

August gold contract increased by 2.4 USD, to 3,352.2 USD/ounce. September silver price increased by 0.058 USD, reaching 36.455 USD/ounce.

Traders are starting to pay attention to the US Department of Labor's June employment report, which is considered the most important figure of the month. The report will be released one day early due to the US National Day holiday (July 4). Non-farm payrolls are forecast to increase by 110,000, down from the 139,000 increase in May.

Asian and European stocks fluctuated in different directions overnight. The US stock index expected to open is also not consistent. The market's attention is gradually returning to global trade issues, especially US trade agreements, as the deadline for some countries to reach agreements on July 9 is approaching.

Technically, gold buyers for August delivery still have a short-term advantage. The next upside target is to close above the strong resistance level of $3,400/ounce. On the contrary, the sellers will aim to push the price below the support level of 3,200 USD/ounce.

The immediate resistance level is the peak this week at $3,370.5 an ounce, then $3,400 an ounce. The most recent support was last night's bottom of $3,337.2 an ounce, followed by Tuesday's low of $3,313.7/ounce.

In the outside market, the USD index increased slightly. Nymex crude oil futures are firmer, trading around $66/barrel. The yield on the 10-year US Treasury note is currently at 4.287%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...