Update SJC gold price

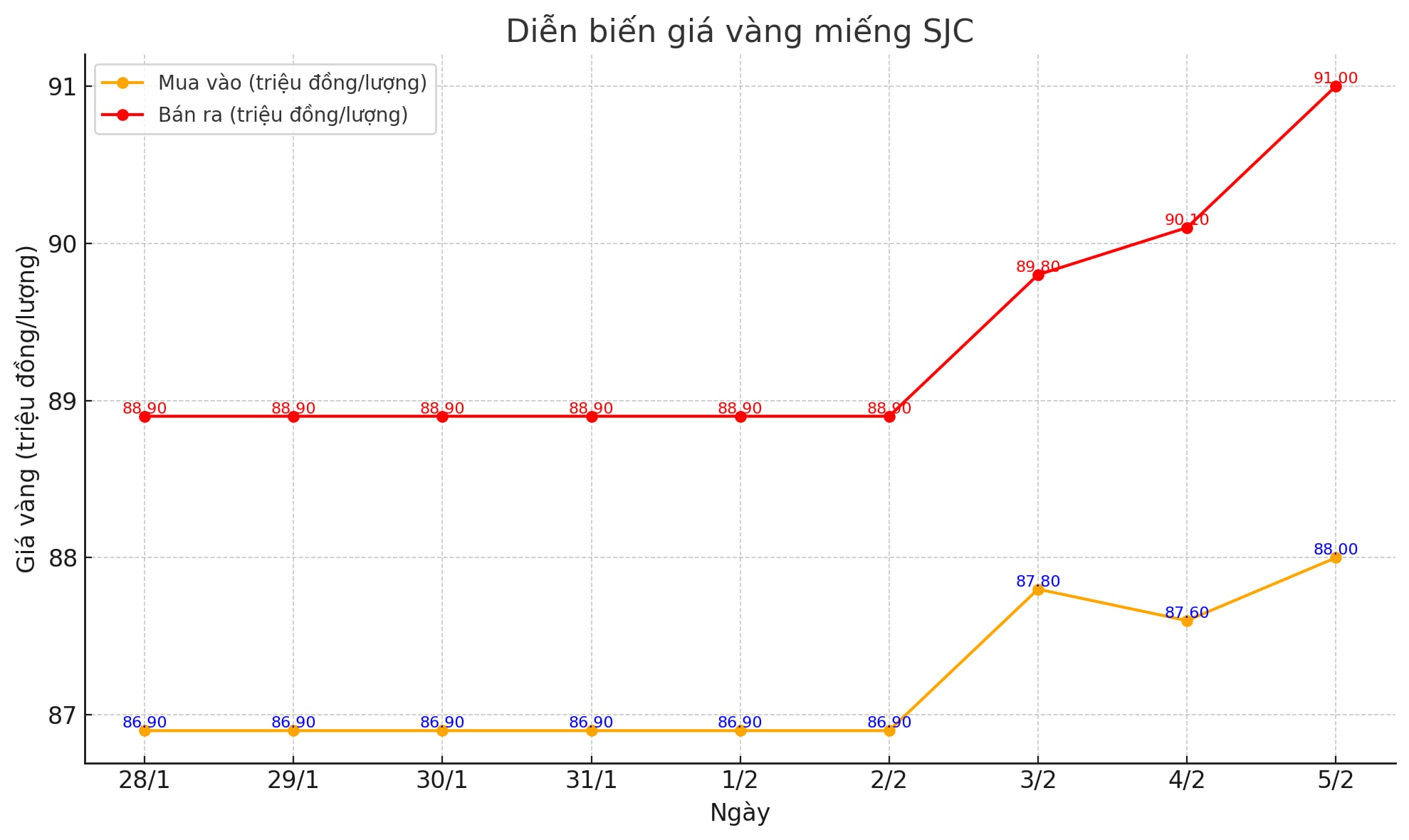

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND88-91 million/tael (buy - sell); down VND100,000/tael for buying and up VND400,000/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 3 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 88-91 million VND/tael (buy - sell); down 100,000 VND/tael for buying and up 400,000 VND/tael for selling.

The difference between buying and selling prices of SJC gold at DOJI Group is at 3 million VND/tael.

