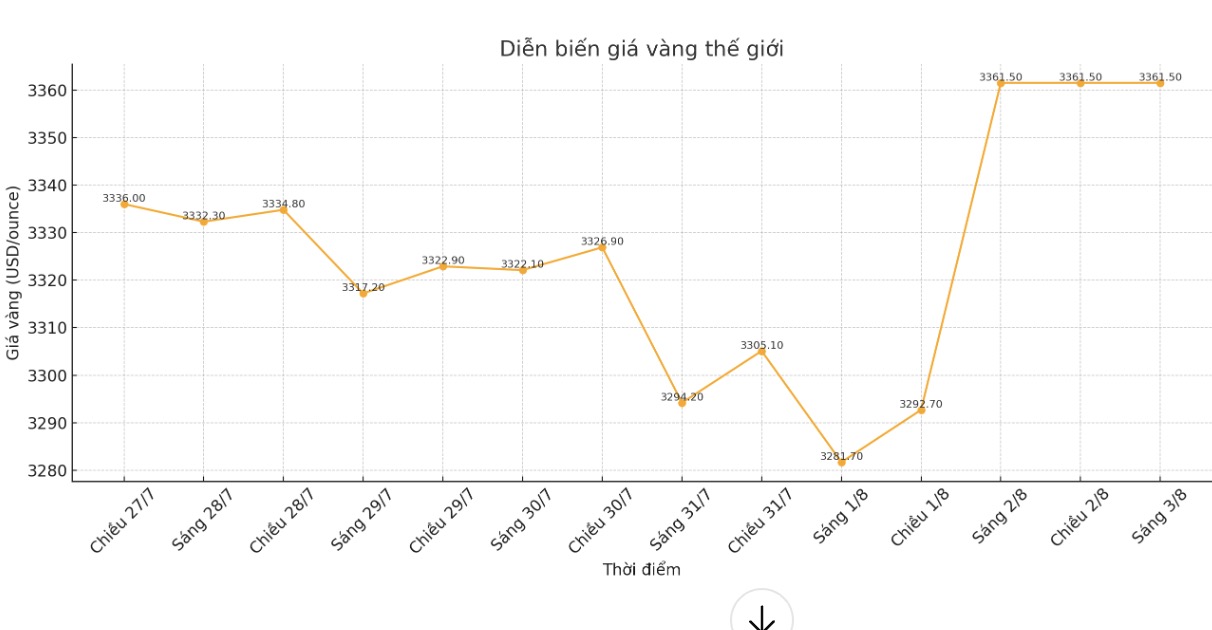

Gold price developments last week

After a relatively quiet summer, less positive figures from the US labor market have breathed new life into the gold market, making investors expecting a bull market on Wall Street start to get excited.

Gold prices ended the week at $3,361.5 an ounce. According to the weekly gold survey of an international financial information platform, market analysts' sentiment is at the highest level possible.

The change in market sentiment has taken place quite rapidly, as the precious metal started the week with selling pressure after economic data showed that US GDP grew by 3% in the second quarter of 2025.

However, some economists have dismissed the significance of this data, saying that growth figures are still very sensitive to major fluctuations in trade activities.

In addition to less positive news for gold, on Wednesday, the US Federal Reserve (FED) decided to keep interest rates unchanged and Fed Chairman Jerome Powell even doubted the possibility of a rate cut in September.

We have not made a decision for September, Powell said at a press conference following the central banks decision.

However, by the end of the week, analysts said that Mr. Powell's statements had become outdated, as the US non-farm payrolls data for July was a big disappointment.

According to the US Bureau of Labor Statistics, the economy created only 73,000 more jobs last month. At the same time, the total number of jobs in May and June was also adjusted down by 258,000 jobs. Based on the revised figures, only 14,000 jobs were created in June and 19,000 in May.

This disappointing employment data alone has returned to expectations of a September interest rate cut, thereby adding vitality to the gold market.

Its clear that the US job market is not golden yet as Chairman Powell declared, and the governments jobs data is clear evidence of that, said Adrian Day, chairman of Adrian Day Asset Management Company.

Since the job market was the main pillar for Mr. Powell to citate not cutting interest rates this week, this new job report created significant pressure to cut in September. So after two weeks of a slight decline in gold prices, we expect prices to increase next week.

Gold price forecast for next week

Chris Vecchio - Head of futures and foreign exchange strategy at Tastylive.com commented: "Taxes make countries reduce USD trading, so I think gold will continue to benefit as the world looks for an alternative currency asset".

Gold has had a few difficult weeks as the US dollar recovers and fake selling positions are liquidated, but perhaps this is the dosage that gold needs to regain its glory, he added.

Darin Newsom - Senior Analyst at Barchart.com - said he is optimistic about gold due to increasing geopolitical instability from the US President Donald Trump trade war.

Meanwhile, David Morrison - an analyst at Trade Nation is neutral, saying that employment data is a supporting factor for gold prices, but he does not expect gold prices to soon break out of the current fluctuation zone.

Although gold prices increased sharply last weekend, the precious metal is still fluctuating within range. Perhaps gold prices need a period of accumulation before there is enough momentum to surpass the $3,400 mark again, not to mention holding this level after adjustments.

We need to note that today's increase is largely due to the sudden reversal of the USD. The reason for that change is the worse-than-expected US non-farm payrolls. While this increases the likelihood of a rate cut in September, don't forget that this is just a figure - along with a downward correction in a series of data that is notoriously volatile," he said.

See more news related to gold prices HERE...