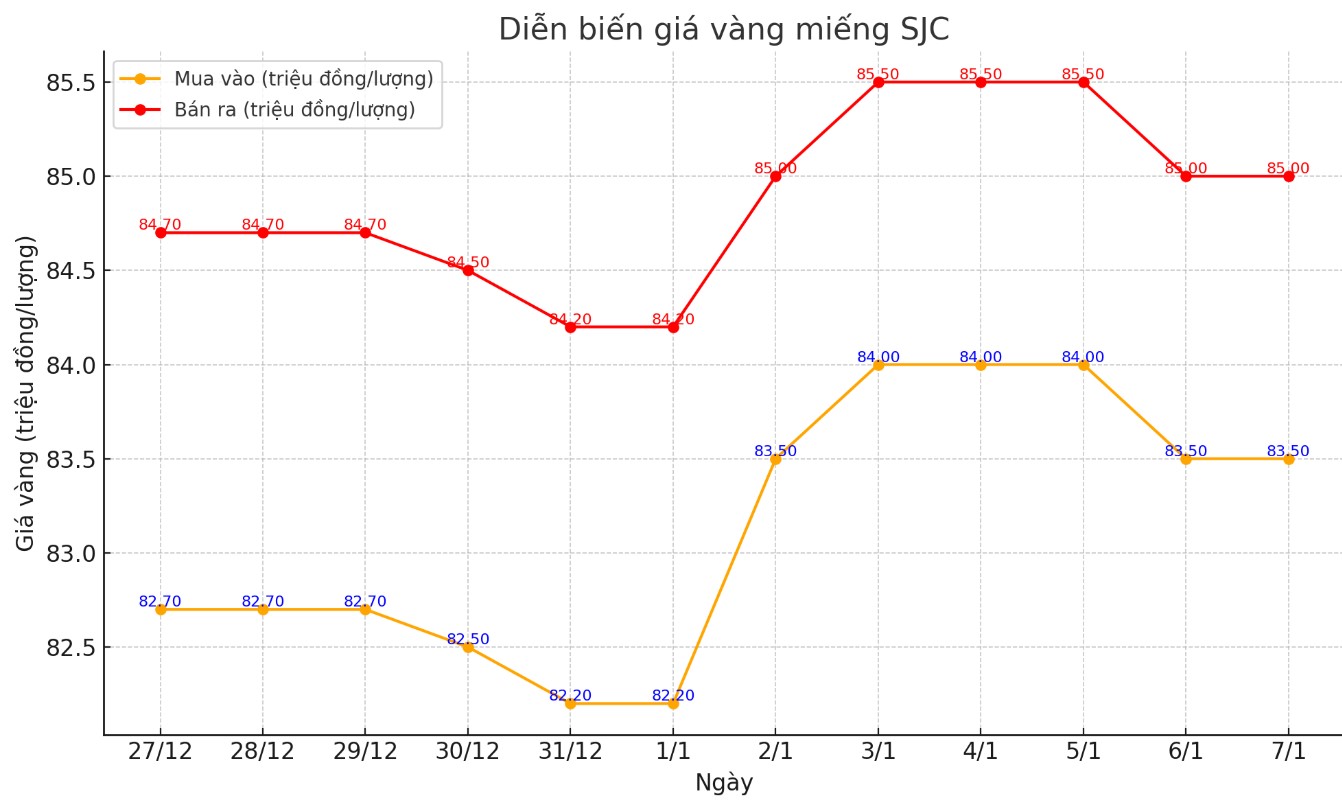

Update SJC gold price

As of 9:15 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND83.5-85 million/tael (buy - sell); down VND500,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 83.5-85 million VND/tael (buy - sell); down 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83.7-85 million VND/tael (buy - sell); down 400,000 VND/tael for buying and down 500,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 1.3 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

