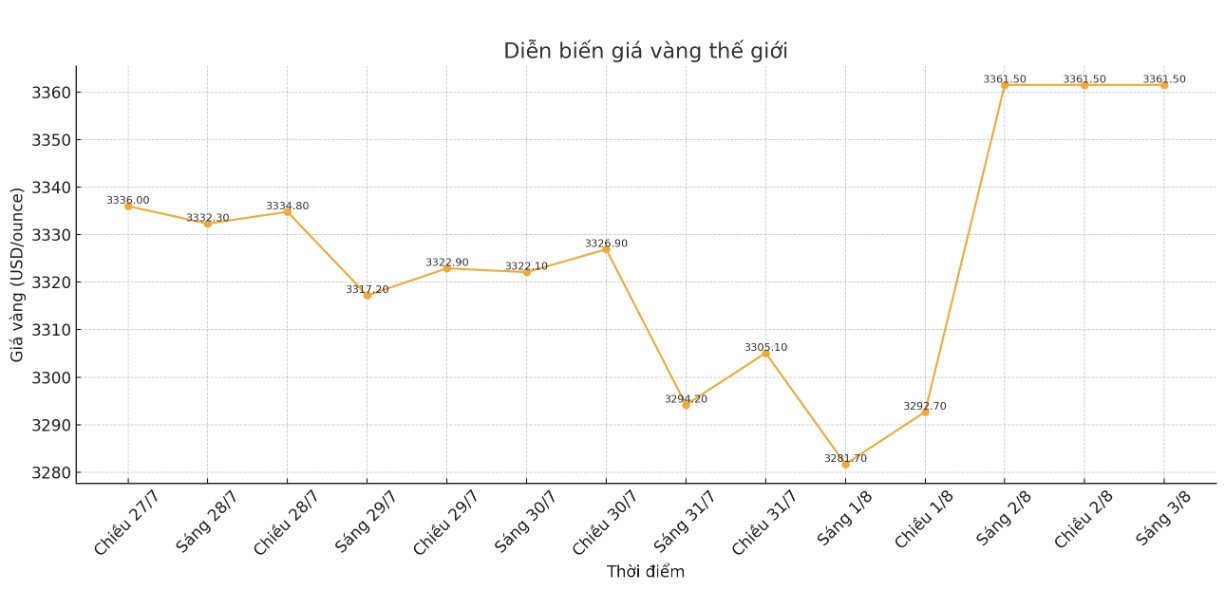

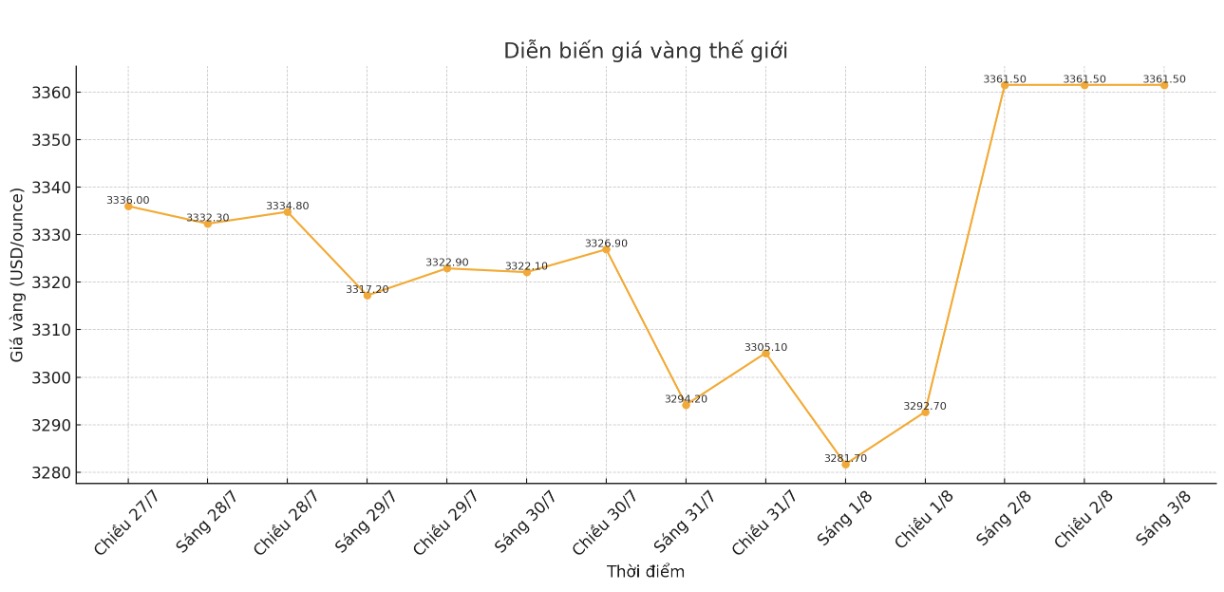

World gold prices had a strong breakout over the weekend, erasing losses at the beginning of the week and soaring towards the important resistance level of 3,400 USD/ounce, in the context of weak US labor data raising hopes that the US Federal Reserve (FED) will cut interest rates in September.

In an impressive recovery, gold prices ended the week above short-term resistance of $3,350/ounce. The latest record shows spot gold prices at $3,361.5 an ounce.

Lukman Otunuga - Senior market strategist at FXTM - commented: "Buyers are attacking strongly with the mark of 3,400 USD/ounce only less than 2%. When it closes the week above $3,330/ounce, gold prices could head towards $3,400.

Gold was under strong selling pressure on Wednesday after the Fed kept interest rates unchanged and Chairman Jerome Powell left open the possibility of a cut in September. We have not made a decision for September, Powell said at a press conference after the policy announcement.

However, doubts about the likelihood of a rate cut have all but disappeared after disappointing US labor market data. According to the US Bureau of Labor Statistics, last month the economy created only 73,000 new jobs. At the same time, the May and June figures were revised down to 258,000 jobs meaning there were only 14,000 jobs in June and 19,000 in May.

The weaker-than-expected jobs report weakens confidence in the US economy, putting pressure on the USD as the market expects the Fed to ease policy to stimulate growth, said Aaron Hill, senior market analyst at FP Markets. With gold, poor labor data further strengthens the role of safe-haven assets, boosting prices as investors seek stability.

According to the CME FedWatch tool tool tool, the probability of the Fed cutting interest rates in September has now increased to about 92%, compared to only 38% on Thursday.

Jamie Cox CEO at Harris Financial Group commented: In September, the Fed will almost certainly cut interest rates, possibly by 50 basis points to make up for the lost time.

