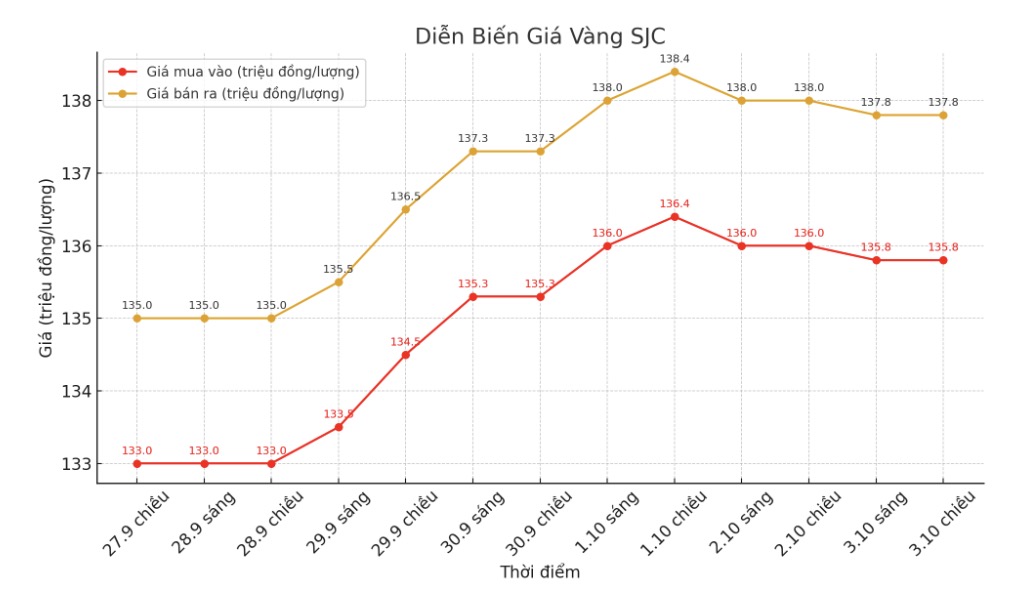

SJC gold bar price

As of 6:00 a.m. on October 4, the price of SJC gold bars was listed by DOJI Group and Bao Tin Minh Chau at 135.8-137.8 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 135.1-137.8 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

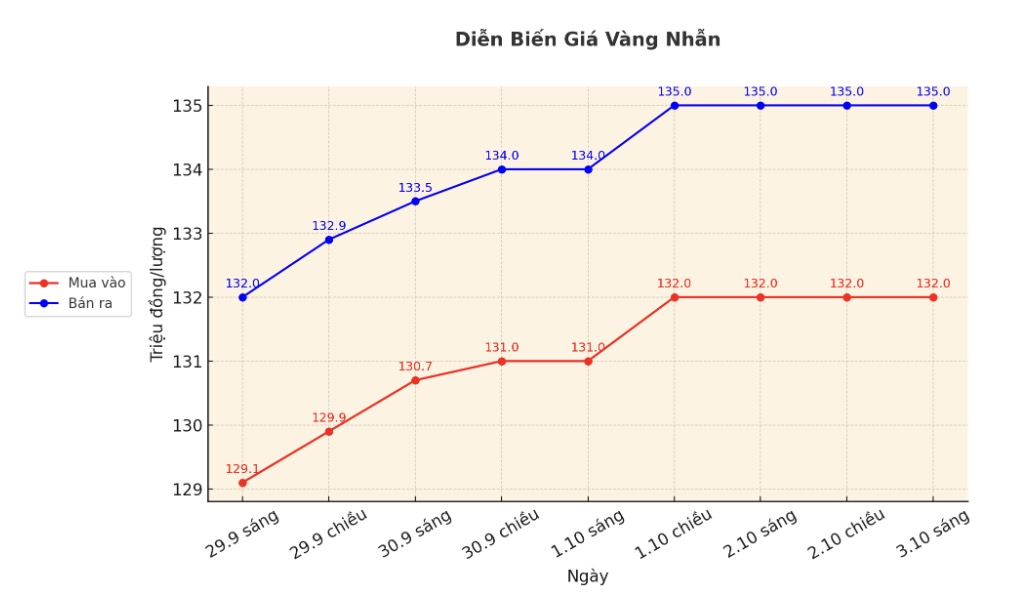

9999 gold ring price

As of 6:00 a.m. on October 4, DOJI Group and Phu Quy listed the price of gold rings at VND132-135 million/tael (buy in - sell out), unchanged in both directions compared to a day ago. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 132.8-135.8 million VND/tael (buy - sell), unchanged in both directions compared to a day ago. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