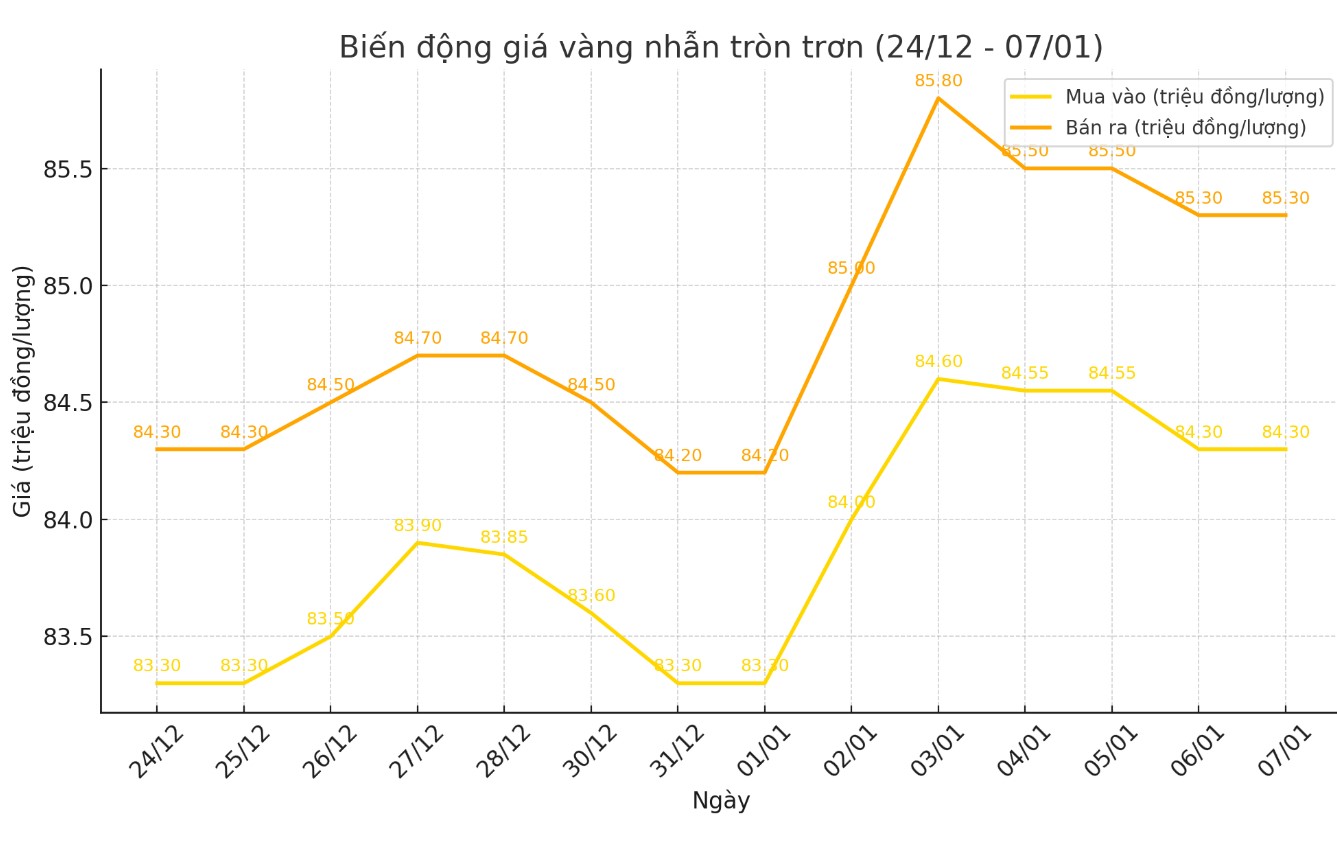

Price of round gold ring 9999

As of 9:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.3-85.3 million VND/tael (buy - sell); down 350,000 VND/tael for buying and down 300,000 VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 84.4-85.5 million VND/tael (buy - sell), down 200,000 VND/tael for buying and down 300,000 VND/tael for selling compared to early this morning.

World gold price

As of 9:15 a.m., the world gold price listed on Kitco was at 2,637.6 USD/ounce, down 5 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell slightly amid an increase in the US dollar. At 9:15 a.m. on January 7, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 108.180 points (up 0.09%).

Despite the pressure, gold prices held firm, signaling a year of strong central bank demand. Global central banks continued to drive gold demand in November 2024, with the bulk of the purchases driven by emerging markets, according to Krishan Gopaul, senior analyst for EMEA at the World Gold Council.

“November was another strong month for gold buying as central banks added a total of 53 tonnes of gold to global official reserves, based on reported data.

This continues the general trend throughout 2024, when central banks - mainly from emerging markets - maintained their gold purchases, driven by the need for a stable and safe asset amid global economic uncertainty," Gopaul said.

The Central Bank of Uzbekistan increased its reserves by 9 tonnes, marking the first increase since July, bringing total net purchases for the year to 11 tonnes and gold reserves to 382 tonnes.

The Reserve Bank of India continued its gold buying streak in 2024, adding another 8 tonnes in November. "This brings the total purchases year-to-date to 73 tonnes, taking the total gold reserves to 876 tonnes, maintaining its position as the second-largest buyer in 2024 after Poland," he said.

The National Bank of Kazakhstan added 5 tons of gold, raising its reserves to 295 tons and becoming a net buyer of 1 ton in 2024.

A notable development during the month was the announcement by the People’s Bank of China (PBoC) that it would resume gold purchases. After a six-month hiatus, the PBoC added 5 tonnes of gold, bringing its total net purchases for the year to 34 tonnes and reported gold reserves to 2,264 tonnes (5% of total reserves).

The Central Bank of Jordan bought 4 tons of gold in November 2024, bringing the total purchase volume since the beginning of the year to nearly 2 tons, with total reserves reaching 73 tons...

Chantelle Schieven, head of research at Capitalight Research, said she remains bullish on the precious metal this year, but said she expects the rally to continue over the next few months.

Chantelle Schieven believes that gold prices will fluctuate between $2,500 and $2,700 per ounce in the first half of the year, before breaking out and surpassing the $3,000 per ounce mark in the second half of 2025.

See more news related to gold prices HERE...