Mr. Naeem Aslam - Investment Director at Zaye Capital Markets - commented that interest rate cut expectations are changing rapidly and gold is likely to reach the mark of 3,400 USD/ounce.

If the Fed signals a dovish stance, speculative capital flows could push prices above the psychological level of 3,400, especially in the context of investors seeking safe assets amid economic uncertainty.

Technical indicators such as the upward trend in gold ETFs and the volume of open-end contracts are supporting the possibility of a breakthrough. Investors seem to be preparing for an autumn rally, as gold typically improves after August. Although fluctuations may hold back short-term gains, the general trend is still positive and the quiet summer season may be over.

Next week, with a rather light schedule for issuing economic data, investors will continue to monitor the reaction after the employment report.

Michael Brown Market strategist at Pepperstone still maintains an optimistic view on gold, believing that global trade instability is the main driver of golds value as a currency asset.

The trend of diversifying reserves away from the US dollar and moving towards gold, especially in emerging markets, will continue in the near future. In addition, demand for shelter amid concerns about the US economy will continue to strengthen the upward trend. The prices to watch are $3,400/ounce, then the peak around $3,445/ounce, and the possibility of breaking a new record at $3,500/ounce. I absolutely do not rule out the possibility of gold prices reaching a new peak before the end of 2025" - Michael Brown said.

Chris Vecchio - Head of futures and Forex strategy at Tastylive.com said that gold is in a good position to become a replacement global currency. Tax will limit US dollar transactions, so I expect gold to continue to rise as the world looks for alternative currency assets.

Notable economic data next week

Tuesday: ISM Service PMI (USA).

Wednesday: The US auctions a 10-year Treasury note.

Thursday: Bank of England monetary policy decision, US weekly jobless claims.