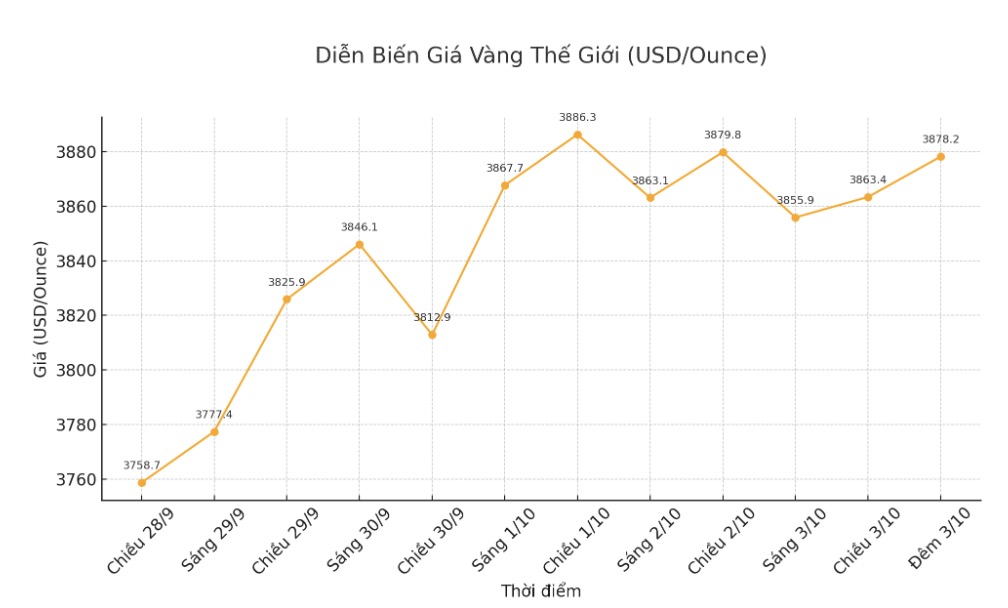

World gold price

The world gold price was listed at 10:15 on October 3 at 3,878.2 USD/ounce, up 40.5 USD compared to a day ago.

Gold price forecast

World gold prices increased, approaching a record high on Thursday as demand for safe-haven purchases before the weekend holiday was dominating.

The latest December gold contract increased by 18.1 USD to 3,886 USD/ounce. December delivery silver price increased by 1.081 USD to 47.445 USD/ounce.

The US government shutdown shows no signs of improving to end it. Democratic lawmakers remain determined in response to President Donald Trump's announcement to fire thousands of federal employees, as both sides fall into a deadlock that increases the likelihood of prolonged unpaid work stoppages and long-term disruptions to government services.

Bloomber reported: Both party leaders are still sticking to familiar political arguments as the first government shutdown in nearly seven years enters the third day. Lower-level negotiations have failed to reach a settlement, and a Senate vote on a temporary spending bill passed by the House of Representatives on Friday is also expected to fail.

The Senate is unlikely to hold a vote on the weekend, almost certain causing the closure to continue into the week after the two sides continued to blame each other for not reaching an agreement.

The global stock market fluctuated overnight. US stock indexes are expected to open slightly and set a new record when the trading session in New York begins.

Key outside markets today saw the USD index slightly decline, while crude oil prices were higher, trading around 60.75 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.092%.

Technical analysis: Technically, December gold futures bulls still have a strong advantage in the short term. The next upside target for buyers is to close the session above a solid resistance level of $4,000/ounce. The short-term downside target for the bears is to push prices below the solid technical support level at $3,750/ounce.

The first resistance level seen at this week's record peak was $3,923.3 and then $3,950. The first support level was at an overnight low of $3,861.1 and then a low of $3,842.8 on Thursday.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...