Price of round gold ring 9999

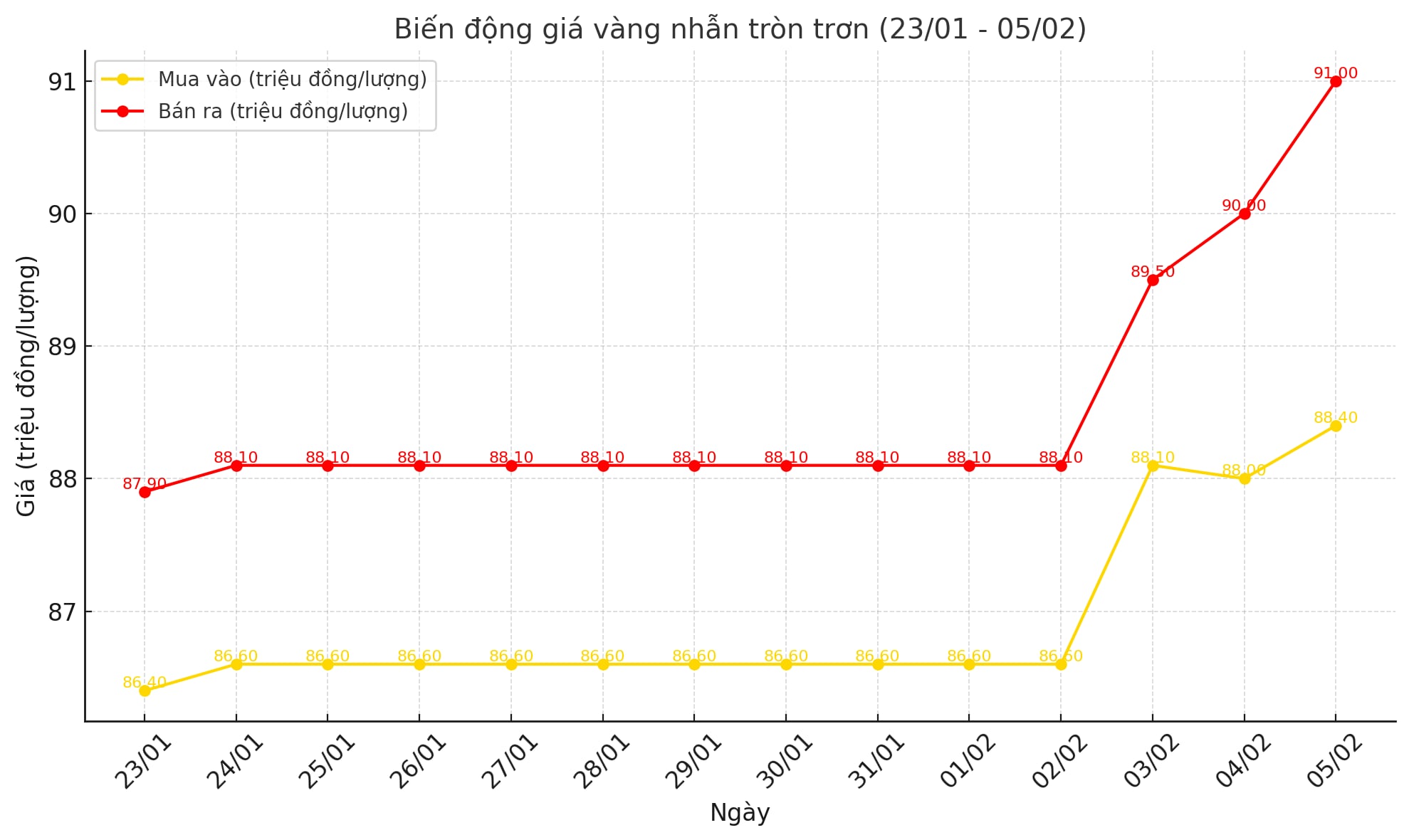

As of 9:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 88.4-91 million VND/tael (buy - sell); down 500,000 VND/tael for buying and up 500,000 VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 88.4-90.95 million VND/tael (buy - sell), down 100,000 VND/tael for buying and up 400,000 VND/tael for selling compared to early this morning.

World gold price

As of 9:12 a.m., the world gold price listed on Kitco was at 2,853.7 USD/ounce, up 30 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased sharply in the context of the USD falling. Recorded at 9:15 a.m. on February 5, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 107.740 points (down 0.09%).

Despite the temporary halt to trade tensions, gold prices are showing no signs of cooling down. One market strategist said geopolitical uncertainty will continue to support gold prices.

In an interview with Kitco News, Joy Yang, Global Director of Index Product Management at MarketVector, said that despite gold hitting a record high above $2,800 an ounce, the precious metal could still rise higher as geopolitical instability shows no signs of ending.

Even as US President Donald Trump delayed imposing tariffs on Mexico and Canada for 30 days, the expert explained that gold's renewed drive as a safe-haven asset is not limited to a few trade disputes.

“There will be times when another unexpected factor appears that the market cannot react to. In this context, it is reasonable for gold prices to remain above $2,800/ounce,” said Joy Yang.

Geopolitical uncertainty isn’t the only factor driving gold prices, however. Joy Yang said gold will also become an important asset to diversify portfolios as investors continue to adjust their expectations in the technology sector after China announced a cheaper AI product.

With stock valuations at historic levels, investors are inherently more cautious, so demand for defensive assets like gold is increasing, she stressed.

“When you don’t know what’s going to happen, you want to find an asset that is not affected by surprises and other factors, which is gold. It tends to move in its own way, and that’s good,” Yang said.

She also stressed that gold is an important safe-haven asset because of the buying power coming from central banks, which is the main driver behind the gold price rally in 2024. Yang expects central banks to continue to increase their gold holdings.

See more news related to gold prices HERE...